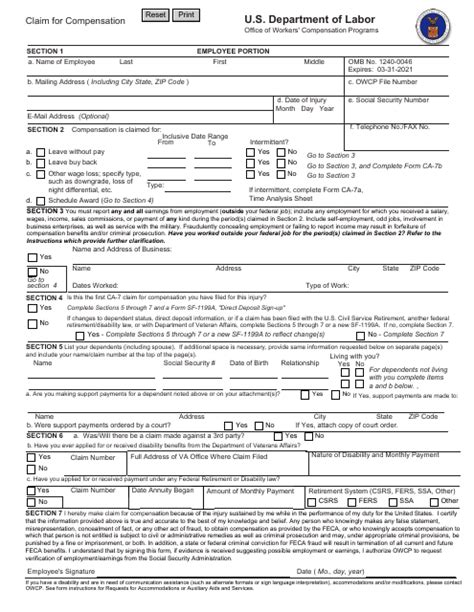

Understanding the CA-7 Form and Its Importance

The CA-7 form, also known as the "Time and Attendance Record" form, is a crucial document used by federal employees to record their work hours, leave, and overtime. The form is typically used by employees who are paid on an hourly or bi-weekly basis. Filling out the CA-7 form accurately and on time is essential to ensure that employees receive their correct pay and benefits. In this article, we will guide you through the 5 easy steps to fill out the CA-7 form.

Step 1: Gather Required Information and Documents

Before starting to fill out the CA-7 form, it's essential to gather all the required information and documents. This includes:

- Your employee ID number

- Pay period dates

- Work schedule

- Leave balances (annual, sick, and family leave)

- Overtime hours worked (if applicable)

- Any other relevant information related to your work hours or leave

Having all the necessary information and documents will help you fill out the form accurately and efficiently.

Tips for Gathering Information:

- Check your pay stubs and leave balances regularly to ensure accuracy.

- Keep a record of your work hours and leave taken.

- Review your work schedule and any changes made during the pay period.

Step 2: Fill Out the Header Section

The header section of the CA-7 form includes essential information such as your name, employee ID number, pay period dates, and agency name. Make sure to fill out this section accurately and completely.

- Your name: Write your full name as it appears on your official personnel records.

- Employee ID number: Enter your unique employee ID number.

- Pay period dates: Write the start and end dates of the pay period.

- Agency name: Enter the name of your agency or department.

Tips for Filling Out the Header Section:

- Double-check your employee ID number and pay period dates for accuracy.

- Ensure your name matches your official personnel records.

Step 3: Record Your Work Hours and Leave

The next step is to record your work hours and leave taken during the pay period. This includes:

-

Regular hours worked

-

Overtime hours worked (if applicable)

-

Leave taken (annual, sick, and family leave)

-

Holidays and other non-workdays

-

Regular hours worked: Enter the number of regular hours you worked during the pay period.

-

Overtime hours worked: Enter the number of overtime hours worked during the pay period (if applicable).

-

Leave taken: Enter the type and number of hours of leave taken during the pay period.

-

Holidays and other non-workdays: Enter the number of holidays and other non-workdays during the pay period.

Tips for Recording Work Hours and Leave:

- Keep a record of your work hours and leave taken to ensure accuracy.

- Review your leave balances regularly to avoid errors.

Step 4: Calculate Your Pay and Leave Balances

After recording your work hours and leave, calculate your pay and leave balances. This includes:

-

Gross pay

-

Net pay

-

Leave balances (annual, sick, and family leave)

-

Gross pay: Calculate your gross pay based on your regular and overtime hours worked.

-

Net pay: Calculate your net pay by subtracting deductions from your gross pay.

-

Leave balances: Calculate your leave balances by subtracting leave taken from your total leave balance.

Tips for Calculating Pay and Leave Balances:

- Review your pay stubs and leave balances regularly to ensure accuracy.

- Use a calculator to avoid errors in calculations.

Step 5: Review and Certify the CA-7 Form

The final step is to review and certify the CA-7 form. Make sure to:

-

Review the form for accuracy and completeness.

-

Certify the form by signing and dating it.

-

Review the form: Check the form for any errors or inaccuracies.

-

Certify the form: Sign and date the form to certify its accuracy.

Tips for Reviewing and Certifying the CA-7 Form:

- Double-check the form for errors or inaccuracies.

- Keep a copy of the certified form for your records.

Now that you have completed the 5 easy steps to fill out the CA-7 form, you can be confident that you have accurately recorded your work hours and leave. Remember to review and certify the form carefully to avoid any errors or inaccuracies.

What is the CA-7 form used for?

+The CA-7 form is used by federal employees to record their work hours, leave, and overtime. It is typically used by employees who are paid on an hourly or bi-weekly basis.

How often should I fill out the CA-7 form?

+The CA-7 form should be filled out every pay period, typically every two weeks.

What happens if I make a mistake on the CA-7 form?

+If you make a mistake on the CA-7 form, you should correct it as soon as possible and resubmit the form to your supervisor or payroll office. Failure to correct errors can result in delayed or incorrect pay.