Obtaining prior authorization for medical procedures and treatments can be a daunting task, especially when dealing with large health insurance providers like Blue Cross FEP. However, with the right guidance, navigating the process can be made easier. In this article, we will break down the prior authorization process for Blue Cross FEP into 5 easy steps, helping you understand what to expect and how to prepare.

Understanding the Importance of Prior Authorization

Prior authorization is a critical step in ensuring that patients receive necessary medical treatments while also controlling healthcare costs. By requiring prior authorization, Blue Cross FEP can review the medical necessity of a procedure or treatment, ensuring that patients receive only the most effective and efficient care.

Step 1: Verify Eligibility and Benefits

Before starting the prior authorization process, it's essential to verify the patient's eligibility and benefits with Blue Cross FEP. This step involves contacting the insurance provider to confirm the patient's coverage, including any deductibles, copays, or coinsurance. You can verify eligibility by:

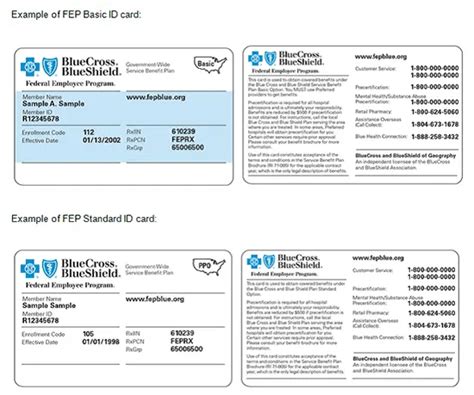

- Calling the Blue Cross FEP customer service number

- Checking the insurance provider's website

- Using online eligibility verification tools

What to Expect During Eligibility Verification

During the eligibility verification process, you will need to provide the patient's identification information, including their name, date of birth, and policy number. The insurance provider will then confirm the patient's coverage and provide information on any out-of-pocket costs or pre-authorization requirements.

Step 2: Gather Required Documents and Information

To initiate the prior authorization process, you will need to gather relevant documents and information, including:

- Patient demographics and identification information

- Medical records and test results

- Prescription information and medication lists

- Treatment plans and diagnoses

What Documents Are Required for Prior Authorization?

The specific documents required for prior authorization may vary depending on the treatment or procedure. However, common documents include:

- Medical records and test results

- Prescription information and medication lists

- Treatment plans and diagnoses

- Letters of medical necessity

Step 3: Submit the Prior Authorization Request

Once you have gathered the necessary documents and information, you can submit the prior authorization request to Blue Cross FEP. This can be done:

- Online through the insurance provider's website

- By phone or fax

- By mail

What to Expect During the Prior Authorization Review Process

After submitting the prior authorization request, Blue Cross FEP will review the information to determine medical necessity. This process typically takes 1-3 business days, but may take longer in some cases.

Step 4: Receive Prior Authorization Approval or Denial

After reviewing the prior authorization request, Blue Cross FEP will issue an approval or denial. If approved, the patient can proceed with the treatment or procedure. If denied, the patient may appeal the decision.

What to Do If Prior Authorization Is Denied

If prior authorization is denied, the patient may appeal the decision by:

- Submitting additional documentation or information

- Requesting a peer-to-peer review

- Filing a formal appeal

Step 5: Track and Follow Up on Prior Authorization Status

Once the prior authorization request has been submitted, it's essential to track and follow up on the status. This can be done:

- Online through the insurance provider's website

- By phone or email

- By contacting the insurance provider's customer service department

Why Tracking Prior Authorization Status Is Important

Tracking prior authorization status is crucial to ensure that the patient receives timely and necessary medical treatment. By following up on the status, you can:

- Ensure that the prior authorization request is being processed

- Address any issues or concerns

- Plan for the next steps in the treatment process

By following these 5 easy steps, you can navigate the prior authorization process for Blue Cross FEP with confidence. Remember to verify eligibility and benefits, gather required documents and information, submit the prior authorization request, receive approval or denial, and track and follow up on the status.

What is prior authorization, and why is it required?

+Prior authorization is a process required by health insurance providers to review the medical necessity of a treatment or procedure before it is administered. This process helps control healthcare costs and ensures that patients receive only the most effective and efficient care.

How long does the prior authorization process typically take?

+The prior authorization process typically takes 1-3 business days, but may take longer in some cases.

What happens if prior authorization is denied?

+If prior authorization is denied, the patient may appeal the decision by submitting additional documentation or information, requesting a peer-to-peer review, or filing a formal appeal.

We hope this article has provided you with a comprehensive understanding of the prior authorization process for Blue Cross FEP. If you have any further questions or concerns, please don't hesitate to reach out. Remember to stay informed and take an active role in your healthcare journey!