When it comes to filing taxes, mistakes can happen, and it's essential to correct them to avoid any penalties or interest on your tax bill. If you've already filed your tax return and realized you made an error or omitted some information, don't worry – you can amend your return using Form IL 1040-X. In this article, we'll guide you through the process of filing an amended tax return and provide you with the necessary information to ensure you get it right.

Why Amend Your Tax Return?

There are various reasons why you might need to amend your tax return. Here are some common scenarios:

- You forgot to report some income or claim a deduction or credit.

- You received additional income or had changes in your income after filing your original return.

- You discovered an error in your math calculations or incorrect information.

- You want to change your filing status or claim a different exemption.

Understanding Form IL 1040-X

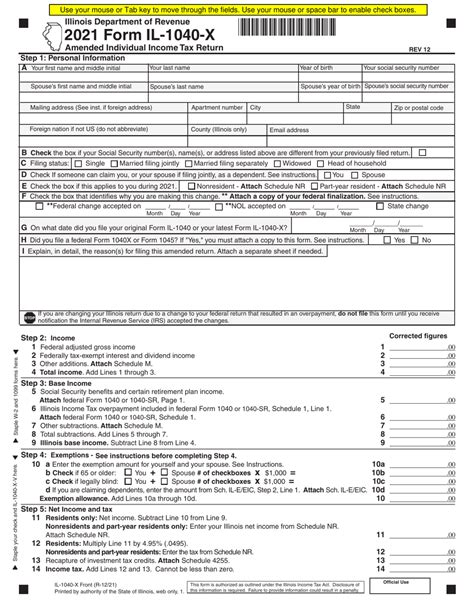

Form IL 1040-X is the Amended Individual Income Tax Return form used to correct errors or make changes to your original tax return. The form is divided into several sections, and you'll need to provide detailed information about the changes you're making. Here's an overview of what you can expect:

How to File an Amended Tax Return

Filing an amended tax return involves several steps. Here's a step-by-step guide to help you through the process:

Step 1: Gather Your Documents

Before you start, make sure you have all the necessary documents and information. You'll need:

- A copy of your original tax return (Form IL 1040)

- The corrected information or documentation (e.g., W-2, 1099, receipts)

- A completed Form IL 1040-X

What to Include in Your Amended Return

When completing Form IL 1040-X, you'll need to provide detailed information about the changes you're making. This includes:

- The reason for the amendment (e.g., "additional income," " incorrect math")

- The corrected information (e.g., new income amount, corrected deduction)

- The amount of tax owed or refund due

Step 2: Complete Form IL 1040-X

To complete Form IL 1040-X, follow these steps:

- Enter your name, address, and Social Security number (or Individual Taxpayer Identification Number) at the top of the form.

- Indicate the tax year you're amending and the reason for the amendment.

- Report the corrected information in the applicable sections (e.g., income, deductions, credits).

- Calculate the correct tax liability or refund due.

- Sign and date the form.

Filing and Submitting Your Amended Return

Once you've completed Form IL 1040-X, you'll need to submit it to the Illinois Department of Revenue. Here are your options:

- Mail the form to the address listed in the instructions.

- E-file the form through the Illinois Department of Revenue's website (if eligible).

- Take the form to a local tax office or drop-off location.

What to Expect After Filing Your Amended Return

After submitting your amended return, you can expect the following:

- The Illinois Department of Revenue will review your amended return and process it within 8-12 weeks.

- If you owe additional tax, you'll receive a bill with instructions on how to pay.

- If you're due a refund, you'll receive a check or direct deposit (if eligible).

Tips and Reminders

Here are some important tips and reminders to keep in mind when filing an amended tax return:

- You can only amend your tax return within three years from the original filing deadline.

- You may need to file additional forms or schedules with your amended return (e.g., Form IL 2210 for underpayment of estimated tax).

- If you're amending your federal return, you'll need to complete Form 1040-X and submit it to the IRS.

Common Mistakes to Avoid

When filing an amended tax return, it's essential to avoid common mistakes that can delay processing or lead to errors. Here are some mistakes to watch out for:

- Incorrect math calculations or incorrect information.

- Failing to sign and date the form.

- Not including required documentation or attachments.

- Submitting an amended return for a tax year that's outside the three-year statute of limitations.

Conclusion: Taking Control of Your Tax Return

Filing an amended tax return can seem daunting, but with the right guidance, you can navigate the process with ease. By following these steps and tips, you'll be able to correct errors, report additional income, and ensure you're in compliance with tax laws. Remember to take your time, gather all necessary documents, and double-check your math calculations to avoid common mistakes. If you're unsure or need help, consider consulting a tax professional or seeking guidance from the Illinois Department of Revenue.

What is the deadline for filing an amended tax return?

+You can file an amended tax return within three years from the original filing deadline.

Can I e-file my amended tax return?

+Yes, you can e-file your amended tax return through the Illinois Department of Revenue's website if you're eligible.

What documentation do I need to include with my amended return?

+You'll need to include a copy of your original tax return, corrected information, and any required attachments or documentation.