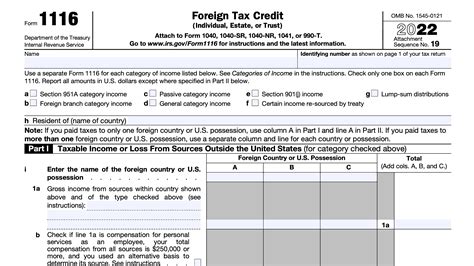

The Form 1116 is a crucial document for taxpayers who have foreign-earned income and want to claim the foreign earned income exclusion (FEIE) or the foreign housing exclusion (FHE). One of the key components of the Form 1116 is reporting gross income, which can be done in five different ways. In this article, we will explore these methods in detail, providing examples and explanations to help taxpayers understand how to report their gross income accurately.

Understanding Gross Income on Form 1116

Before diving into the five ways to report gross income on Form 1116, it's essential to understand what gross income means in this context. Gross income refers to the total amount of money earned from foreign sources, including wages, salaries, tips, and other forms of compensation. This income can be earned from various sources, such as employment, self-employment, or investments.

Method 1: Reporting Gross Income from a Single Foreign Employer

The first method is to report gross income from a single foreign employer. If you have only one foreign employer, you can report your gross income on Form 1116 using the following steps:

- Enter the name and address of your foreign employer in Part I of the form.

- Report the total amount of gross income earned from that employer in Box 1 of the form.

- If you have any deductions or exemptions, you can claim them in Part II of the form.

For example, let's say you work as an English teacher in Japan and earn ¥5 million (approximately $45,000 USD) per year. You would report this income on Form 1116, Box 1, as follows:

| Box 1 | Gross Income from Foreign Employer |

|---|---|

| ¥5,000,000 | $45,000 USD |

Method 2: Reporting Gross Income from Multiple Foreign Employers

If you have multiple foreign employers, you will need to report your gross income from each employer separately. Here's how:

- List each foreign employer in Part I of the form, including their name and address.

- Report the total amount of gross income earned from each employer in Box 1 of the form.

- If you have any deductions or exemptions, you can claim them in Part II of the form.

For example, let's say you work as a freelancer and have two foreign clients: one in the UK and one in Australia. You earn £20,000 (approximately $26,000 USD) from the UK client and AU$30,000 (approximately $20,000 USD) from the Australian client. You would report this income on Form 1116, Box 1, as follows:

| Box 1 | Gross Income from Foreign Employers |

|---|---|

| £20,000 | $26,000 USD |

| AU$30,000 | $20,000 USD |

Method 3: Reporting Gross Income from Self-Employment

If you are self-employed and have foreign-earned income, you will need to report your gross income on Form 1116 using the following steps:

- Complete Schedule C (Form 1040) to calculate your self-employment income.

- Report the total amount of gross income from self-employment on Form 1116, Box 1.

- If you have any deductions or exemptions, you can claim them in Part II of the form.

For example, let's say you are a self-employed writer and earn €50,000 (approximately $55,000 USD) per year from foreign clients. You would report this income on Form 1116, Box 1, as follows:

| Box 1 | Gross Income from Self-Employment |

|---|---|

| €50,000 | $55,000 USD |

Method 4: Reporting Gross Income from Investments

If you have foreign-earned income from investments, such as dividends or interest, you will need to report your gross income on Form 1116 using the following steps:

- Complete Schedule 1 (Form 1040) to calculate your investment income.

- Report the total amount of gross income from investments on Form 1116, Box 1.

- If you have any deductions or exemptions, you can claim them in Part II of the form.

For example, let's say you earn CHF 10,000 (approximately $10,500 USD) per year from a Swiss investment account. You would report this income on Form 1116, Box 1, as follows:

| Box 1 | Gross Income from Investments |

|---|---|

| CHF 10,000 | $10,500 USD |

Method 5: Reporting Gross Income from Other Foreign Sources

If you have foreign-earned income from other sources, such as rental income or royalties, you will need to report your gross income on Form 1116 using the following steps:

- Complete the relevant schedules (e.g., Schedule E for rental income or Schedule E for royalties) to calculate your income.

- Report the total amount of gross income from other foreign sources on Form 1116, Box 1.

- If you have any deductions or exemptions, you can claim them in Part II of the form.

For example, let's say you earn NZD 20,000 (approximately $12,500 USD) per year from renting out a property in New Zealand. You would report this income on Form 1116, Box 1, as follows:

| Box 1 | Gross Income from Other Foreign Sources |

|---|---|

| NZD 20,000 | $12,500 USD |

In conclusion, reporting gross income on Form 1116 can be done in five different ways, depending on the source of your foreign-earned income. By following the steps outlined above, you can ensure that you accurately report your gross income and claim any applicable deductions or exemptions.

What is the purpose of Form 1116?

+Form 1116 is used to claim the foreign earned income exclusion (FEIE) or the foreign housing exclusion (FHE) for taxpayers who have foreign-earned income.

What is considered gross income on Form 1116?

+Gross income on Form 1116 refers to the total amount of money earned from foreign sources, including wages, salaries, tips, and other forms of compensation.

Can I claim deductions or exemptions on Form 1116?

+Yes, you can claim deductions or exemptions on Form 1116, but you must follow the specific instructions and guidelines outlined in the form and its accompanying schedules.