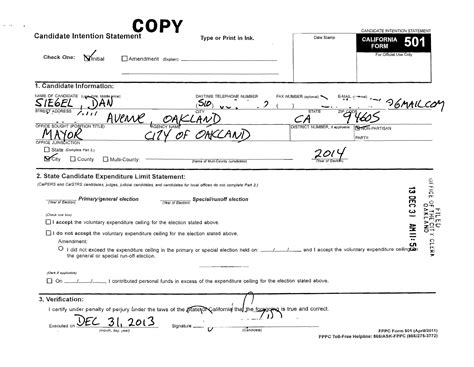

The California Fair Political Practices Commission (FPPC) Form 501 is a crucial document that must be filed by candidates and committees in California to disclose their financial information. Filing this form accurately and on time is essential to maintain transparency and comply with the state's campaign finance laws. Here are five tips to help you file FPPC Form 501 correctly:

Tip 1: Understand the Filing Requirements

Before filing FPPC Form 501, it is essential to understand the filing requirements. The form must be filed by all candidates and committees that have raised or spent $2,000 or more in a calendar year. The filing deadline is usually within 24 hours of receiving a contribution of $5,000 or more, but not later than the next regular filing deadline.

Tip 2: Gather Required Information

To file FPPC Form 501, you will need to gather the following information:

- Candidate or committee name and address

- Treasurer's name and address

- Bank account information

- List of contributors and their contributions

- List of expenditures and the purpose of each expenditure

- Beginning and ending cash balances

Make sure to have all the necessary documents and information before starting the filing process.

Tip 3: Use the Correct Filing Schedule

FPPC Form 501 has different filing schedules depending on the type of candidate or committee. Make sure to use the correct filing schedule to avoid errors and penalties. The filing schedules are as follows:

- Candidates: File semi-annually on June 30th and December 31st, and 24 hours before the election

- Committees: File quarterly on January 31st, April 30th, July 31st, and October 31st

Tip 4: Disclose Contributions and Expenditures

Accurate disclosure of contributions and expenditures is critical when filing FPPC Form 501. Make sure to disclose all contributions, including loans and non-monetary contributions, and all expenditures, including loans and loan repayments.

Use the following tips to ensure accurate disclosure:

- List each contribution separately

- Include the contributor's name, address, and occupation

- List each expenditure separately

- Include the payee's name, address, and purpose of the expenditure

Tip 5: Review and Certify the Form

Before submitting FPPC Form 501, review the form carefully to ensure accuracy and completeness. The candidate or committee treasurer must certify the form, which includes signing and dating the form.

Use the following tips to ensure a smooth review and certification process:

- Review the form for completeness and accuracy

- Verify the math calculations

- Check for any inconsistencies or errors

- Sign and date the form

By following these five tips, you can ensure that your FPPC Form 501 is filed accurately and on time. Remember to always review the form carefully and seek help if you need it.

Filing FPPC Form 501: What's Next?

After filing FPPC Form 501, you will need to maintain accurate records and file subsequent forms as required. Make sure to keep track of contributions and expenditures and update your records regularly.

If you have any questions or concerns about filing FPPC Form 501, contact the FPPC or seek help from a qualified campaign finance expert.

Get Help with FPPC Form 501

Filing FPPC Form 501 can be complex and time-consuming. If you need help with the filing process, consider seeking assistance from a qualified campaign finance expert. They can guide you through the process and ensure that your form is filed accurately and on time.

We encourage you to share your experiences and tips for filing FPPC Form 501 in the comments below. Your feedback can help others navigate the filing process with ease.

FAQ Section:

What is FPPC Form 501?

+FPPC Form 501 is a document that must be filed by candidates and committees in California to disclose their financial information.

Who needs to file FPPC Form 501?

+All candidates and committees that have raised or spent $2,000 or more in a calendar year must file FPPC Form 501.

What is the filing deadline for FPPC Form 501?

+The filing deadline for FPPC Form 501 is usually within 24 hours of receiving a contribution of $5,000 or more, but not later than the next regular filing deadline.