Filing taxes can be a daunting task, especially for those who are new to the process or are unsure about the specific requirements of their state. Oregon, like many other states, has its own set of tax forms and regulations that residents must follow. One of the most important forms for Oregon residents is the Form 40, which is the state's individual income tax return. In this article, we will break down the 7 steps to complete Oregon Form 40, providing you with a comprehensive guide to help you navigate the process.

Understanding Oregon Form 40

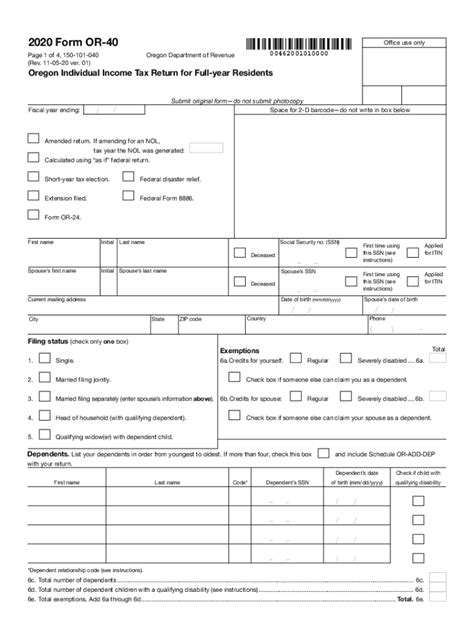

Before we dive into the steps, it's essential to understand what Oregon Form 40 is and who needs to file it. Form 40 is the state's individual income tax return, which is used to report an individual's income, deductions, and credits. If you are a resident of Oregon, you are required to file Form 40 if you have a gross income that exceeds the threshold set by the state.

Step 1: Gather Required Documents

The first step in completing Oregon Form 40 is to gather all the required documents. These documents may include:

- W-2 forms from your employer(s)

- 1099 forms for self-employment income, interest, dividends, and capital gains

- Form 1098 for mortgage interest and property taxes

- Charitable donation receipts

- Medical expense receipts

- Any other relevant tax documents

Tips for Gathering Documents

- Make sure to keep all your tax documents in a safe and organized place.

- Use a tax preparation software or app to help you keep track of your documents.

- If you're missing any documents, contact the relevant parties (e.g., your employer or bank) to request duplicates.

Step 2: Determine Your Filing Status

Your filing status is an essential part of completing Oregon Form 40. Your filing status will determine which tax rates and deductions you are eligible for. Oregon recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Understanding Filing Status

- Your filing status may affect your tax rates, deductions, and credits.

- Make sure to choose the correct filing status to avoid errors or penalties.

- If you're unsure about your filing status, consult with a tax professional or contact the Oregon Department of Revenue.

Step 3: Calculate Your Income

The next step is to calculate your income. This includes reporting all your income from various sources, such as:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Rent and royalty income

Income Calculation Tips

- Use your W-2 and 1099 forms to report your income accurately.

- Make sure to include all sources of income, even if it's not reported on a tax form.

- If you have self-employment income, you may need to complete additional forms (e.g., Schedule C).

Step 4: Claim Deductions and Credits

Deductions and credits can help reduce your tax liability. Oregon allows various deductions and credits, such as:

- Standard deduction or itemized deductions

- Mortgage interest and property taxes

- Charitable donations

- Education credits

- Child care credits

Deductions and Credits Tips

- Keep accurate records of your deductions and credits.

- Use tax preparation software or consult with a tax professional to ensure you're taking advantage of all eligible deductions and credits.

- Make sure to follow Oregon's specific rules and regulations for deductions and credits.

Step 5: Complete Schedules and Forms

Depending on your income and deductions, you may need to complete additional schedules and forms, such as:

- Schedule A for itemized deductions

- Schedule C for self-employment income

- Form 2441 for child and dependent care credit

Schedules and Forms Tips

- Make sure to complete all required schedules and forms accurately.

- Use tax preparation software or consult with a tax professional to ensure you're completing the correct forms.

- Keep accurate records of your schedules and forms.

Step 6: Review and Sign Your Return

Before submitting your return, review it carefully to ensure accuracy and completeness. Make sure to:

- Check for math errors

- Verify your income and deductions

- Ensure you've signed and dated your return

Review and Sign Tips

- Take your time to review your return carefully.

- Use tax preparation software or consult with a tax professional to ensure accuracy.

- Make sure to keep a copy of your return for your records.

Step 7: Submit Your Return

Finally, submit your return to the Oregon Department of Revenue. You can file electronically or by mail. Make sure to:

- Follow Oregon's filing deadlines and requirements.

- Use certified mail or a tracking number to ensure your return is received.

- Keep accurate records of your submission.

Submission Tips

- File electronically to reduce errors and speed up processing.

- Use certified mail or a tracking number to ensure your return is received.

- Keep accurate records of your submission.

What is the deadline for filing Oregon Form 40?

+The deadline for filing Oregon Form 40 is typically April 15th, but it may vary depending on the tax year and any extensions you've been granted.

Can I file Oregon Form 40 electronically?

+Yes, you can file Oregon Form 40 electronically through the Oregon Department of Revenue's website or through a tax preparation software.

What happens if I miss the filing deadline?

+If you miss the filing deadline, you may be subject to penalties and interest on your tax liability. You can file for an extension or contact the Oregon Department of Revenue to discuss your options.

In conclusion, completing Oregon Form 40 requires attention to detail and a thorough understanding of the state's tax laws and regulations. By following these 7 steps, you can ensure that you're taking advantage of all eligible deductions and credits, and submitting an accurate and complete return. Don't hesitate to reach out to a tax professional or the Oregon Department of Revenue if you have any questions or concerns. Share your thoughts and experiences with completing Oregon Form 40 in the comments below!