Missouri State Tax Form: A Step-By-Step Filing Guide

Filing taxes can be a daunting task, especially for those who are new to the process. Missouri state tax forms can be particularly complex, but with the right guidance, you can navigate the process with ease. In this article, we will provide a comprehensive guide on how to file your Missouri state tax form, including the necessary steps, required documents, and deadlines.

Why is it Important to File Your Missouri State Tax Form?

Filing your Missouri state tax form is crucial for several reasons. Firstly, it is a mandatory requirement by law. Failure to file your taxes can result in penalties, fines, and even legal action. Secondly, filing your taxes allows you to claim any refund you may be eligible for. In Missouri, you can claim a refund if you have overpaid your taxes throughout the year. Finally, filing your taxes helps the state government allocate funds for public services and infrastructure.

What You Need to File Your Missouri State Tax Form

Before you start filing your Missouri state tax form, you will need to gather the necessary documents. These include:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Missouri driver's license or state ID

- Your W-2 forms from your employer(s)

- Your 1099 forms for any freelance or contract work

- Your interest statements from banks and investments

- Your dividend statements from investments

- Your charitable donation receipts

- Your medical expense receipts

Missouri State Tax Forms

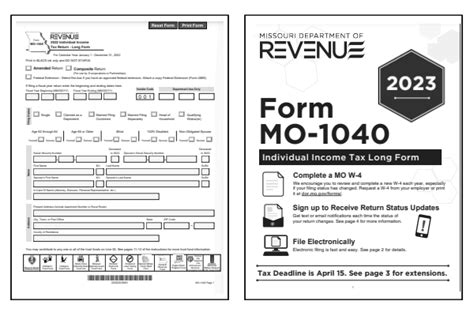

Missouri offers several tax forms, depending on your income level and filing status. The most common forms are:

- MO-1040: This is the standard form for individuals with a simple tax return.

- MO-1040A: This form is for individuals with a more complex tax return, including those with investments and self-employment income.

- MO-1040EZ: This form is for individuals with a very simple tax return, including those with only W-2 income.

Step-By-Step Filing Guide

Now that you have gathered the necessary documents and chosen the correct form, it's time to start filing. Here's a step-by-step guide:

- Download and print the correct form from the Missouri Department of Revenue website or pick one up from a local library or post office.

- Fill out the form carefully, making sure to sign and date it.

- Attach all required documents, including your W-2 and 1099 forms.

- Calculate your tax liability using the Missouri tax tables or a tax calculator.

- If you owe taxes, make a payment online or by mail.

- If you are due a refund, choose your refund option, including direct deposit or a paper check.

- Mail your completed form to the Missouri Department of Revenue.

Missouri State Tax Deadlines

The deadline for filing your Missouri state tax form is April 15th. If you need an extension, you can file Form MO-60 by April 15th to receive an automatic six-month extension.

Tips and Reminders

- Make sure to file your taxes on time to avoid penalties and fines.

- Take advantage of tax credits and deductions, including the Missouri Earned Income Tax Credit (EITC).

- Consider hiring a tax professional if you have a complex tax return.

- Keep a copy of your tax return for your records.

Common Mistakes to Avoid

- Failing to sign and date the form.

- Failing to attach required documents.

- Miscalculating tax liability.

- Failing to make a payment or claim a refund.

Conclusion

Filing your Missouri state tax form can seem overwhelming, but with the right guidance, you can navigate the process with ease. Remember to gather all necessary documents, choose the correct form, and file on time. Don't hesitate to seek help if you need it, and take advantage of tax credits and deductions to minimize your tax liability. By following these steps and tips, you can ensure a smooth and stress-free tax filing experience.

What is the deadline for filing my Missouri state tax form?

+The deadline for filing your Missouri state tax form is April 15th.

What is the Missouri Earned Income Tax Credit (EITC)?

+The Missouri EITC is a tax credit for low-income working individuals and families.

Can I file my Missouri state tax form electronically?

+Yes, you can file your Missouri state tax form electronically through the Missouri Department of Revenue website.