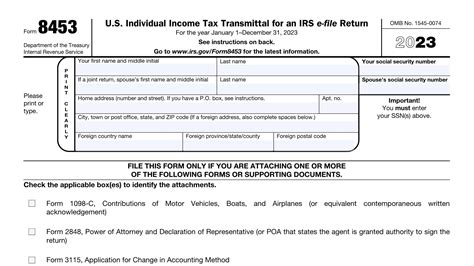

Tax season can be a stressful and overwhelming time for many individuals and businesses. With numerous forms to fill out and deadlines to meet, it's easy to get lost in the sea of paperwork. One form that can often cause confusion is the 8453 tax form, also known as the U.S. Individual Income Tax Transmittal for an IRS e-file Return. In this article, we will break down the 8453 tax form, explaining its purpose, how to fill it out, and common mistakes to avoid.

What is the 8453 Tax Form?

The 8453 tax form is used by individuals and businesses to transmit their tax return to the IRS electronically. This form is required for anyone who files their tax return electronically, whether they use tax preparation software or a tax professional. The 8453 form serves as a cover sheet, providing the IRS with information about the taxpayer and their tax return.

Who Needs to File the 8453 Tax Form?

Anyone who files their tax return electronically needs to complete the 8453 tax form. This includes:

- Individuals who file Form 1040, 1040A, or 1040EZ

- Businesses that file Form 1120, 1120S, or 1065

- Estates and trusts that file Form 1041

- Taxpayers who file amended returns (Form 1040X)

How to Fill Out the 8453 Tax Form

Filling out the 8453 tax form is relatively straightforward. Here's a step-by-step guide:

- Taxpayer Information: Enter your name, address, and Social Security number or Employer Identification Number (EIN).

- Tax Return Information: Enter the type of tax return you are filing (e.g., Form 1040) and the tax year.

- Electronic Filing Information: Provide information about the tax preparation software or tax professional you used to file your return.

- Signature: Sign the form to authorize the IRS to receive your tax return electronically.

Common Mistakes to Avoid

When filling out the 8453 tax form, it's essential to avoid common mistakes that can delay or reject your tax return. Here are some mistakes to watch out for:

- Incorrect taxpayer information: Double-check your name, address, and Social Security number or EIN to ensure accuracy.

- Incorrect tax return information: Make sure you enter the correct tax return type and tax year.

- Missing signature: Don't forget to sign the form, as this is required for electronic filing.

8453 Tax Form Deadline

The deadline for filing the 8453 tax form is the same as the deadline for filing your tax return. For individual taxpayers, this is typically April 15th. For businesses and estates, the deadline varies depending on the type of tax return and tax year.

Conclusion: Simplifying the 8453 Tax Form

Filing the 8453 tax form can seem daunting, but by following these steps and avoiding common mistakes, you can simplify the process. Remember to double-check your information, sign the form, and meet the deadline to ensure a smooth electronic filing experience.

We hope this article has helped you understand the 8453 tax form and how to file it correctly. If you have any questions or need further assistance, please don't hesitate to comment below or share this article with others who may find it helpful.

What is the purpose of the 8453 tax form?

+The 8453 tax form is used to transmit individual income tax returns to the IRS electronically.

Who needs to file the 8453 tax form?

+Individuals and businesses that file their tax return electronically need to complete the 8453 tax form.

What is the deadline for filing the 8453 tax form?

+The deadline for filing the 8453 tax form is the same as the deadline for filing your tax return, typically April 15th for individual taxpayers.