Understanding the intricacies of tax-related forms can be a daunting task for many individuals. The WKC 16b form, in particular, is a crucial document for those who need to report specific financial transactions to the relevant authorities. In this article, we will delve into the world of WKC 16b forms and provide you with a comprehensive guide on how to complete it successfully.

Tax season can be a stressful period for many, and the last thing you want is to face penalties or delays due to incomplete or incorrect forms. The WKC 16b form is an essential document that requires attention to detail and a thorough understanding of the reporting requirements. By the end of this article, you will be equipped with the knowledge and confidence to tackle the WKC 16b form with ease.

In this article, we will cover the following topics:

- What is the WKC 16b form and its significance?

- Benefits of accurate and timely submission of the WKC 16b form

- A step-by-step guide to completing the WKC 16b form successfully

- Common mistakes to avoid when filling out the WKC 16b form

- Best practices for ensuring accuracy and compliance

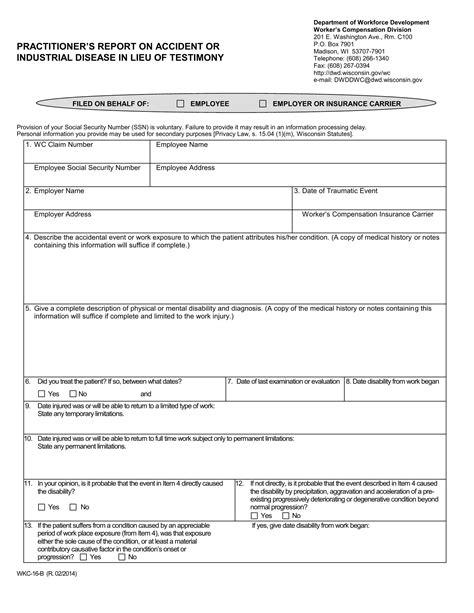

What is the WKC 16b Form and its Significance?

The WKC 16b form is a tax-related document that is used to report specific financial transactions to the relevant authorities. It is an essential form that requires individuals to provide detailed information about their financial activities, which helps the authorities to track and monitor financial transactions.

The WKC 16b form is significant because it helps to:

- Prevent money laundering and terrorist financing

- Ensure compliance with tax laws and regulations

- Provide transparency and accountability in financial transactions

Benefits of Accurate and Timely Submission of the WKC 16b Form

Accurate and timely submission of the WKC 16b form is crucial for several reasons:

- Avoid penalties and fines for non-compliance

- Prevent delays in processing financial transactions

- Ensure compliance with tax laws and regulations

- Maintain transparency and accountability in financial transactions

A Step-by-Step Guide to Completing the WKC 16b Form Successfully

Completing the WKC 16b form requires attention to detail and a thorough understanding of the reporting requirements. Here is a step-by-step guide to help you complete the form successfully:

- Gather required documents and information: Before starting to fill out the form, gather all the required documents and information, including financial statements, receipts, and identification documents.

- Read the instructions carefully: Read the instructions provided with the form carefully to ensure that you understand the reporting requirements.

- Fill out the form accurately and completely: Fill out the form accurately and completely, ensuring that all required fields are completed.

- Attach supporting documents: Attach all supporting documents, including financial statements and receipts.

- Review and verify the information: Review and verify the information provided in the form to ensure accuracy and completeness.

Common Mistakes to Avoid When Filling Out the WKC 16b Form

When filling out the WKC 16b form, it is essential to avoid common mistakes that can lead to penalties, fines, or delays in processing financial transactions. Here are some common mistakes to avoid:

- Inaccurate or incomplete information

- Failure to attach supporting documents

- Late submission of the form

- Failure to follow instructions carefully

Best Practices for Ensuring Accuracy and Compliance

To ensure accuracy and compliance when filling out the WKC 16b form, follow these best practices:

- Use a checklist to ensure that all required fields are completed

- Attach all supporting documents

- Review and verify the information provided in the form

- Submit the form on time

- Seek professional help if needed

Conclusion: Mastering the WKC 16b Form

Completing the WKC 16b form requires attention to detail and a thorough understanding of the reporting requirements. By following the step-by-step guide and best practices outlined in this article, you can ensure accurate and timely submission of the form. Remember to avoid common mistakes and seek professional help if needed.

We hope this article has provided you with valuable insights and knowledge to tackle the WKC 16b form with confidence. If you have any questions or need further clarification, please do not hesitate to comment below.

What is the purpose of the WKC 16b form?

+The WKC 16b form is used to report specific financial transactions to the relevant authorities, helping to prevent money laundering and terrorist financing, ensure compliance with tax laws and regulations, and provide transparency and accountability in financial transactions.

What are the consequences of inaccurate or incomplete submission of the WKC 16b form?

+Inaccurate or incomplete submission of the WKC 16b form can lead to penalties, fines, or delays in processing financial transactions.

What is the best way to ensure accuracy and compliance when filling out the WKC 16b form?

+To ensure accuracy and compliance, use a checklist to ensure that all required fields are completed, attach all supporting documents, review and verify the information provided in the form, submit the form on time, and seek professional help if needed.