Telecommunications carriers play a vital role in our increasingly interconnected world. They provide essential services that enable communication, commerce, and innovation. However, with great responsibility comes great regulation. In the United States, the Federal Communications Commission (FCC) is responsible for overseeing the telecommunications industry. One crucial aspect of this oversight is the annual filing requirement for telecommunications carriers, known as the FCC Form 499-A.

What is FCC Form 499-A?

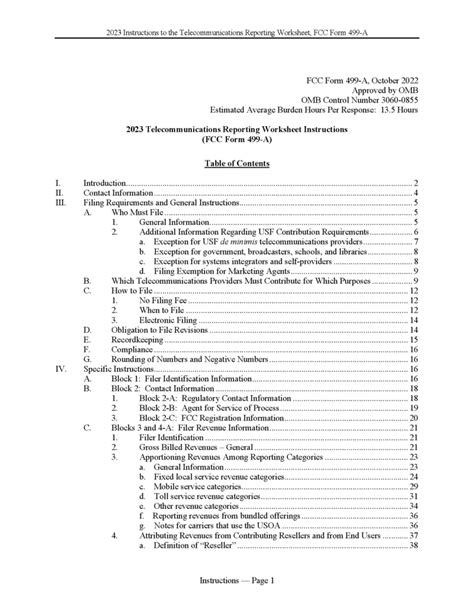

FCC Form 499-A is a mandatory annual filing requirement for telecommunications carriers. The form collects revenue and other data from these carriers, which is used to calculate their contributions to various federal programs. These programs include the Universal Service Fund (USF), which aims to ensure that all Americans have access to affordable telecommunications services.

Who Needs to File FCC Form 499-A?

Not all telecommunications carriers are required to file FCC Form 499-A. To determine if your company needs to file, you must assess whether you provide telecommunications services that are subject to the FCC's jurisdiction. These services include:

- Interstate and international telecommunications services

- Wireless telecommunications services

- Telecommunications services provided over the internet

If your company provides these services, you are likely required to file FCC Form 499-A.

What Information is Required on FCC Form 499-A?

FCC Form 499-A requires telecommunications carriers to provide detailed information about their revenue and operations. This includes:

- Total revenue from telecommunications services

- Revenue from interstate and international services

- Revenue from wireless services

- Number of employees and payroll expenses

- Other financial and operational data

The FCC uses this information to calculate each carrier's contribution to the Universal Service Fund and other federal programs.

How to File FCC Form 499-A

FCC Form 499-A must be filed annually with the FCC by April 1st. Carriers can file the form electronically through the FCC's online portal. To ensure accurate and timely filing, carriers should:

- Review the FCC's instructions and guidelines carefully

- Gather all required information and data in advance

- Use the FCC's online filing system to submit the form

- Verify that the form has been received and accepted by the FCC

Consequences of Failing to File FCC Form 499-A

Failure to file FCC Form 499-A or filing incomplete or inaccurate information can result in serious consequences, including:

- Fines and penalties

- Loss of FCC licenses and authorizations

- Damage to reputation and credibility

- Delayed or denied access to federal programs and funding

Telecommunications carriers must take the FCC Form 499-A filing requirement seriously and ensure timely and accurate submission of the form.

Budgeting for FCC Form 499-A

To avoid unexpected financial burdens, telecommunications carriers should budget for the costs associated with filing FCC Form 499-A. These costs may include:

- Time and resources required to gather and prepare the necessary information

- Fees for consulting services or outside expertise

- Potential fines or penalties for non-compliance

By budgeting for these costs, carriers can ensure that they are prepared to meet the FCC's requirements and avoid any potential financial consequences.

Changes to FCC Form 499-A

The FCC periodically updates and revises FCC Form 499-A to reflect changes in the telecommunications industry and federal regulations. Carriers should stay informed about these changes and adjust their filing processes accordingly.

Best Practices for FCC Form 499-A Compliance

To ensure compliance with the FCC Form 499-A filing requirement, telecommunications carriers should:

- Develop a comprehensive compliance program

- Designate a responsible individual or team to manage the filing process

- Establish clear procedures for gathering and preparing the necessary information

- Conduct regular audits and reviews to ensure accuracy and completeness

By following these best practices, carriers can minimize the risk of non-compliance and ensure timely and accurate submission of FCC Form 499-A.

Conclusion

FCC Form 499-A is a critical annual filing requirement for telecommunications carriers. By understanding the purpose and requirements of the form, carriers can ensure compliance and avoid potential consequences. As the telecommunications industry continues to evolve, carriers must stay informed about changes to the form and adapt their filing processes accordingly. By prioritizing compliance and best practices, carriers can maintain their reputation, credibility, and access to federal programs and funding.

We encourage you to share your thoughts and experiences with FCC Form 499-A in the comments section below. Have you encountered any challenges or successes with the filing process? How do you stay informed about changes to the form and federal regulations? Share your insights and help us build a community of informed and compliant telecommunications carriers.

What is the purpose of FCC Form 499-A?

+FCC Form 499-A collects revenue and other data from telecommunications carriers to calculate their contributions to various federal programs, including the Universal Service Fund (USF).

Who needs to file FCC Form 499-A?

+Telecommunications carriers that provide interstate and international telecommunications services, wireless telecommunications services, and telecommunications services over the internet are required to file FCC Form 499-A.

What information is required on FCC Form 499-A?

+FCC Form 499-A requires telecommunications carriers to provide detailed information about their revenue and operations, including total revenue, revenue from interstate and international services, and number of employees and payroll expenses.