The Lone Star State is known for its vast lands, rich history, and thriving economy. For individuals and businesses operating within the state, it's essential to understand the various tax forms and requirements that come with living and working in Texas. One crucial form that many taxpayers need to be familiar with is Texas Form 05-164, also known as the "Texas Franchise Tax Report." In this article, we will delve into the world of Texas Form 05-164, exploring its importance, key components, and other essential facts that taxpayers need to know.

What is Texas Form 05-164?

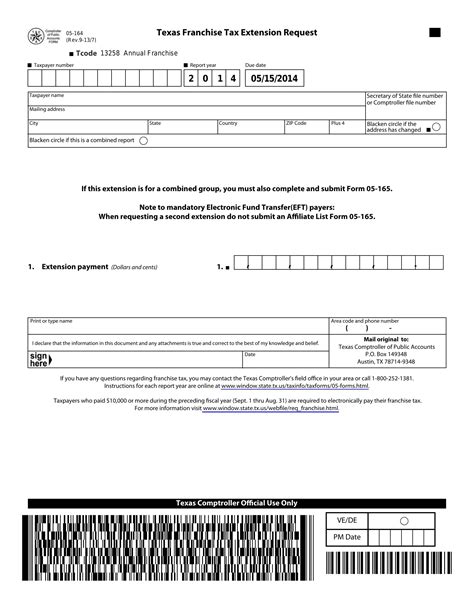

Texas Form 05-164 is a tax form used by businesses and entities to report their franchise tax liability to the state of Texas. The form is typically filed annually, and its primary purpose is to calculate the tax owed by the entity based on its total revenue, apportionment, and other factors. The franchise tax is a privilege tax imposed by the state on businesses for the right to operate in Texas.

Why is Texas Form 05-164 Important?

Texas Form 05-164 is a critical tax form for businesses operating in the state, as it determines their franchise tax liability. Failure to file the form correctly or on time can result in penalties, fines, and even loss of business privileges. Moreover, the form is used to calculate the amount of tax owed, which is essential for businesses to budget and plan their financial obligations. By understanding the form and its requirements, businesses can ensure compliance with state tax regulations and avoid any potential issues.

Who Needs to File Texas Form 05-164?

Not all businesses are required to file Texas Form 05-164. The following entities typically need to file the form:

- Corporations (C-corporations, S-corporations, and non-profit corporations)

- Limited liability companies (LLCs)

- Partnerships (limited partnerships, general partnerships, and limited liability partnerships)

- Business trusts

Entities that are exempt from filing the form include:

- Sole proprietorships

- Estates and trusts

- Certain non-profit organizations

What Information is Required on Texas Form 05-164?

The form requires various pieces of information, including:

- Entity name and address

- Federal tax ID number

- Business type and structure

- Total revenue and apportionment

- Taxable margin and rate

- Tax liability and payment information

Businesses must also attach supporting schedules and documentation, such as financial statements and apportionment schedules.

Key Components of Texas Form 05-164

Texas Form 05-164 consists of several key components, including:

- Part 1: Entity Information: This section requires basic information about the entity, such as its name, address, and federal tax ID number.

- Part 2: Business Activity: This section asks about the entity's business activity, including its type, structure, and primary business activity.

- Part 3: Total Revenue and Apportionment: This section requires the entity to report its total revenue and calculate its apportionment percentage.

- Part 4: Taxable Margin and Rate: This section determines the entity's taxable margin and tax rate.

- Part 5: Tax Liability and Payment: This section calculates the entity's tax liability and payment information.

How to File Texas Form 05-164

Texas Form 05-164 can be filed electronically or by mail. The deadline for filing the form is typically May 15th for calendar-year entities. Businesses can file the form through the Texas Comptroller's website or by mailing it to the address listed on the form.

Penalties for Late or Incorrect Filing

Failure to file Texas Form 05-164 correctly or on time can result in penalties and fines. The Texas Comptroller may impose penalties of up to $50 per day, with a maximum penalty of $2,500. Additionally, interest may accrue on the unpaid tax liability.

Conclusion

Texas Form 05-164 is a critical tax form for businesses operating in the state. By understanding the form's requirements and components, businesses can ensure compliance with state tax regulations and avoid potential penalties. If you have any questions or concerns about Texas Form 05-164, it's essential to consult with a tax professional or the Texas Comptroller's office.

Frequently Asked Questions

Who needs to file Texas Form 05-164?

+Certain business entities, including corporations, LLCs, partnerships, and business trusts, need to file Texas Form 05-164.

What is the deadline for filing Texas Form 05-164?

+The deadline for filing Texas Form 05-164 is typically May 15th for calendar-year entities.

What are the penalties for late or incorrect filing?

+The Texas Comptroller may impose penalties of up to $50 per day, with a maximum penalty of $2,500, and interest may accrue on the unpaid tax liability.

Share your thoughts and experiences with Texas Form 05-164 in the comments below. Have you encountered any challenges or difficulties while filing the form? Do you have any tips or advice for fellow taxpayers? Share your insights and help others navigate the world of Texas taxes!