Filing taxes can be a daunting task, especially when it comes to complex topics like capital loss carryover. However, understanding how to properly file for capital loss carryover can help you save thousands of dollars in taxes. In this article, we will explore the ins and outs of capital loss carryover and provide you with five valuable tips for filing the form.

Capital loss carryover is a tax strategy that allows individuals to offset capital gains by using losses from previous years. This can be a game-changer for investors who have experienced significant losses in the past. By carrying over these losses, you can reduce your tax liability and keep more of your hard-earned money.

Before we dive into the tips, let's take a closer look at what capital loss carryover is and how it works.

Understanding Capital Loss Carryover

Capital loss carryover is a provision in the tax code that allows taxpayers to carry over excess capital losses from one year to another. This means that if you have a net capital loss in a given year, you can use that loss to offset capital gains in future years.

For example, let's say you sold a stock for a $10,000 loss in 2020. If you also had a $5,000 capital gain from the sale of another stock, your net capital loss for the year would be $5,000. You can carry over this $5,000 loss to future years to offset capital gains.

Tip 1: Keep Accurate Records

To take advantage of capital loss carryover, you need to keep accurate records of your capital gains and losses. This includes keeping track of the date you bought and sold each investment, as well as the amount of gain or loss.

It's essential to keep these records for at least three years in case of an audit. You can use a spreadsheet or a tax software program to help you keep track of your investments.

Why Accurate Records Matter

Accurate records are crucial when it comes to capital loss carryover. Without them, you may not be able to claim the losses you're eligible for, which can result in a higher tax bill.

Additionally, accurate records can help you identify patterns and trends in your investments, which can inform your future investment decisions.

Tip 2: Understand the Rules

Before you start filing for capital loss carryover, it's essential to understand the rules. Here are a few key things to keep in mind:

- The wash sale rule: This rule states that if you sell a security at a loss and buy a substantially identical security within 30 days, the loss will be disallowed.

- The $3,000 limit: You can only claim up to $3,000 in capital losses per year. Any excess losses must be carried over to future years.

- The 20-year limit: You can only carry over capital losses for 20 years. After that, the losses expire.

Why Understanding the Rules Matters

Understanding the rules can help you avoid costly mistakes and ensure you're taking advantage of the tax savings you're eligible for.

Tip 3: Use the Right Forms

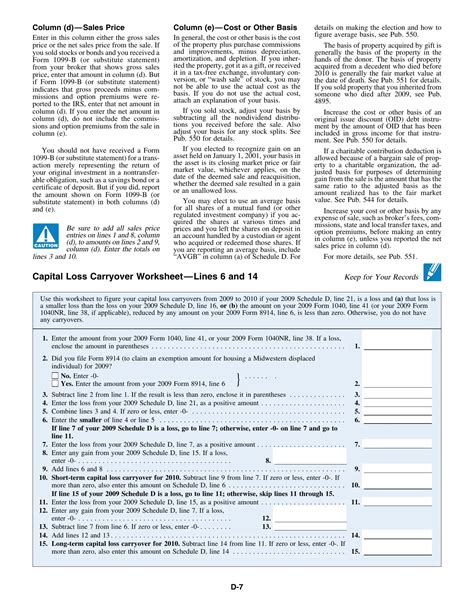

To file for capital loss carryover, you'll need to use the right forms. Here are a few key forms to keep in mind:

- Form 8949: This form is used to report sales and other dispositions of capital assets.

- Schedule D: This form is used to report capital gains and losses.

- Form 3800: This form is used to report general business credits, including the capital loss carryover.

Why Using the Right Forms Matters

Using the right forms can help ensure your tax return is accurate and complete. This can help you avoid delays and potential penalties.

Tip 4: Consider Consulting a Tax Professional

Filing for capital loss carryover can be complex, especially if you have multiple investments and a large portfolio. Consider consulting a tax professional to ensure you're taking advantage of the tax savings you're eligible for.

A tax professional can help you navigate the rules and regulations, ensure you're using the right forms, and provide guidance on how to maximize your tax savings.

Why Consulting a Tax Professional Matters

Consulting a tax professional can help you save time and reduce stress. Additionally, a tax professional can help you identify potential tax savings you may not have been aware of.

Tip 5: Plan Ahead

Finally, it's essential to plan ahead when it comes to capital loss carryover. Here are a few key things to keep in mind:

- Keep track of your capital gains and losses throughout the year.

- Consider harvesting losses at the end of the year to offset gains.

- Plan for future years by carrying over losses.

Why Planning Ahead Matters

Planning ahead can help you maximize your tax savings and reduce your tax liability. By keeping track of your capital gains and losses, you can make informed investment decisions and ensure you're taking advantage of the tax savings you're eligible for.

By following these five tips, you can ensure you're taking advantage of the tax savings you're eligible for and reducing your tax liability. Remember to keep accurate records, understand the rules, use the right forms, consider consulting a tax professional, and plan ahead.

We hope you found this article informative and helpful. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them understand the ins and outs of capital loss carryover.

What is capital loss carryover?

+Capital loss carryover is a tax strategy that allows individuals to offset capital gains by using losses from previous years.

How do I report capital loss carryover on my tax return?

+You'll need to use Form 8949 and Schedule D to report capital gains and losses, and Form 3800 to report the capital loss carryover.

Can I carry over capital losses indefinitely?

+No, you can only carry over capital losses for 20 years. After that, the losses expire.