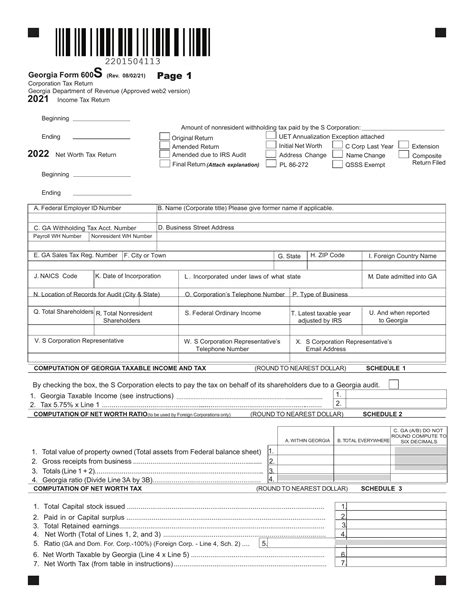

The Georgia Form 600 is a crucial document for businesses operating in the state of Georgia. It is a corporate tax return form that must be filed annually with the Georgia Department of Revenue. The form is used to report a company's income, deductions, and tax liability. In this article, we will delve into the instructions and filing requirements for the Georgia Form 600.

Who Must File Georgia Form 600?

All corporations, including S corporations, C corporations, and limited liability companies (LLCs) that are taxed as corporations, must file the Georgia Form 600. This includes companies that are incorporated in Georgia or have nexus in the state. Nexus refers to a company's presence or activity in the state, such as owning property, having employees, or generating income.

What is the Filing Deadline for Georgia Form 600?

The filing deadline for Georgia Form 600 is April 15th of each year. However, if the 15th falls on a weekend or holiday, the deadline is the next business day. Companies can request an automatic six-month extension by filing Form 600ES. The extension will be granted if the company pays either 90% of its current year's tax liability or 100% of its prior year's tax liability, whichever is less.

Instructions for Filing Georgia Form 600

To file the Georgia Form 600, companies must follow these steps:

- Gather required information: Companies must gather their financial records, including income statements, balance sheets, and tax-related documents.

- Complete the form: Companies must complete the Georgia Form 600, which includes sections for reporting income, deductions, and tax liability.

- Attach required schedules: Companies must attach required schedules, such as Schedule A (Additions and Subtractions) and Schedule B (Non-Resident Shareholder Allocations).

- Sign and date the form: The company's authorized representative must sign and date the form.

- File the form: Companies can file the form electronically or by mail.

Electronic Filing Requirements

Companies with 250 or more returns, including the Georgia Form 600, must file electronically. Electronic filing is also required for companies that make payments electronically. Companies can file electronically through the Georgia Tax Center or through an approved e-file provider.

Additional Filing Requirements

In addition to filing the Georgia Form 600, companies may need to file other forms and schedules, such as:

- Form 600ES: This form is used to request an automatic six-month extension.

- Schedule A: This schedule is used to report additions and subtractions to income.

- Schedule B: This schedule is used to report non-resident shareholder allocations.

- Form 600-X: This form is used to amend a previously filed return.

Penalties for Late Filing

Companies that fail to file the Georgia Form 600 on time may be subject to penalties and interest. The penalty for late filing is 5% of the tax liability per month, up to a maximum of 25%. In addition, companies may be subject to interest on the unpaid tax liability.

Common Errors to Avoid

When filing the Georgia Form 600, companies should avoid common errors, such as:

- Incorrect or incomplete information: Companies must ensure that all information is accurate and complete.

- Failure to attach required schedules: Companies must attach all required schedules and forms.

- Late filing: Companies must file the form on time to avoid penalties and interest.

Conclusion

Filing the Georgia Form 600 is a critical requirement for businesses operating in the state of Georgia. Companies must follow the instructions and filing requirements carefully to avoid penalties and interest. By understanding the requirements and avoiding common errors, companies can ensure compliance with the Georgia Department of Revenue.

Engage with Us

If you have any questions or concerns about the Georgia Form 600, please leave a comment below. Share this article with your colleagues and friends who may be interested in learning more about the Georgia Form 600.

What is the filing deadline for Georgia Form 600?

+The filing deadline for Georgia Form 600 is April 15th of each year.

Who must file Georgia Form 600?

+All corporations, including S corporations, C corporations, and limited liability companies (LLCs) that are taxed as corporations, must file the Georgia Form 600.

What is the penalty for late filing?

+The penalty for late filing is 5% of the tax liability per month, up to a maximum of 25%.