Dissolving a business in Alabama can be a complex process, but understanding the requirements and procedures involved can help make it smoother. Whether you're closing a sole proprietorship, partnership, LLC, or corporation, it's essential to follow the correct steps to avoid any potential issues or liabilities. In this article, we'll provide a comprehensive guide on how to dissolve a business in Alabama, including the necessary forms, fees, and steps involved.

Why Dissolve a Business in Alabama?

There are several reasons why a business owner may need to dissolve their company in Alabama. Some common reasons include:

- Closure of business operations due to financial difficulties or bankruptcy

- Merger or acquisition with another company

- Retirement or death of the business owner

- Change in business structure or organization

- Cease of operations due to regulatory or compliance issues

Types of Alabama Business Dissolution Forms

In Alabama, the type of dissolution form required depends on the type of business entity. The most common types of business dissolution forms in Alabama include:

- Articles of Dissolution for Corporations (Form C-101)

- Articles of Dissolution for Limited Liability Companies (Form LLC-101)

- Certificate of Dissolution for Limited Partnerships (Form LP-101)

- Certificate of Dissolution for Limited Liability Partnerships (Form LLP-101)

Step-by-Step Guide to Dissolving a Business in Alabama

To dissolve a business in Alabama, follow these steps:

- Review Alabama Business Code: Familiarize yourself with the Alabama Business Code, specifically the sections related to business dissolution.

- Gather Required Documents: Collect all necessary documents, including the business's articles of incorporation, operating agreement, and any other relevant records.

- Obtain Tax Clearance: Obtain a tax clearance certificate from the Alabama Department of Revenue, which confirms that the business has paid all taxes due.

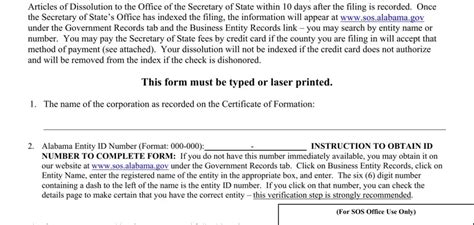

- Prepare and File Dissolution Form: Prepare the required dissolution form, sign it, and file it with the Alabama Secretary of State's office.

- Pay Filing Fee: Pay the required filing fee, which varies depending on the type of business entity.

- Publish Notice of Dissolution: Publish a notice of dissolution in a local newspaper, as required by Alabama law.

- Wind Down Business Operations: Wind down the business's operations, including closing bank accounts, canceling contracts, and disposing of assets.

- Distribute Assets: Distribute the business's assets according to the dissolution agreement or operating agreement.

- Obtain Certificate of Dissolution: Obtain a certificate of dissolution from the Alabama Secretary of State's office, which confirms that the business has been dissolved.

Filing Fees for Alabama Business Dissolution Forms

The filing fees for Alabama business dissolution forms vary depending on the type of business entity:

- Articles of Dissolution for Corporations (Form C-101): $100

- Articles of Dissolution for Limited Liability Companies (Form LLC-101): $100

- Certificate of Dissolution for Limited Partnerships (Form LP-101): $50

- Certificate of Dissolution for Limited Liability Partnerships (Form LLP-101): $50

Common Mistakes to Avoid When Dissolving a Business in Alabama

When dissolving a business in Alabama, it's essential to avoid common mistakes that can lead to costly consequences:

- Failure to file the required dissolution form

- Insufficient notice to creditors and stakeholders

- Inadequate distribution of assets

- Failure to obtain tax clearance

- Incomplete or inaccurate filing information

Conclusion

Dissolving a business in Alabama requires careful attention to detail and compliance with state regulations. By following the step-by-step guide outlined in this article, business owners can ensure a smooth dissolution process and avoid potential pitfalls. Remember to review the Alabama Business Code, gather required documents, and file the necessary dissolution form with the Alabama Secretary of State's office.

We hope this article has been informative and helpful. If you have any questions or need further guidance, please leave a comment below or share this article with others who may find it useful.

What is the difference between dissolution and termination?

+Dissolution refers to the process of winding down a business's operations and distributing its assets, while termination refers to the cancellation of a business's existence.

Do I need to file a tax return after dissolving my business?

+Yes, you will need to file a final tax return with the Alabama Department of Revenue, even if your business is no longer operating.

Can I dissolve my business online?

+No, Alabama does not currently offer online filing for business dissolution forms. You will need to file the forms by mail or in person.