Missouri residents and non-residents alike must navigate the complexities of state income taxes. As a taxpayer in Missouri, it's essential to understand the various forms and schedules required to file your state income tax return accurately. One of the most critical forms is the MO-1040A, also known as the Missouri Individual Income Tax Return (Short Form). In this article, we'll delve into the details of the MO-1040A form, its purpose, and what you need to know to file it correctly.

Understanding the MO-1040A Form

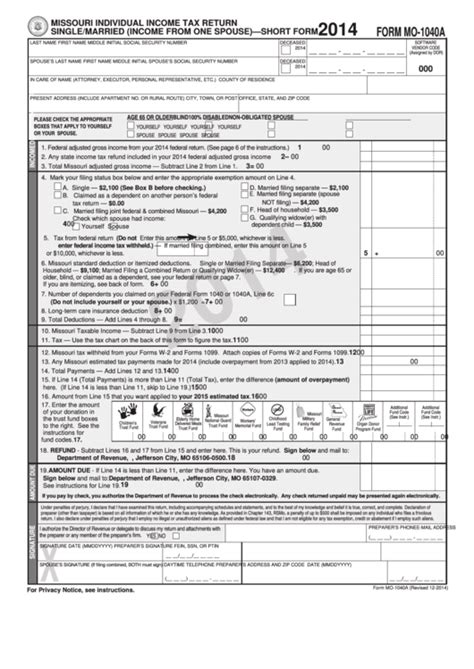

The MO-1040A form is a simplified version of the standard MO-1040 form. It's designed for taxpayers with straightforward income tax situations, making it easier to file and report their state income tax. The MO-1040A form is typically used by individuals who:

- Have only one source of income (e.g., a single W-2 job)

- Don't have any dependents

- Don't itemize deductions

- Don't claim any credits except for the Missouri Earned Income Tax Credit (EITC)

Key Components of the MO-1040A Form

The MO-1040A form consists of two pages, with the following sections:

- Name, Address, and Social Security Number: This section requires your personal details, including your name, address, and Social Security number.

- Filing Status: You'll need to select your filing status, which determines the tax rates and deductions you're eligible for.

- Income: Report your total income from all sources, including wages, salaries, and tips.

- Adjustments to Income: Claim any adjustments to your income, such as alimony paid or student loan interest.

- Tax Credits: Claim any tax credits you're eligible for, including the Missouri EITC.

- Tax: Calculate your total tax liability based on your income and credits.

Benefits of Using the MO-1040A Form

Using the MO-1040A form offers several benefits, including:

- Simplified filing process: The MO-1040A form is easier to complete than the standard MO-1040 form, making it ideal for taxpayers with straightforward income tax situations.

- Reduced paperwork: With fewer schedules and attachments required, the MO-1040A form reduces the amount of paperwork you need to file.

- Faster processing: The Missouri Department of Revenue processes MO-1040A forms more quickly than the standard MO-1040 form.

Who Should Use the MO-1040A Form?

The MO-1040A form is suitable for taxpayers who:

- Have a single source of income

- Don't have dependents

- Don't itemize deductions

- Don't claim any credits except for the Missouri EITC

However, if you have a more complex income tax situation, you may need to use the standard MO-1040 form or consult with a tax professional.

Steps to Complete the MO-1040A Form

To complete the MO-1040A form, follow these steps:

- Gather all necessary documents, including your W-2 forms and any other relevant tax documents.

- Determine your filing status and report your total income from all sources.

- Claim any adjustments to your income and tax credits you're eligible for.

- Calculate your total tax liability based on your income and credits.

- Sign and date the form.

Tips for Filing the MO-1040A Form

To ensure a smooth filing process, follow these tips:

- Use the correct form: Make sure you're using the correct MO-1040A form for the tax year you're filing for.

- Review and double-check: Carefully review your form for accuracy and completeness before submitting it.

- E-file: Consider e-filing your MO-1040A form to reduce processing time and minimize errors.

Common Errors to Avoid

When completing the MO-1040A form, avoid the following common errors:

- Inaccurate Social Security numbers or addresses

- Incorrect filing status or income reporting

- Failure to claim eligible credits or deductions

Missouri State Income Tax Rates

Missouri has a progressive income tax system, with tax rates ranging from 1.5% to 5.2%. The tax rates are as follows:

- 1.5% on the first $1,000 of taxable income

- 2% on taxable income between $1,001 and $2,000

- 2.5% on taxable income between $2,001 and $3,000

- 3% on taxable income between $3,001 and $4,000

- 3.5% on taxable income between $4,001 and $5,000

- 4% on taxable income between $5,001 and $6,000

- 4.5% on taxable income between $6,001 and $7,000

- 5% on taxable income between $7,001 and $8,000

- 5.2% on taxable income over $8,000

Missouri State Income Tax Deductions and Credits

Missouri offers various deductions and credits to reduce your tax liability. Some of the most common deductions and credits include:

- Missouri Earned Income Tax Credit (EITC)

- Missouri Child Tax Credit

- Missouri Education Savings Account (ESA) contribution deduction

- Missouri Public Safety Officer (PSO) exemption

Claiming Missouri State Income Tax Deductions and Credits

To claim Missouri state income tax deductions and credits, you'll need to complete the relevant schedules and attach them to your MO-1040A form. Make sure to review the eligibility criteria and requirements for each deduction and credit to ensure you're eligible.

Filing the MO-1040A Form Online

You can file your MO-1040A form online through the Missouri Department of Revenue's website. To e-file, you'll need to:

- Create an account on the Missouri Department of Revenue's website

- Complete the MO-1040A form online

- Attach any required schedules and documents

- Submit your return electronically

E-filing offers several benefits, including:

- Faster processing time

- Reduced errors

- Electronic confirmation of receipt

Missouri State Income Tax Payment Options

If you owe state income tax, you can pay online, by phone, or by mail. The Missouri Department of Revenue accepts various payment methods, including:

- Electronic check or debit card

- Credit card

- Cash

- Check or money order

Make sure to include your Social Security number or Missouri Tax ID number with your payment to ensure accurate processing.

Amending the MO-1040A Form

If you need to make changes to your MO-1040A form after submitting it, you'll need to file an amended return. To amend your return, you'll need to:

- Complete a new MO-1040A form with the corrected information

- Attach a statement explaining the changes

- Submit the amended return to the Missouri Department of Revenue

Missouri State Income Tax Audit and Appeal Process

If you're selected for an audit, you'll receive a notice from the Missouri Department of Revenue. During an audit, the department will review your return to ensure accuracy and compliance with state tax laws.

If you disagree with the audit findings, you can appeal the decision. To appeal, you'll need to:

- Submit a written protest to the Missouri Department of Revenue

- Provide supporting documentation and evidence

- Attend a hearing or meeting with a representative from the department

Conclusion

Filing the MO-1040A form can be a straightforward process if you understand the requirements and guidelines. By following the steps outlined in this article, you'll be able to complete your Missouri state income tax return accurately and efficiently.

Remember to review the Missouri Department of Revenue's website for the most up-to-date information on state income tax laws, forms, and procedures.

FAQ Section:

What is the MO-1040A form used for?

+The MO-1040A form is used for filing Missouri state income tax returns for individuals with straightforward income tax situations.

Who should use the MO-1040A form?

+The MO-1040A form is suitable for taxpayers with a single source of income, no dependents, and no itemized deductions.

What are the benefits of using the MO-1040A form?

+The MO-1040A form offers a simplified filing process, reduced paperwork, and faster processing times.