The wait for the new tax forms can be frustrating, especially for businesses and individuals who need to report depreciation and amortization. The Form 4562, also known as the Depreciation and Amortization form, is a crucial document for taxpayers who need to report their assets' depreciation and amortization expenses.

As we enter the new tax year, many are wondering when the Form 4562 will be available in 2023. The Internal Revenue Service (IRS) typically releases new tax forms and instructions in the latter part of the previous year or early in the new tax year.

Understanding the Importance of Form 4562

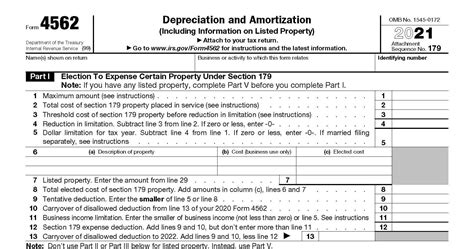

Before we dive into the availability of the Form 4562 in 2023, let's quickly review its purpose. The Form 4562 is used to report depreciation and amortization expenses for assets acquired by a business or individual. This form is essential for taxpayers who need to claim these expenses as deductions on their tax returns.

The form requires taxpayers to provide detailed information about their assets, including the asset's cost, useful life, and depreciation method. Taxpayers must also calculate the depreciation and amortization expenses for each asset and report these expenses on their tax return.

When Will the Form 4562 Be Available in 2023?

The IRS typically releases new tax forms and instructions in the latter part of the previous year or early in the new tax year. Based on previous trends, we can expect the Form 4562 to be available in early 2023.

Here's a rough estimate of when the Form 4562 might be available:

- January 2023: The IRS typically releases the new tax forms and instructions in January of each year. We can expect the Form 4562 to be available on the IRS website around this time.

- February 2023: If the IRS follows its usual schedule, the Form 4562 should be available in February 2023. This will give taxpayers enough time to prepare and file their tax returns by the April 15th deadline.

Please note that these dates are estimates and may be subject to change. The IRS may release the Form 4562 earlier or later than expected, depending on various factors, such as changes in tax laws or updates to the tax code.

What to Do If You Need to File Form 4562 Before It's Available

If you need to file Form 4562 before it's available, you can use the previous year's form as a substitute. However, please note that the IRS may not accept the previous year's form if there have been significant changes to the tax code or the form itself.

To ensure that you're using the correct form, we recommend checking the IRS website regularly for updates on the availability of the Form 4562. You can also consult with a tax professional or accountant who can provide guidance on the best course of action.

Conclusion

The Form 4562 is a critical document for taxpayers who need to report depreciation and amortization expenses. While we can't predict the exact date of its availability, we can expect it to be released in early 2023.

To stay up-to-date on the latest tax forms and instructions, we recommend checking the IRS website regularly. You can also consult with a tax professional or accountant who can provide guidance on the best course of action.

We hope this article has provided you with valuable insights into the availability of the Form 4562 in 2023. If you have any further questions or concerns, please don't hesitate to reach out.

What is the purpose of Form 4562?

+Form 4562 is used to report depreciation and amortization expenses for assets acquired by a business or individual.

When can I expect the Form 4562 to be available in 2023?

+The IRS typically releases new tax forms and instructions in the latter part of the previous year or early in the new tax year. We can expect the Form 4562 to be available in early 2023.

What should I do if I need to file Form 4562 before it's available?

+If you need to file Form 4562 before it's available, you can use the previous year's form as a substitute. However, please note that the IRS may not accept the previous year's form if there have been significant changes to the tax code or the form itself.