In the United States, tax season can be a daunting time for many individuals and businesses. With numerous forms and regulations to navigate, it's essential to understand the requirements and implications of each. One such form is the Form 7203, which is used in conjunction with the 1120S and 1040 forms. In this article, we will delve into the world of Form 7203, explaining its purpose, eligibility, and the steps involved in filing it with the 1120S and 1040 forms.

What is Form 7203?

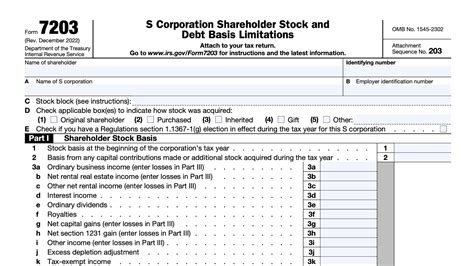

Form 7203 is an IRS form used by S corporations to report certain types of income and make adjustments to the shareholder's basis. The form is used in conjunction with the 1120S form, which is the income tax return for S corporations. The primary purpose of Form 7203 is to report the following types of income:

- Section 179 deduction

- Bonus depreciation

- Listed property

Who is Eligible to File Form 7203?

To be eligible to file Form 7203, the taxpayer must be an S corporation that has made certain types of elections or has specific types of income. The following are some of the key eligibility requirements:

- The S corporation must have made an election under Section 179 to expense certain types of property.

- The S corporation must have claimed bonus depreciation on certain types of property.

- The S corporation must have listed property, such as vehicles or other types of equipment.

How to File Form 7203 with 1120S

Filing Form 7203 with the 1120S form is a straightforward process. The following steps outline the process:

- Complete the 1120S form, which is the income tax return for S corporations.

- Determine if the S corporation has any of the types of income or elections that require the filing of Form 7203.

- Complete Form 7203, which will require the taxpayer to report the Section 179 deduction, bonus depreciation, and listed property.

- Attach Form 7203 to the 1120S form and submit it to the IRS.

How to File Form 7203 with 1040

In some cases, individuals may need to file Form 7203 with their 1040 form. This typically occurs when an individual has a flow-through interest in an S corporation that has made certain types of elections or has specific types of income.

The following steps outline the process for filing Form 7203 with the 1040 form:

- Complete the 1040 form, which is the individual income tax return.

- Determine if the individual has a flow-through interest in an S corporation that has made certain types of elections or has specific types of income.

- Complete Form 7203, which will require the individual to report the Section 179 deduction, bonus depreciation, and listed property.

- Attach Form 7203 to the 1040 form and submit it to the IRS.

Benefits of Filing Form 7203

Filing Form 7203 can provide several benefits to taxpayers, including:

- Increased deductions: By reporting the Section 179 deduction and bonus depreciation, taxpayers may be able to increase their deductions and reduce their tax liability.

- Accurate reporting: Form 7203 ensures that taxpayers accurately report their income and make the necessary adjustments to their basis.

- Compliance with IRS regulations: Filing Form 7203 demonstrates compliance with IRS regulations and can help to avoid penalties and fines.

Common Mistakes to Avoid

When filing Form 7203, there are several common mistakes to avoid, including:

- Failure to complete the form accurately: It's essential to complete the form accurately and thoroughly to avoid delays or penalties.

- Failure to attach the form to the 1120S or 1040: The form must be attached to the 1120S or 1040 form to ensure that it is processed correctly.

- Failure to file the form on time: The form must be filed on time to avoid penalties and fines.

Conclusion

In conclusion, Form 7203 is an essential form for S corporations and individuals with flow-through interests in S corporations. By understanding the purpose and eligibility requirements of the form, taxpayers can ensure that they accurately report their income and make the necessary adjustments to their basis. By following the steps outlined in this article, taxpayers can file Form 7203 with confidence and avoid common mistakes.

We hope this article has been informative and helpful. If you have any questions or need further clarification, please don't hesitate to ask.

Call to Action

If you're an S corporation or individual with a flow-through interest in an S corporation, don't wait until the last minute to file your taxes. Consult with a tax professional today to ensure that you're taking advantage of all the deductions and credits available to you.

FAQs

What is the purpose of Form 7203?

+Form 7203 is used to report certain types of income and make adjustments to the shareholder's basis.

Who is eligible to file Form 7203?

+S corporations that have made certain types of elections or have specific types of income are eligible to file Form 7203.

How do I file Form 7203 with the 1120S form?

+Complete the 1120S form and attach Form 7203 to it.