Tax season is upon us, and Colorado residents are gearing up to file their state income tax returns. If you're a Colorado taxpayer, you'll likely need to file Form 104, also known as the Colorado Individual Income Tax Return. However, if you're a non-resident or a part-year resident of Colorado, you'll need to file Form 104PN, also known as the Colorado Non-Resident/Part-Year Resident Income Tax Return. In this article, we'll provide a step-by-step guide on how to file Colorado Form 104PN.

Understanding Form 104PN

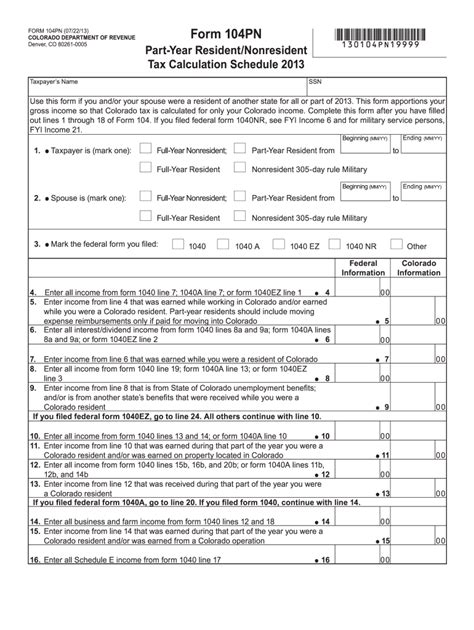

Form 104PN is used by non-resident and part-year resident individuals to report their Colorado income tax liability. The form is similar to Form 104, but it requires additional information to determine the taxpayer's Colorado income tax liability. If you're a non-resident or part-year resident of Colorado, you'll need to file Form 104PN if you have income from Colorado sources, such as wages, salaries, tips, and self-employment income.

Who Needs to File Form 104PN?

Who Needs to File Form 104PN?

You'll need to file Form 104PN if you're a non-resident or part-year resident of Colorado and you have income from Colorado sources. This includes:

- Non-resident individuals who have income from Colorado sources, such as wages, salaries, tips, and self-employment income.

- Part-year resident individuals who have income from Colorado sources during the period they were a resident of Colorado.

- Non-resident and part-year resident individuals who have income from Colorado sources and are required to file a federal income tax return.

Gathering Required Documents

Gathering Required Documents

Before you start filing Form 104PN, make sure you have all the required documents. These include:

- Your federal income tax return (Form 1040)

- Your W-2 forms from your employer(s)

- Your 1099 forms for self-employment income and other income

- Your schedule of deductions and credits

- Any other relevant tax documents

Filing Form 104PN

Filing Form 104PN

Now that you have all the required documents, let's go through the step-by-step process of filing Form 104PN.

Step 1: Complete the Form 104PN Header

The first section of Form 104PN requires you to provide your personal and contact information. This includes your name, address, Social Security number, and date of birth.

Step 2: Report Your Income

The next section requires you to report your income from Colorado sources. This includes wages, salaries, tips, and self-employment income. You'll need to complete Schedule 1, which is attached to Form 104PN.

Step 3: Calculate Your Tax Liability

Once you've reported your income, you'll need to calculate your tax liability. You'll need to complete Schedule 2, which is attached to Form 104PN. This schedule requires you to calculate your tax liability based on your income and deductions.

Step 4: Claim Your Credits and Deductions

If you're eligible for any credits or deductions, you'll need to claim them on Form 104PN. This includes the Earned Income Tax Credit (EITC), the Child Tax Credit, and other credits and deductions.

Step 5: File Your Return

Once you've completed Form 104PN, you'll need to file your return with the Colorado Department of Revenue. You can file your return electronically or by mail.

Tips and Reminders

- Make sure to file your return on time to avoid penalties and interest.

- Keep a copy of your return and supporting documents for at least three years.

- If you need help with filing Form 104PN, consider consulting a tax professional or contacting the Colorado Department of Revenue.

FAQs

Who needs to file Form 104PN?

+Non-resident and part-year resident individuals who have income from Colorado sources need to file Form 104PN.

What documents do I need to file Form 104PN?

+You'll need your federal income tax return, W-2 forms, 1099 forms, schedule of deductions and credits, and other relevant tax documents.

How do I file Form 104PN?

+You can file Form 104PN electronically or by mail. Make sure to keep a copy of your return and supporting documents for at least three years.

We hope this step-by-step guide has helped you understand how to file Colorado Form 104PN. Remember to file your return on time and keep a copy of your return and supporting documents for at least three years. If you have any questions or need help with filing Form 104PN, consider consulting a tax professional or contacting the Colorado Department of Revenue.