As the world grapples with the challenges of healthcare, governments are continually seeking ways to fund and improve medical services. In the United States, the Additional Medicare Tax, also known as the Net Investment Income Tax (NIIT), was introduced as part of the Affordable Care Act (ACA) to help finance healthcare reform. The tax is reported on Form 8959, and understanding how it works is crucial for taxpayers to comply with the law and avoid potential penalties. In this comprehensive guide, we will delve into the world of Form 8959, exploring its purpose, who is required to file, and how to complete it accurately.

Understanding the Additional Medicare Tax

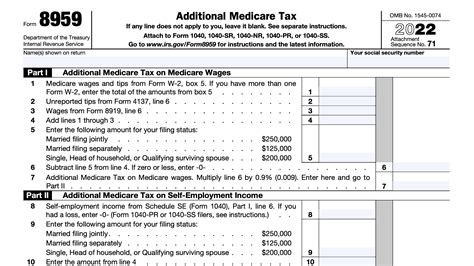

The Additional Medicare Tax is a 0.9% tax on certain types of income, including wages, compensation, and self-employment income. It is designed to fund Medicare, a federal health insurance program for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). The tax applies to individuals with a modified adjusted gross income (MAGI) above certain thresholds.

Who is Required to File Form 8959?

Not everyone is required to file Form 8959. The Additional Medicare Tax applies to individuals with a MAGI above the following thresholds:

- $200,000 for single filers

- $250,000 for joint filers

- $125,000 for married filing separately

If your MAGI exceeds these thresholds, you will need to file Form 8959 with your tax return. Even if you are not required to file Form 8959, you may still need to report Additional Medicare Tax withheld by your employer on your tax return.

How to Complete Form 8959

Completing Form 8959 requires you to report your Additional Medicare Tax liability. Here's a step-by-step guide to help you complete the form:

- Determine your MAGI: Calculate your modified adjusted gross income (MAGI) by adding back certain deductions and exemptions to your adjusted gross income (AGI).

- Calculate your Additional Medicare Tax liability: Use the tax rates and thresholds above to calculate your Additional Medicare Tax liability.

- Complete Form 8959: Report your Additional Medicare Tax liability on Form 8959, which is attached to your tax return (Form 1040).

Additional Medicare Tax Withholding

Employers are required to withhold Additional Medicare Tax from wages and compensation when an employee's income exceeds $200,000 in a calendar year. If you have multiple employers, each employer will withhold Additional Medicare Tax separately, and you will report the total amount withheld on your tax return.

Self-Employment Income and the Additional Medicare Tax

Self-employment income is subject to Additional Medicare Tax, but the tax is not withheld by clients or customers. Instead, self-employed individuals must pay the tax when they file their tax return. You will report your self-employment income and calculate your Additional Medicare Tax liability on Schedule SE (Form 1040).

Net Investment Income Tax (NIIT)

The Net Investment Income Tax (NIIT) is a 3.8% tax on certain types of investment income, including interest, dividends, and capital gains. The NIIT is reported on Form 8960, which is attached to your tax return. While the NIIT is separate from the Additional Medicare Tax, both taxes are designed to fund healthcare reform.

Frequently Asked Questions

Here are some frequently asked questions about Form 8959 and the Additional Medicare Tax:

Who is required to file Form 8959?

+Individuals with a modified adjusted gross income (MAGI) above $200,000 for single filers, $250,000 for joint filers, and $125,000 for married filing separately.

What is the Additional Medicare Tax rate?

+The Additional Medicare Tax rate is 0.9% of certain types of income, including wages, compensation, and self-employment income.

Do I need to file Form 8959 if I am not required to pay Additional Medicare Tax?

+No, you are not required to file Form 8959 if you are not required to pay Additional Medicare Tax. However, you may still need to report Additional Medicare Tax withheld by your employer on your tax return.

Take Action

If you are required to file Form 8959, it's essential to understand your Additional Medicare Tax liability and complete the form accurately. Take the following steps to ensure compliance:

- Review your income and calculate your MAGI

- Determine if you are required to file Form 8959

- Complete Form 8959 accurately and attach it to your tax return

- Pay any Additional Medicare Tax liability when you file your tax return

By following these steps, you can ensure compliance with the Additional Medicare Tax and avoid potential penalties.