Recovering from a qualified 2020 disaster or a qualified 2021 disaster can be a challenging and overwhelming experience, especially when it comes to navigating the complex world of tax relief. One crucial aspect of this process is completing Form 8915-F, also known as the Qualified Disaster Retirement Plan Distributions and Repayments. In this article, we will delve into the intricacies of Form 8915-F and provide you with five essential tips to help you navigate this critical tax document.

Understanding Form 8915-F

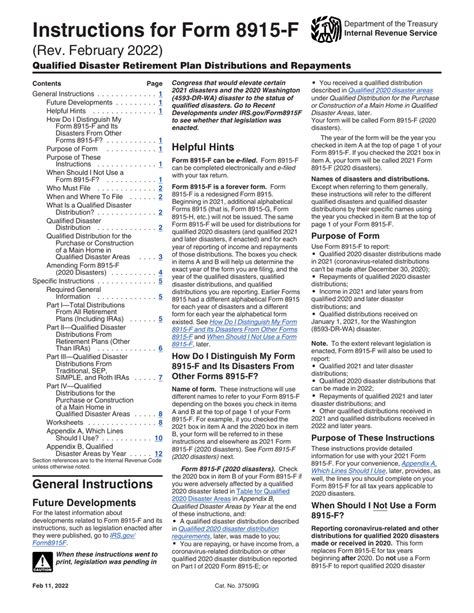

Before we dive into the tips, it's essential to understand the purpose of Form 8915-F. This form is designed to help individuals who have taken qualified disaster distributions from their retirement plans, such as 401(k) or IRA accounts, report these distributions and any repayments made. The form is divided into two parts: Part I, which deals with qualified disaster distributions, and Part II, which focuses on repayments.

Tip 1: Determine If You Qualify for Relief

To qualify for relief under Form 8915-F, you must have taken a qualified disaster distribution from your retirement plan. A qualified disaster distribution is a distribution that meets specific criteria, including:

- The distribution was made on or after the first day of the incident period and before December 31, 2022.

- The distribution was made to an individual whose principal residence was located in a qualified disaster area.

- The distribution was made due to a qualified disaster.

Calculating Qualified Disaster Distributions

If you qualify for relief, you'll need to calculate the amount of your qualified disaster distribution. This involves determining the amount of the distribution that is eligible for relief and reporting it on Form 8915-F.

Tip 2: Report Distributions Correctly

When reporting qualified disaster distributions on Form 8915-F, it's crucial to ensure accuracy. You'll need to report the distribution amount, the date of the distribution, and the type of retirement plan from which the distribution was made. Failure to report this information correctly can lead to delays or even penalties.

Repaying Qualified Disaster Distributions

One of the benefits of Form 8915-F is that it allows you to repay qualified disaster distributions without penalty. This can be a significant advantage, especially if you're not in immediate need of the funds.

Tip 3: Understand Repayment Rules

To repay qualified disaster distributions, you'll need to follow specific rules. These rules include:

- Repayments must be made within three years of the date of the distribution.

- Repayments must be made to the same retirement plan from which the distribution was made.

- Repayments are subject to certain limits and restrictions.

Claiming the Repayment Benefit

If you repay a qualified disaster distribution, you may be eligible to claim a repayment benefit on your tax return.

Tip 4: Claim the Repayment Benefit Correctly

To claim the repayment benefit, you'll need to complete Form 8915-F and attach it to your tax return. You'll also need to report the repayment amount and the date of the repayment. Failure to claim the repayment benefit correctly can result in missing out on valuable tax relief.

Seeking Professional Help

Completing Form 8915-F can be a complex and time-consuming process, especially if you're not familiar with tax law.

Tip 5: Seek Professional Help When Needed

If you're unsure about any aspect of Form 8915-F, it's highly recommended that you seek professional help from a qualified tax professional. They can guide you through the process, ensure accuracy, and help you claim the maximum amount of tax relief available.

By following these five tips, you can ensure a smooth and stress-free experience when completing Form 8915-F. Remember to take your time, seek professional help when needed, and claim the maximum amount of tax relief available.

What is Form 8915-F used for?

+Form 8915-F is used to report qualified disaster distributions and repayments from retirement plans, such as 401(k) or IRA accounts.

Who qualifies for relief under Form 8915-F?

+To qualify for relief, you must have taken a qualified disaster distribution from your retirement plan, and the distribution must meet specific criteria.

How do I report qualified disaster distributions on Form 8915-F?

+You'll need to report the distribution amount, the date of the distribution, and the type of retirement plan from which the distribution was made.