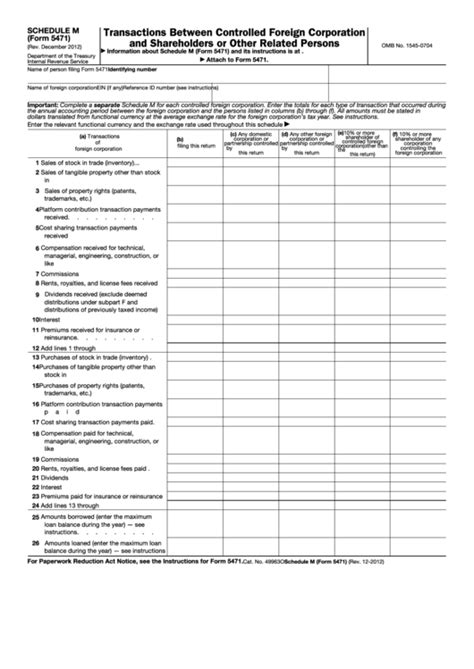

Form 5471, Information Return of U.S. Persons with Respect to Certain Foreign Corporations, is a critical filing for U.S. taxpayers with interests in foreign corporations. One of the most complex aspects of this form is Schedule M, which deals with the calculation of foreign corporation tax credits. In this article, we will delve into the details of Form 5471 Schedule M, explaining the importance of accurate calculations and providing guidance on how to navigate this complex aspect of international taxation.

Why is Form 5471 Schedule M Important?

Form 5471 Schedule M is essential for U.S. taxpayers who own interests in foreign corporations, as it helps determine the foreign tax credits that can be claimed against U.S. tax liabilities. Foreign tax credits are crucial in reducing the double taxation that can occur when income is taxed by both the United States and a foreign country. By accurately calculating foreign corporation tax credits, taxpayers can minimize their U.S. tax liability and avoid paying unnecessary taxes.

Understanding the Components of Schedule M

Schedule M is divided into several sections, each addressing a specific aspect of foreign corporation tax credits. The key components of Schedule M include:

- Section 1: Foreign Taxes Paid or Accrued: This section requires taxpayers to report the foreign taxes paid or accrued by the foreign corporation.

- Section 2: Foreign Taxes Deemed Paid: This section involves calculating the foreign taxes deemed paid by the U.S. taxpayer, which is based on the proportion of the foreign corporation's income that is included in the taxpayer's gross income.

- Section 3: Limitation on Credit: This section applies the limitation on credit, which ensures that the foreign tax credit does not exceed the U.S. tax liability.

Calculating Foreign Corporation Tax Credits

To calculate foreign corporation tax credits, taxpayers must follow a series of steps:

- Determine the foreign corporation's taxable income: This involves calculating the foreign corporation's taxable income, taking into account any deductions or exemptions.

- Calculate the foreign taxes paid or accrued: Taxpayers must report the foreign taxes paid or accrued by the foreign corporation, including any withholding taxes.

- Calculate the foreign taxes deemed paid: This involves calculating the foreign taxes deemed paid by the U.S. taxpayer, based on the proportion of the foreign corporation's income that is included in the taxpayer's gross income.

- Apply the limitation on credit: The limitation on credit ensures that the foreign tax credit does not exceed the U.S. tax liability.

Navigating the Complexities of Schedule M

Schedule M is a complex schedule, and taxpayers often require guidance to ensure accurate calculations. Some common challenges include:

- Determining the correct tax rate: Taxpayers must determine the correct tax rate applicable to the foreign corporation's income.

- Calculating the foreign taxes deemed paid: This requires taxpayers to calculate the proportion of the foreign corporation's income that is included in the taxpayer's gross income.

- Applying the limitation on credit: Taxpayers must apply the limitation on credit to ensure that the foreign tax credit does not exceed the U.S. tax liability.

Foreign Corporation Tax Credits: A Step-by-Step Guide

To help taxpayers navigate the complexities of Schedule M, we have created a step-by-step guide to calculating foreign corporation tax credits:

Step 1: Determine the Foreign Corporation's Taxable Income

- Calculate the foreign corporation's taxable income, taking into account any deductions or exemptions.

Step 2: Calculate the Foreign Taxes Paid or Accrued

- Report the foreign taxes paid or accrued by the foreign corporation, including any withholding taxes.

Foreign Taxes Paid or Accrued

- Withholding taxes: $10,000

- Corporate taxes: $20,000

- Total foreign taxes paid or accrued: $30,000

Step 3: Calculate the Foreign Taxes Deemed Paid

- Calculate the foreign taxes deemed paid by the U.S. taxpayer, based on the proportion of the foreign corporation's income that is included in the taxpayer's gross income.

Foreign Taxes Deemed Paid

- Proportion of foreign corporation's income included in taxpayer's gross income: 50%

- Foreign taxes deemed paid: $15,000

Step 4: Apply the Limitation on Credit

- Apply the limitation on credit to ensure that the foreign tax credit does not exceed the U.S. tax liability.

Limitation on Credit

- U.S. tax liability: $50,000

- Foreign tax credit: $15,000

- Limitation on credit: $15,000

By following these steps, taxpayers can accurately calculate foreign corporation tax credits and minimize their U.S. tax liability.

Conclusion: Accurate Calculations Matter

Form 5471 Schedule M is a critical component of international taxation, and accurate calculations are essential to minimize U.S. tax liability. By understanding the components of Schedule M and following the step-by-step guide, taxpayers can ensure that they are taking advantage of the foreign tax credits available to them.

Call to Action

If you are a U.S. taxpayer with interests in foreign corporations, it is essential to seek guidance from a qualified tax professional to ensure accurate calculations of foreign corporation tax credits. Don't miss out on the opportunity to minimize your U.S. tax liability – consult with a tax expert today!

What is Form 5471 Schedule M?

+Form 5471 Schedule M is a schedule used to calculate foreign corporation tax credits for U.S. taxpayers with interests in foreign corporations.

Why is accurate calculation of foreign corporation tax credits important?

+Accurate calculation of foreign corporation tax credits is essential to minimize U.S. tax liability and avoid paying unnecessary taxes.

What are the key components of Schedule M?

+The key components of Schedule M include foreign taxes paid or accrued, foreign taxes deemed paid, and the limitation on credit.