As an employer in Wisconsin, it's essential to comply with the state's labor laws and regulations. One crucial aspect of this is completing the Wisconsin Form WT-7, also known as the "Employer's Annual Reconciliation of Wisconsin Income Tax Withheld" form. This form is used to reconcile the amount of Wisconsin income tax withheld from employees' wages and report it to the Wisconsin Department of Revenue. In this article, we'll provide you with five ways to complete Wisconsin Form WT-7 correctly, ensuring you avoid any potential penalties or fines.

Understanding the Purpose of Wisconsin Form WT-7

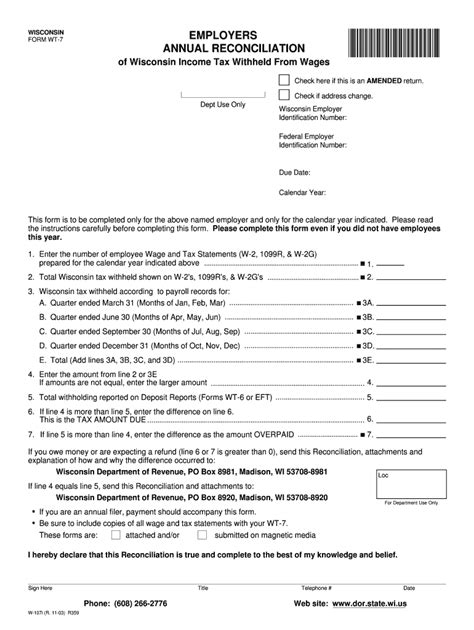

Before we dive into the five ways to complete the form correctly, it's essential to understand its purpose. Wisconsin Form WT-7 is used to report the total amount of Wisconsin income tax withheld from employees' wages throughout the year. This form is typically filed annually, and it's crucial to ensure accuracy to avoid any discrepancies or penalties.

5 Ways to Complete Wisconsin Form WT-7 Correctly

1. Gather Necessary Documents and Information

To complete Wisconsin Form WT-7 correctly, you'll need to gather necessary documents and information, including:

- Employee W-2 forms (Wisconsin and federal)

- Payroll records

- Wisconsin income tax withholding tables

- Business registration information

Having these documents readily available will ensure you have the necessary information to complete the form accurately.

2. Verify Employee Information

It's essential to verify employee information, including names, addresses, and Social Security numbers, to ensure accuracy. This information should match the information provided on the employee's W-2 form.

- Review employee W-2 forms to ensure accuracy

- Verify employee names, addresses, and Social Security numbers

- Make any necessary corrections to employee information

3. Calculate Wisconsin Income Tax Withheld

To calculate the total amount of Wisconsin income tax withheld, you'll need to review your payroll records and calculate the total amount of tax withheld from employees' wages.

- Review payroll records to determine the total amount of Wisconsin income tax withheld

- Calculate the total amount of tax withheld using Wisconsin income tax withholding tables

- Ensure accuracy by double-checking calculations

4. Complete Form WT-7 Sections

Wisconsin Form WT-7 consists of several sections that require completion. Ensure you complete each section accurately and thoroughly.

- Complete Section 1: Employer Information

- Complete Section 2: Wisconsin Income Tax Withheld

- Complete Section 3: Reconciliation of Wisconsin Income Tax Withheld

5. Review and Submit the Form

Once you've completed Wisconsin Form WT-7, review it carefully to ensure accuracy. Make any necessary corrections before submitting the form to the Wisconsin Department of Revenue.

- Review the form for accuracy and completeness

- Make any necessary corrections

- Submit the form to the Wisconsin Department of Revenue by the designated deadline

Additional Tips for Completing Wisconsin Form WT-7

- Ensure you use the correct form and instructions for the tax year

- Keep accurate records of Wisconsin income tax withheld and employee information

- Consider consulting with a tax professional or accountant if you're unsure about completing the form

By following these five ways to complete Wisconsin Form WT-7 correctly, you'll ensure you're in compliance with Wisconsin labor laws and regulations. Remember to review and submit the form accurately and thoroughly to avoid any potential penalties or fines.

Conclusion

Completing Wisconsin Form WT-7 correctly is crucial for employers in Wisconsin. By gathering necessary documents and information, verifying employee information, calculating Wisconsin income tax withheld, completing form sections, and reviewing and submitting the form, you'll ensure accuracy and compliance. Remember to keep accurate records and consider consulting with a tax professional or accountant if you're unsure about completing the form.Share Your Thoughts

We'd love to hear your thoughts on completing Wisconsin Form WT-7. Have you encountered any challenges or difficulties when completing this form? Share your experiences and tips in the comments below.

Stay Informed

Stay up-to-date with the latest news and updates on Wisconsin labor laws and regulations. Follow us on social media or subscribe to our newsletter to receive the latest information and resources.

What is Wisconsin Form WT-7 used for?

+Wisconsin Form WT-7 is used to report the total amount of Wisconsin income tax withheld from employees' wages throughout the year.

When is Wisconsin Form WT-7 due?

+Wisconsin Form WT-7 is typically due on January 31st of each year.

What information is required to complete Wisconsin Form WT-7?

+To complete Wisconsin Form WT-7, you'll need to gather employee W-2 forms, payroll records, Wisconsin income tax withholding tables, and business registration information.