The role of a withholding agent is a crucial one in the context of tax compliance, particularly when it comes to Form 5498. This form is used to report contributions to and distributions from Individual Retirement Accounts (IRAs) and other types of retirement savings accounts. The information provided on Form 5498 is essential for both the account holder and the IRS, as it helps in tracking and reporting income for tax purposes.

To understand who the withholding agent is on Form 5498, we need to delve into the details of the form and the responsibilities associated with being a withholding agent.

Understanding Form 5498

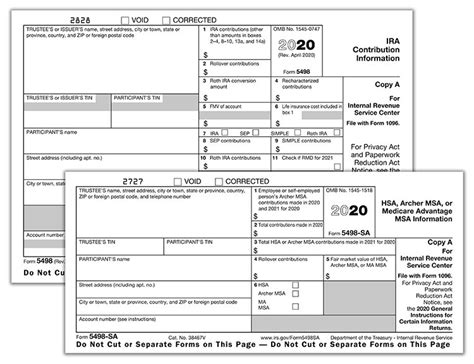

Form 5498 is a document that financial institutions, such as banks, insurance companies, and investment firms, use to report certain information to the IRS and to the individuals who hold IRAs and other retirement accounts. The form details contributions made to these accounts during the tax year, as well as the fair market value of the accounts as of December 31st of the same year.

The primary purpose of Form 5498 is to ensure that both the account holder and the IRS have accurate information regarding contributions and distributions from these accounts, which is essential for tax reporting and compliance.

The Role of the Withholding Agent

A withholding agent is an individual or entity that is responsible for withholding taxes on certain types of income and paying those taxes to the government on behalf of the taxpayer. In the context of Form 5498, the withholding agent typically refers to the financial institution that maintains the IRA or retirement account.

The withholding agent's role includes:

-

Withholding Taxes: The most direct responsibility of a withholding agent is to withhold taxes on distributions from IRAs and other retirement accounts when required. This usually applies to distributions that are subject to income tax, such as distributions made before the account holder reaches the age of 59 ½.

-

Reporting: The withholding agent must also report the amount of taxes withheld to both the account holder and the IRS. This is typically done using Form 1099-R for distributions and Form 5498 for contributions and account valuations.

-

Paying Withheld Taxes: Beyond withholding and reporting, the agent must also ensure that the withheld taxes are paid to the IRS in a timely manner. This is crucial for maintaining tax compliance and avoiding penalties.

Responsibilities of the Withholding Agent on Form 5498

The withholding agent plays a critical role in the accurate completion and submission of Form 5498. Some of their key responsibilities regarding this form include:

- Accurate Reporting: Ensuring that all contributions and account valuations are accurately reported on Form 5498.

- Timely Filing: Submitting the form to the IRS and providing a copy to the account holder by the required deadline.

- Record Keeping: Maintaining detailed records of contributions, distributions, and account valuations to support the information reported on Form 5498.

By fulfilling these responsibilities, the withholding agent helps ensure that both the account holder and the IRS have the necessary information for tax compliance and planning.

Conclusion

The withholding agent plays a vital role in ensuring tax compliance and accurate reporting for IRAs and other retirement accounts. Their responsibilities are not only critical for the account holder's tax obligations but also for the integrity of the tax system as a whole. Understanding the role of the withholding agent on Form 5498 is essential for navigating the complexities of tax reporting for retirement savings.

Who is typically considered the withholding agent on Form 5498?

+The financial institution that maintains the IRA or retirement account is typically considered the withholding agent on Form 5498.

What is the primary purpose of Form 5498?

+The primary purpose of Form 5498 is to report contributions made to IRAs and other retirement accounts, as well as the fair market value of these accounts as of December 31st of the tax year.

What are the responsibilities of the withholding agent regarding Form 5498?

+The withholding agent is responsible for accurate reporting, timely filing of the form, and maintaining detailed records to support the information reported on Form 5498.