As a nonresident of California, navigating the complexities of state income tax can be daunting. One crucial form that nonresidents need to familiarize themselves with is Form 540NR, also known as the Nonresident or Part-Year Resident Income Tax Return. In this comprehensive guide, we will delve into the world of Form 540NR, explaining its purpose, who needs to file it, and the key steps involved in completing this form.

What is Form 540NR?

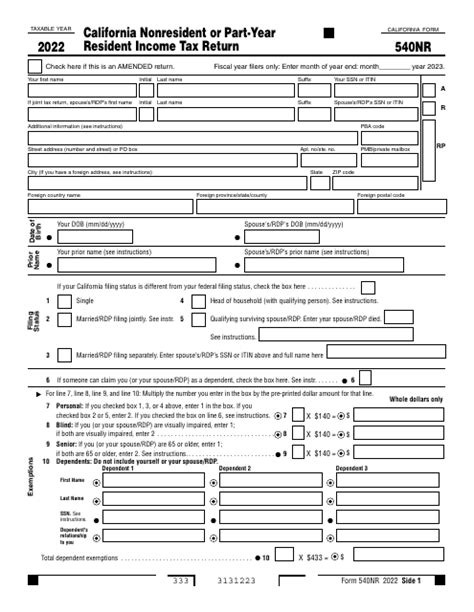

Form 540NR is a tax form used by the California Franchise Tax Board (FTB) to report income earned by nonresidents or part-year residents of California. The form is used to calculate the amount of state income tax owed on income earned from California sources, such as employment, self-employment, or investments.

Who Needs to File Form 540NR?

Not everyone who earns income in California needs to file Form 540NR. To determine if you need to file this form, ask yourself the following questions:

- Are you a nonresident of California?

- Did you earn income from California sources, such as employment, self-employment, or investments?

- Did you have any withholding on income earned from California sources?

If you answered "yes" to any of these questions, you may need to file Form 540NR.

Types of Income Subject to California Tax

As a nonresident, you are only subject to California tax on income earned from California sources. Some examples of income subject to California tax include:

- Wages earned while working in California

- Self-employment income earned from a business or profession conducted in California

- Rental income from property located in California

- Capital gains from the sale of California real estate or other investments

On the other hand, some types of income are exempt from California tax, such as:

- Income earned from employment outside of California

- Dividend and interest income from investments

- Capital gains from the sale of securities or other investments outside of California

How to Complete Form 540NR

Completing Form 540NR can be a complex process, but we will break it down into manageable steps.

Step 1: Gather Required Documents

Before starting the form, make sure you have the following documents:

- W-2 forms for wages earned in California

- 1099 forms for self-employment income or other income earned in California

- Schedule K-1 forms for partnership or S corporation income

- Records of California withholding

Step 2: Determine Your Residency Status

You will need to determine your residency status for the tax year. You can use the FTB's residency guidelines to determine if you are a nonresident, part-year resident, or resident.

Step 3: Complete the Form

The form is divided into several sections, including:

- Section 1: Residency Information

- Section 2: Income

- Section 3: Deductions and Credits

- Section 4: Tax Computation

Complete each section carefully, using the instructions provided by the FTB.

Special Considerations for Part-Year Residents

If you are a part-year resident, you will need to complete a separate form, Schedule CA (540NR), to report your California income and deductions. You will also need to complete Form 540NR to report your non-California income.

Common Errors to Avoid

When completing Form 540NR, it's essential to avoid common errors that can delay your refund or lead to penalties. Some common errors to avoid include:

- Failing to report all California income

- Claiming incorrect deductions or credits

- Failing to sign the form

- Not including required supporting documents

Additional Tips and Reminders

- Make sure to file your return on time to avoid penalties and interest.

- Use the correct mailing address to ensure timely processing of your return.

- Keep a copy of your return and supporting documents for your records.

Wrapping Up

Form 540NR can seem intimidating, but by understanding its purpose and following the steps outlined in this guide, you can ensure a smooth and accurate filing process. Remember to gather all required documents, determine your residency status, and complete the form carefully to avoid common errors. If you have any questions or concerns, don't hesitate to reach out to the FTB or a tax professional for assistance.

Now that you have completed this comprehensive guide, you are well on your way to mastering Form 540NR. Take a moment to review the FAQs below for additional information and insights.

What is the deadline for filing Form 540NR?

+The deadline for filing Form 540NR is typically April 15th, but it may vary depending on the tax year and other factors. Check the FTB website for specific deadlines and requirements.

Can I e-file Form 540NR?

+Yes, you can e-file Form 540NR using the FTB's e-file system. This can help reduce errors and speed up the processing of your return.

What if I need help completing Form 540NR?

+If you need help completing Form 540NR, you can contact the FTB or a tax professional for assistance. They can provide guidance and support to ensure accurate and timely filing.