The IRS Form 720 is a crucial document for businesses that manufacture or sell certain products, as it requires them to report and pay excise taxes on a quarterly basis. Completing this form can be a daunting task, especially for those who are new to the process. In this article, we will provide a step-by-step guide on how to complete Form 720, making it easier for businesses to navigate the process and avoid any potential penalties.

What is Form 720 and Who Needs to File It?

Form 720 is a quarterly federal excise tax return that is used to report and pay taxes on certain goods and services. Businesses that are required to file Form 720 include those that manufacture or sell:

- Gasoline and diesel fuel

- Kerosene and other types of fuel

- Tobacco products, including cigarettes, cigars, and snuff

- Firearms and ammunition

- Certain types of tires and tubes

What are the Benefits of Filing Form 720?

Filing Form 720 is essential for businesses that are required to do so, as it allows them to report and pay their excise taxes in a timely manner. This can help businesses avoid penalties and interest charges that can add up quickly. Additionally, filing Form 720 can help businesses to:

- Maintain compliance with IRS regulations

- Avoid audits and penalties

- Take advantage of potential refunds or credits

Step 1: Gather Required Information and Documents

Before starting to complete Form 720, businesses will need to gather certain information and documents. This includes:

- Business name and address

- Employer Identification Number (EIN)

- Quarter and year for which the return is being filed

- Total amount of excise taxes owed

- Records of sales and purchases of taxable goods and services

Step 2: Complete Part I - Tax Liability

The first part of Form 720 requires businesses to report their tax liability for the quarter. This includes:

- Total amount of excise taxes owed

- Amount of taxes paid with the return

- Amount of taxes paid in advance

- Amount of credit or refund claimed

Step 3: Complete Part II - Taxable Fuel

The second part of Form 720 requires businesses to report information about taxable fuel. This includes:

- Type of fuel (gasoline, diesel, kerosene, etc.)

- Total amount of fuel sold or used

- Tax rate for each type of fuel

- Total amount of taxes owed on fuel sales

Step 4: Complete Part III - Other Taxable Articles

The third part of Form 720 requires businesses to report information about other taxable articles, such as tobacco products, firearms, and certain types of tires and tubes. This includes:

- Type of article (tobacco, firearms, etc.)

- Total amount of articles sold or used

- Tax rate for each type of article

- Total amount of taxes owed on article sales

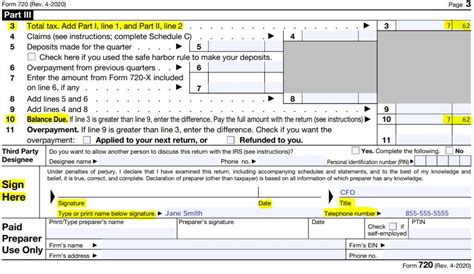

Step 5: Sign and Date the Return

Once all of the required information has been entered, the return must be signed and dated. This is a critical step, as unsigned returns will not be accepted by the IRS.

Step 6: File the Return and Pay Any Tax Owed

The final step is to file the return with the IRS and pay any tax owed. This can be done electronically or by mail. Businesses that owe taxes must pay them by the due date to avoid penalties and interest charges.

Conclusion and Next Steps

Completing Form 720 can be a complex process, but by following the steps outlined in this guide, businesses can ensure that they are in compliance with IRS regulations. It's essential to take the time to accurately complete the form and pay any tax owed to avoid penalties and interest charges.

We hope this guide has been helpful in explaining the process of completing Form 720. If you have any questions or need further assistance, please don't hesitate to comment below or share this article with others who may find it helpful.

What is the due date for filing Form 720?

+The due date for filing Form 720 is the last day of the month following the end of the quarter. For example, the due date for the first quarter (January 1 - March 31) is April 30.

Can I file Form 720 electronically?

+Yes, you can file Form 720 electronically through the IRS's Electronic Federal Tax Payment System (EFTPS).

What happens if I don't file Form 720 on time?

+If you don't file Form 720 on time, you may be subject to penalties and interest charges. The IRS may also assess additional taxes and penalties if you don't pay your excise taxes on time.