Taking control of your retirement savings is a significant step towards securing your financial future. If you're a participant in the Brighthouse Financial 403(b) plan, you may be considering withdrawing funds to address immediate financial needs or to consolidate your retirement assets. However, navigating the withdrawal process can be daunting without the right guidance. In this article, we'll delve into the specifics of the Brighthouse 403(b) withdrawal form and provide a step-by-step guide to help you through the process.

Understanding the Brighthouse 403(b) Plan

Before we dive into the withdrawal process, it's essential to understand the basics of the Brighthouse 403(b) plan. A 403(b) plan is a type of tax-deferred retirement savings plan available to certain employees of public schools and tax-exempt organizations. Brighthouse Financial, a leading provider of life insurance and retirement products, offers a range of investment options and services to help plan participants achieve their retirement goals.

Why Withdraw from Your 403(b) Plan?

There are various reasons why you may need to withdraw funds from your Brighthouse 403(b) plan. Some common scenarios include:

- Financial hardship: You may be facing unexpected expenses, such as medical bills or home repairs, and need to access your retirement savings to cover these costs.

- Retirement: If you're retiring or separating from your employer, you may want to withdraw funds from your 403(b) plan to supplement your retirement income.

- Consolidation: You may be looking to consolidate your retirement accounts and simplify your financial management.

The Brighthouse 403(b) Withdrawal Form: A Step-By-Step Guide

To initiate a withdrawal from your Brighthouse 403(b) plan, you'll need to complete the withdrawal form. Here's a step-by-step guide to help you through the process:

Step 1: Review Your Plan Documents

Before starting the withdrawal process, review your Brighthouse 403(b) plan documents to understand the rules and regulations governing withdrawals. Check for any specific requirements, such as minimum distribution requirements or loan provisions.

Step 2: Determine Your Eligibility

Check if you're eligible to withdraw funds from your 403(b) plan. Typically, you must be at least 59 1/2 years old or have a qualifying event, such as separation from service or disability, to withdraw funds without penalty.

Step 3: Choose Your Withdrawal Option

Brighthouse Financial offers various withdrawal options, including:

- Lump sum: A single payment of your entire account balance.

- Installment payments: Regular payments over a specified period.

- Annuity: A guaranteed income stream for a set period or lifetime.

Choose the option that best suits your needs and financial goals.

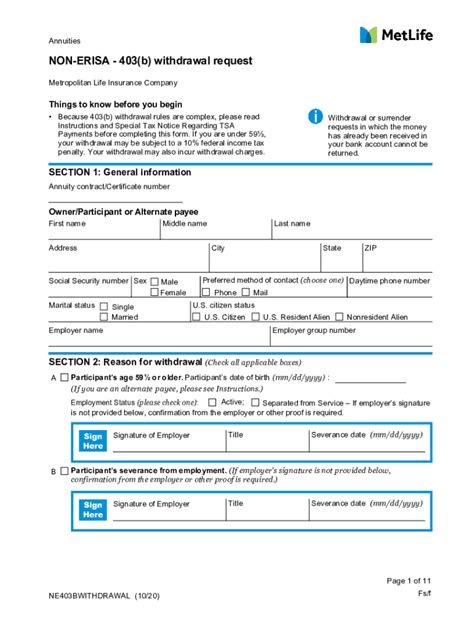

Step 4: Complete the Withdrawal Form

Obtain the Brighthouse 403(b) withdrawal form from your plan administrator or download it from the Brighthouse Financial website. Complete the form carefully, ensuring you provide all required information, including:

- Account information: Your account number and plan details.

- Withdrawal amount: The amount you wish to withdraw.

- Withdrawal option: Your chosen withdrawal option.

- Beneficiary information: The beneficiary's name and contact details, if applicable.

Step 5: Submit the Withdrawal Form

Submit the completed withdrawal form to your plan administrator or Brighthouse Financial, following the instructions provided. You may need to include additional documentation, such as proof of age or identity.

Step 6: Review and Verify

Review your withdrawal request carefully to ensure accuracy. Verify that all information is correct and complete to avoid delays or rejection.

Timing and Tax Implications

When withdrawing funds from your Brighthouse 403(b) plan, it's essential to consider the timing and tax implications:

- Taxation: Withdrawals are generally subject to income tax and may be subject to a 10% penalty if taken before age 59 1/2.

- Required minimum distributions: If you're 72 or older, you may be required to take minimum distributions from your 403(b) plan, which could impact your withdrawal strategy.

FAQs

Q: Can I withdraw funds from my Brighthouse 403(b) plan at any time?

A: Generally, you can withdraw funds from your 403(b) plan after age 59 1/2 or upon separation from service. However, some plans may allow earlier withdrawals for qualified expenses or loans.

Q: How long does it take to process a withdrawal from my Brighthouse 403(b) plan?

A: The processing time for withdrawals may vary depending on the plan and Brighthouse Financial's processing times. Typically, it takes 2-4 weeks for withdrawals to be processed.

Q: Can I change my mind after submitting the withdrawal form?

A: Once you've submitted the withdrawal form, it may be difficult to change your mind or cancel the withdrawal. Review your decision carefully before submitting the form.

Can I withdraw funds from my Brighthouse 403(b) plan at any time?

+Generally, you can withdraw funds from your 403(b) plan after age 59 1/2 or upon separation from service. However, some plans may allow earlier withdrawals for qualified expenses or loans.

How long does it take to process a withdrawal from my Brighthouse 403(b) plan?

+The processing time for withdrawals may vary depending on the plan and Brighthouse Financial's processing times. Typically, it takes 2-4 weeks for withdrawals to be processed.

Can I change my mind after submitting the withdrawal form?

+Once you've submitted the withdrawal form, it may be difficult to change your mind or cancel the withdrawal. Review your decision carefully before submitting the form.

Taking the Next Step

Withdrawing funds from your Brighthouse 403(b) plan requires careful consideration and planning. By following the steps outlined in this guide and understanding the rules and regulations governing withdrawals, you can make informed decisions about your retirement savings.

If you're considering withdrawing funds from your Brighthouse 403(b) plan, take the time to review your plan documents, determine your eligibility, and choose the withdrawal option that best suits your needs. Don't hesitate to reach out to Brighthouse Financial or your plan administrator for guidance and support throughout the process.

We hope this guide has provided valuable insights and information to help you navigate the Brighthouse 403(b) withdrawal process. Share your thoughts and experiences in the comments below, and don't forget to share this article with others who may benefit from this information.

By taking control of your retirement savings and making informed decisions, you can secure a brighter financial future for yourself and your loved ones.