Completing the Oregon Form OR-40 is a crucial step in filing your Oregon state income tax return. The OR-40 form is used to report your income, claim deductions and credits, and calculate your tax liability. In this article, we will guide you through the 5 steps to complete the Oregon Form OR-40.

Step 1: Gather Necessary Documents and Information

Before starting to fill out the OR-40 form, gather all the necessary documents and information. You will need:

- Your federal income tax return (Form 1040)

- Your W-2 forms from your employer(s)

- Your 1099 forms for any self-employment income or other income

- Your interest and dividend statements (1099-INT and 1099-DIV)

- Your mortgage interest statement (1098)

- Your property tax statement

- Your charitable donation receipts

- Your medical expense receipts

Having all the necessary documents and information will help you complete the form accurately and efficiently.

What to Expect in Step 1

In this step, you will gather all the necessary documents and information to complete the OR-40 form. This includes your federal income tax return, W-2 forms, 1099 forms, and other relevant documents.

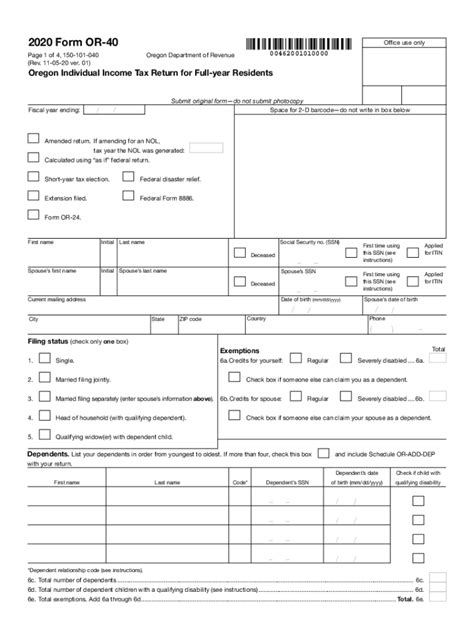

Step 2: Complete the Form OR-40 Identification Section

The identification section of the OR-40 form requires your personal and tax-related information. You will need to provide:

- Your name and address

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er))

- Your number of dependents

- Your occupation and employer's name and address

This information is used to identify you and process your tax return.

What to Expect in Step 2

In this step, you will complete the identification section of the OR-40 form. This includes providing your personal and tax-related information.

Step 3: Report Your Income

The income section of the OR-40 form requires you to report all your income from various sources. You will need to report:

- Your wages, salaries, and tips from your W-2 forms

- Your self-employment income from your 1099 forms

- Your interest and dividend income from your 1099-INT and 1099-DIV forms

- Your capital gains and losses from your Schedule D (Form 1040)

- Your other income, such as alimony, unemployment benefits, and social security benefits

You will also need to calculate your total income and report it on the form.

What to Expect in Step 3

In this step, you will report all your income from various sources. This includes wages, salaries, tips, self-employment income, interest and dividend income, and other income.

Step 4: Claim Deductions and Credits

The deductions and credits section of the OR-40 form allows you to reduce your tax liability. You will need to claim:

- Your standard deduction or itemized deductions

- Your personal exemptions

- Your mortgage interest deduction

- Your charitable contribution deduction

- Your medical expense deduction

- Your child care credit

- Your earned income tax credit (EITC)

You will also need to calculate your total deductions and credits and report them on the form.

What to Expect in Step 4

In this step, you will claim deductions and credits to reduce your tax liability. This includes standard deduction or itemized deductions, personal exemptions, mortgage interest deduction, charitable contribution deduction, and other deductions and credits.

Step 5: Calculate Your Tax Liability and Sign the Form

The final step is to calculate your tax liability and sign the form. You will need to:

- Calculate your total tax liability

- Calculate your total payments, including withholding and estimated tax payments

- Determine if you owe tax or are due a refund

- Sign and date the form

Make sure to review the form carefully and accurately before signing and submitting it.

What to Expect in Step 5

In this step, you will calculate your tax liability and sign the form. This includes calculating your total tax liability, total payments, and determining if you owe tax or are due a refund.

We hope this guide has helped you complete the Oregon Form OR-40. Remember to file your tax return on time to avoid penalties and interest.

What is the due date for filing the Oregon Form OR-40?

+The due date for filing the Oregon Form OR-40 is April 15th of each year.

Can I file the Oregon Form OR-40 electronically?

+Yes, you can file the Oregon Form OR-40 electronically through the Oregon Department of Revenue's website.

What is the penalty for filing the Oregon Form OR-40 late?

+The penalty for filing the Oregon Form OR-40 late is 5% of the unpaid tax per month, up to a maximum of 25%.

We hope this guide has helped you complete the Oregon Form OR-40. If you have any further questions or need assistance, please don't hesitate to ask.