Streamlining payroll processes is crucial for businesses to save time, reduce errors, and improve employee satisfaction. One aspect of payroll management that can be simplified is employee direct deposit authorization. QuickBooks Payroll offers a convenient and secure way to set up direct deposit for employees, making it easier for businesses to manage their payroll. In this article, we will delve into the world of QuickBooks Payroll employee direct deposit authorization, exploring its benefits, setup process, and best practices.

Benefits of Direct Deposit Authorization

Direct deposit authorization offers numerous benefits for both employers and employees. Some of the most significant advantages include:

- Convenience: Direct deposit eliminates the need for paper checks, reducing the risk of lost or stolen checks.

- Time-saving: Employers can save time and effort by avoiding the need to print and distribute paper checks.

- Cost-effective: Direct deposit reduces the cost of printing, processing, and mailing paper checks.

- Security: Direct deposit is a secure way to transfer funds, reducing the risk of check tampering or theft.

- Flexibility: Employees can receive their pay in their bank account, credit union, or prepaid debit card.

How Direct Deposit Works

Direct deposit works by transferring funds from the employer's bank account to the employee's bank account. The process involves the following steps:

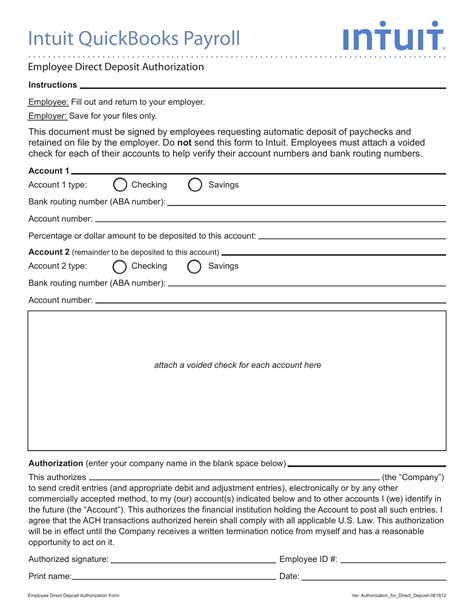

- The employer sets up direct deposit for each employee, obtaining their bank account information and authorization.

- The employer submits the direct deposit information to their bank or payroll service provider.

- The bank or payroll service provider processes the direct deposit transaction, transferring funds from the employer's account to the employee's account.

- The employee receives the funds in their account on the designated payday.

Setting Up Direct Deposit Authorization in QuickBooks Payroll

Setting up direct deposit authorization in QuickBooks Payroll is a straightforward process. Here are the steps to follow:

- Go to the "Payroll" menu and select "Employee List."

- Choose the employee for whom you want to set up direct deposit.

- Click on the "Payroll Info" tab and select "Direct Deposit."

- Enter the employee's bank account information, including the routing number, account number, and account type.

- Obtain the employee's authorization for direct deposit, either electronically or by paper.

- Save the changes and confirm the direct deposit setup.

Best Practices for Direct Deposit Authorization

To ensure a smooth and secure direct deposit process, follow these best practices:

- Verify employee bank account information to prevent errors or rejections.

- Obtain employee authorization for direct deposit, either electronically or by paper.

- Use a secure method to store and transmit employee bank account information.

- Regularly review and update employee direct deposit information to ensure accuracy.

- Communicate with employees about the direct deposit process and any changes or issues.

Managing Direct Deposit in QuickBooks Payroll

Once direct deposit is set up, managing it in QuickBooks Payroll is easy. Here are some tips:

- Use the "Direct Deposit" report to review and verify employee direct deposit information.

- Regularly review payroll transactions to ensure accurate and timely direct deposit processing.

- Use the "Payroll Error" report to identify and resolve any direct deposit errors or issues.

- Update employee direct deposit information as needed, such as when an employee changes banks or accounts.

Troubleshooting Common Direct Deposit Issues

Sometimes, direct deposit issues may arise. Here are some common issues and their solutions:

- Insufficient funds: Verify that the employer's bank account has sufficient funds to cover the direct deposit amount.

- Incorrect bank account information: Verify employee bank account information and update it if necessary.

- Technical issues: Contact QuickBooks Payroll support or the bank's technical support for assistance.

Conclusion and Next Steps

In conclusion, QuickBooks Payroll employee direct deposit authorization is a convenient and secure way to streamline payroll processes. By following the setup process and best practices outlined in this article, businesses can ensure accurate and timely direct deposit processing. To get started, log in to your QuickBooks Payroll account and set up direct deposit for your employees today.

We hope this article has provided valuable insights into the world of QuickBooks Payroll employee direct deposit authorization. If you have any questions or comments, please feel free to share them below.

What is direct deposit authorization?

+Direct deposit authorization is the process of obtaining an employee's permission to deposit their paycheck directly into their bank account.

How do I set up direct deposit in QuickBooks Payroll?

+To set up direct deposit in QuickBooks Payroll, go to the "Payroll" menu, select "Employee List," choose the employee, click on the "Payroll Info" tab, and select "Direct Deposit." Enter the employee's bank account information and obtain their authorization.

What are the benefits of direct deposit authorization?

+The benefits of direct deposit authorization include convenience, time-saving, cost-effectiveness, security, and flexibility.