The complexities of tax forms can be overwhelming, especially for small business owners and self-employed individuals. One such form that often raises questions is the Form F-7004, used for automatic extensions of time to file certain business income tax, information, and other returns. Understanding the ins and outs of this form is crucial to avoid potential penalties and ensure timely compliance. In this article, we will delve into the world of Form F-7004, exploring its purpose, benefits, and a step-by-step guide on how to file it.

What is Form F-7004 and Why is it Important?

Form F-7004 is an application for automatic extension of time to file certain business income tax, information, and other returns with the Internal Revenue Service (IRS). This form is essential for businesses that need more time to file their tax returns, providing an automatic six-month extension to file the return. The importance of Form F-7004 lies in its ability to help businesses avoid late-filing penalties and provide ample time for gathering necessary documentation and information required for filing tax returns.

Eligible Returns for Form F-7004

Not all business tax returns are eligible for an automatic extension using Form F-7004. The form is specifically designed for the following types of returns:

- Form 1065: U.S. Return of Partnership Income

- Form 1120: U.S. Corporation Income Tax Return

- Form 1120S: U.S. Income Tax Return for an S Corporation

- Form 2553: Election by a Small Business Corporation

- Form 8288: U.S. Withholding Tax Return for Certain Real Property Transactions

Benefits of Filing Form F-7004

Filing Form F-7004 offers several benefits to businesses, including:

- Avoidance of Late-Filing Penalties: By filing Form F-7004, businesses can avoid the penalty for late filing of tax returns, which can be substantial.

- More Time to File: The automatic six-month extension provides businesses with ample time to gather necessary documentation and information required for filing tax returns.

- Reduced Stress: The extra time allows businesses to file their tax returns without rushing, reducing the stress associated with meeting tight deadlines.

- Improved Accuracy: With more time to file, businesses can ensure that their tax returns are accurate and complete, reducing the risk of errors and subsequent penalties.

Step-by-Step Guide to Filing Form F-7004

Filing Form F-7004 is a straightforward process that can be completed in a few steps:

- Determine Eligibility: Ensure that the business tax return is eligible for an automatic extension using Form F-7004.

- Gather Required Information: Collect the necessary information, including the business name, address, and tax identification number.

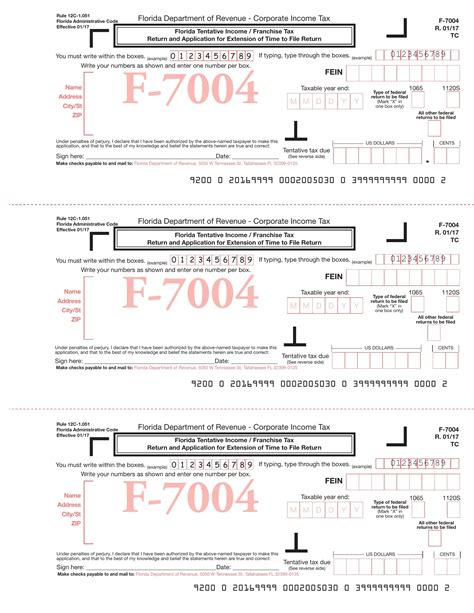

- Complete Form F-7004: Fill out Form F-7004, ensuring that all required fields are completed accurately.

- Submit the Form: File Form F-7004 with the IRS, either electronically or by mail, on or before the original due date of the tax return.

- Pay Any Required Payment: If a payment is required, submit it with the form to avoid interest and penalties.

Common Mistakes to Avoid When Filing Form F-7004

When filing Form F-7004, businesses should avoid the following common mistakes:

- Incorrect or Incomplete Information: Ensure that all required fields are completed accurately to avoid delays or rejection of the form.

- Late Filing: File Form F-7004 on or before the original due date of the tax return to avoid late-filing penalties.

- Insufficient Payment: If a payment is required, ensure that it is submitted with the form to avoid interest and penalties.

Conclusion and Next Steps

Understanding Form F-7004 is crucial for businesses that need more time to file their tax returns. By following the step-by-step guide and avoiding common mistakes, businesses can ensure a smooth and successful filing process. If you have any questions or concerns about Form F-7004, feel free to comment below or share this article with others who may find it helpful.

What is the purpose of Form F-7004?

+Form F-7004 is an application for automatic extension of time to file certain business income tax, information, and other returns with the IRS.

Which business tax returns are eligible for an automatic extension using Form F-7004?

+Form F-7004 is specifically designed for Form 1065, Form 1120, Form 1120S, Form 2553, and Form 8288.

What are the benefits of filing Form F-7004?

+The benefits of filing Form F-7004 include avoidance of late-filing penalties, more time to file, reduced stress, and improved accuracy.