With the rise of online tax filing and electronic submissions, it's easy to get confused about where to mail a W-4V form for easy processing. The W-4V form, also known as the Voluntary Withholding Request, is used by individuals to request that the Social Security Administration (SSA) withhold federal income tax from their Social Security benefits. In this article, we'll walk you through the steps and provide you with the necessary information to ensure your W-4V form is processed efficiently.

Understanding the W-4V Form

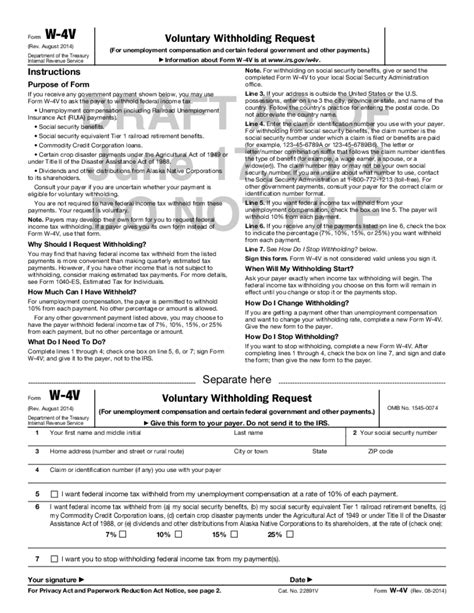

Before we dive into where to mail the form, let's quickly review what the W-4V form is and why it's used. The W-4V form is a voluntary request to withhold federal income tax from your Social Security benefits. By completing this form, you're authorizing the SSA to deduct a portion of your benefits and send them to the IRS as federal income tax.

Where to Mail the W-4V Form

Now that we've covered the basics of the W-4V form, let's move on to where to mail it for easy processing. The SSA provides specific addresses for mailing the W-4V form, depending on your location.

- If you're a U.S. citizen or resident: Mail the completed W-4V form to the following address: Social Security Administration Wilkes-Barre Data Operations Center 1150 E. High St. Wilkes-Barre, PA 18705-1697

- If you're a non-U.S. citizen or non-resident: Mail the completed W-4V form to the following address: Social Security Administration Office of International Operations 6401 Security Blvd. Baltimore, MD 21235-6401

Tips for Easy Processing

To ensure your W-4V form is processed efficiently, follow these tips:

- Use black ink: When completing the form, use black ink to fill in the fields. This will help the SSA's automated processing system read the information accurately.

- Be accurate and complete: Double-check your information for accuracy and completeness. Incomplete or inaccurate forms may delay processing.

- Sign the form: Don't forget to sign the form in the designated area. Unsigned forms will not be processed.

- Use the correct mailing address: Verify that you're using the correct mailing address for your location.

Benefits of Withholding Federal Income Tax from Social Security Benefits

Withholding federal income tax from your Social Security benefits can provide several benefits, including:

- Reduced tax burden: By withholding tax from your benefits, you can avoid a large tax bill when you file your tax return.

- Simplified tax filing: Withholding tax from your benefits can simplify your tax filing process, as you won't need to worry about making estimated tax payments throughout the year.

- Avoiding penalties: Withholding tax from your benefits can help you avoid penalties and interest associated with underpayment of taxes.

How to Complete the W-4V Form

Completing the W-4V form is a straightforward process. Here's a step-by-step guide:

- Download or obtain the form: You can download the W-4V form from the SSA's website or obtain a copy from your local SSA office.

- Fill in the fields: Complete the form using black ink, making sure to fill in all required fields.

- Choose your withholding rate: Select the percentage of your benefits that you want to withhold for federal income tax.

- Sign the form: Sign the form in the designated area.

- Mail the form: Mail the completed form to the SSA at the address listed above.

Conclusion

Mailing your W-4V form to the correct address is crucial for easy processing. By following the tips outlined in this article, you can ensure that your form is processed efficiently and accurately. Remember to use black ink, be accurate and complete, sign the form, and use the correct mailing address. If you have any questions or concerns, don't hesitate to contact the SSA or consult with a tax professional.

What is the W-4V form used for?

+The W-4V form is used to request that the Social Security Administration withhold federal income tax from your Social Security benefits.

Where do I mail the W-4V form?

+Mail the completed W-4V form to the Social Security Administration at the address listed above, depending on your location.

Can I e-file the W-4V form?

+No, the W-4V form must be mailed to the Social Security Administration. E-filing is not available for this form.