Tax season can be a daunting time for many individuals, especially those who are eligible for the Earned Income Tax Credit (EITC). The EITC is a refundable tax credit designed to help low-to-moderate-income working individuals and families. However, to claim this credit, taxpayers must file the correct forms and provide the necessary information. One crucial form for claiming the EITC is the Tax Form 8862, also known as the Information To Claim Earned Income Credit After Disallowance.

In this article, we will delve into the world of Tax Form 8862, exploring its purpose, who needs to file it, and what information is required. We will also discuss the EITC, its benefits, and how to claim it.

What is the Earned Income Tax Credit (EITC)?

The Earned Income Tax Credit is a tax credit provided by the federal government to low-to-moderate-income working individuals and families. The EITC is designed to help these individuals and families offset the burden of payroll taxes and other taxes, providing them with a refundable tax credit. The credit amount varies based on income, family size, and filing status.

To be eligible for the EITC, taxpayers must meet certain requirements, including:

- Having a valid Social Security number

- Being a U.S. citizen or resident alien

- Having earned income from a job or self-employment

- Filing a tax return

- Meeting income and family size requirements

Benefits of the EITC

The EITC provides several benefits to eligible taxpayers, including:

- Reduced tax liability: The EITC can reduce the amount of taxes owed, providing a refundable tax credit.

- Increased refund: The EITC can result in a larger tax refund, helping individuals and families cover essential expenses.

- Economic stimulus: The EITC can stimulate local economies by providing eligible taxpayers with additional income.

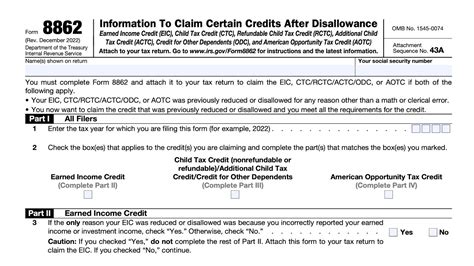

What is Tax Form 8862?

Tax Form 8862, Information To Claim Earned Income Credit After Disallowance, is a form used by the Internal Revenue Service (IRS) to verify the eligibility of taxpayers claiming the EITC. The form is required for taxpayers who have been previously denied the EITC or have had their EITC claim disallowed.

The form requires taxpayers to provide detailed information about their income, family size, and filing status. The IRS uses this information to verify the taxpayer's eligibility for the EITC and to ensure that the credit is claimed correctly.

Who Needs to File Tax Form 8862?

Taxpayers who need to file Tax Form 8862 include:

- Those who have been previously denied the EITC or have had their EITC claim disallowed.

- Those who are claiming the EITC for the first time.

- Those who have experienced changes in income, family size, or filing status.

What Information is Required on Tax Form 8862?

Tax Form 8862 requires taxpayers to provide the following information:

- Personal identification information, including name, address, and Social Security number.

- Income information, including earned income from jobs and self-employment.

- Family size and composition information.

- Filing status information.

Taxpayers must also provide documentation to support their EITC claim, including:

- Form W-2, Wage and Tax Statement.

- Form 1099, Miscellaneous Income.

- Schedule C, Form 1040, Profit or Loss from Business.

How to Claim the EITC

To claim the EITC, taxpayers must follow these steps:

- Determine eligibility: Use the IRS's EITC Assistant tool to determine eligibility for the EITC.

- Gather required documents: Collect all necessary documents, including Form W-2, Form 1099, and Schedule C.

- Complete Tax Form 8862: Fill out Tax Form 8862, providing all required information and documentation.

- File the tax return: File the tax return, including Tax Form 8862, with the IRS.

Tips for Claiming the EITC

- File electronically: Filing electronically can help reduce errors and speed up the refund process.

- Use tax preparation software: Tax preparation software, such as TurboTax or H&R Block, can help guide taxpayers through the EITC claim process.

- Seek professional help: Tax professionals, such as certified public accountants (CPAs), can provide assistance with claiming the EITC.

In conclusion, Tax Form 8862 is a crucial form for taxpayers claiming the EITC. By providing the necessary information and documentation, taxpayers can ensure that their EITC claim is processed correctly and efficiently. Remember to determine eligibility, gather required documents, complete Tax Form 8862, and file the tax return to claim the EITC.

We hope this article has provided valuable information about Tax Form 8862 and the EITC. If you have any questions or concerns, please leave a comment below. Share this article with friends and family who may be eligible for the EITC.

What is the purpose of Tax Form 8862?

+Tax Form 8862 is used to verify the eligibility of taxpayers claiming the EITC.

Who needs to file Tax Form 8862?

+Taxpayers who have been previously denied the EITC or have had their EITC claim disallowed need to file Tax Form 8862.

What information is required on Tax Form 8862?

+Tax Form 8862 requires taxpayers to provide personal identification information, income information, family size and composition information, and filing status information.