The world of taxation can be a complex and daunting one, especially for individuals and businesses who are required to file various forms and reports with the government. One such form is the WI Form WT-7, which is used by employers in the state of Wisconsin to report and pay taxes on wages and salaries paid to employees. In this article, we will provide a comprehensive guide to filing WI Form WT-7, including its purpose, who needs to file, and a step-by-step guide on how to complete and submit the form.

What is WI Form WT-7?

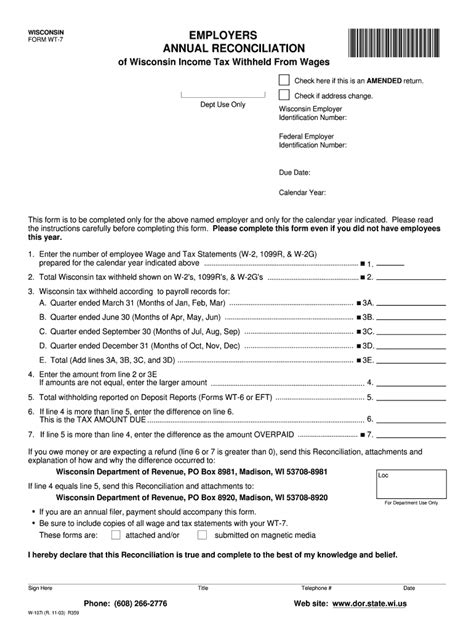

WI Form WT-7 is a withholding tax return form that is used by employers in Wisconsin to report and pay taxes on wages and salaries paid to employees. The form is used to report the amount of Wisconsin state income tax withheld from employee wages, as well as the amount of taxes paid by the employer on behalf of their employees.

Who Needs to File WI Form WT-7?

Employers in Wisconsin who are required to withhold state income tax from employee wages are required to file WI Form WT-7. This includes employers who have employees who are residents of Wisconsin, as well as employers who have employees who work in Wisconsin but are not residents of the state.

Benefits of Filing WI Form WT-7

Filing WI Form WT-7 is important for several reasons:

- It allows employers to report and pay taxes on wages and salaries paid to employees, which helps to ensure that the state of Wisconsin receives the tax revenue it needs to fund public services and programs.

- It helps employers to comply with state tax laws and regulations, which can help to avoid penalties and fines.

- It provides employers with a record of the taxes they have paid on behalf of their employees, which can be useful for accounting and tax purposes.

Step-by-Step Guide to Filing WI Form WT-7

Filing WI Form WT-7 is a relatively straightforward process that can be completed in a few steps:

- Gather Required Information: Before starting the filing process, employers will need to gather certain information, including:

- Employer identification number (EIN)

- Business name and address

- Total wages and salaries paid to employees during the reporting period

- Total amount of Wisconsin state income tax withheld from employee wages

- Total amount of taxes paid by the employer on behalf of their employees

- Complete the Form: Once the required information has been gathered, employers can complete WI Form WT-7. The form will require employers to report the total wages and salaries paid to employees, as well as the total amount of Wisconsin state income tax withheld from employee wages.

- Calculate the Tax: Employers will also need to calculate the amount of taxes they owe on behalf of their employees. This can be done using the tax rates and tables provided by the state of Wisconsin.

- Submit the Form: Once the form has been completed and the tax has been calculated, employers can submit WI Form WT-7 to the state of Wisconsin. The form can be submitted online or by mail.

Tips for Filing WI Form WT-7

Here are a few tips to keep in mind when filing WI Form WT-7:

- File on Time: Employers are required to file WI Form WT-7 on a quarterly basis, with the following due dates:

- January 31st for the fourth quarter of the previous year

- April 30th for the first quarter of the current year

- July 31st for the second quarter of the current year

- October 31st for the third quarter of the current year

- Use the Correct Form: Make sure to use the correct form for the reporting period. The state of Wisconsin provides a new form for each reporting period.

- Double-Check the Math: Make sure to double-check the math on the form to ensure that the tax is calculated correctly.

Common Mistakes to Avoid When Filing WI Form WT-7

Here are a few common mistakes to avoid when filing WI Form WT-7:

- Filing Late: Filing the form late can result in penalties and fines.

- Using the Wrong Form: Using the wrong form can result in delays and errors.

- Miscalculating the Tax: Miscalculating the tax can result in underpayment or overpayment of taxes.

Conclusion

Filing WI Form WT-7 is an important part of the tax compliance process for employers in Wisconsin. By following the steps outlined in this guide, employers can ensure that they are in compliance with state tax laws and regulations. Remember to file on time, use the correct form, and double-check the math to avoid common mistakes.

FAQs

Q: What is the due date for filing WI Form WT-7? A: The due date for filing WI Form WT-7 is January 31st for the fourth quarter of the previous year, April 30th for the first quarter of the current year, July 31st for the second quarter of the current year, and October 31st for the third quarter of the current year.

Q: Can I file WI Form WT-7 online? A: Yes, you can file WI Form WT-7 online through the state of Wisconsin's website.

Q: What is the penalty for filing WI Form WT-7 late? A: The penalty for filing WI Form WT-7 late is 5% of the unpaid tax for each month or part of a month that the form is late, up to a maximum of 25%.

Q: Can I use a previous year's form to file for the current year? A: No, you should use the current year's form to file for the current year. The state of Wisconsin provides a new form for each reporting period.

What is the purpose of WI Form WT-7?

+WI Form WT-7 is used by employers in Wisconsin to report and pay taxes on wages and salaries paid to employees.

Who needs to file WI Form WT-7?

+Employers in Wisconsin who are required to withhold state income tax from employee wages are required to file WI Form WT-7.

How do I file WI Form WT-7?

+WI Form WT-7 can be filed online or by mail. Employers will need to gather required information, complete the form, calculate the tax, and submit the form to the state of Wisconsin.