The world of corporate finance and governance can be complex and overwhelming, especially when it comes to regulatory requirements and paperwork. One crucial document that publicly traded companies must file with the Securities and Exchange Commission (SEC) is the proxy statement. In this article, we will delve into the world of proxy statement forms, exploring their purpose, structure, and importance.

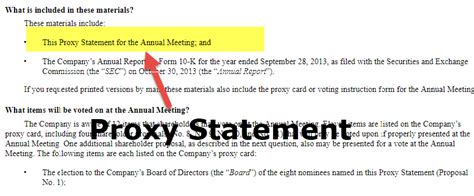

A proxy statement, also known as a DEF 14A, is a document that provides shareholders with information necessary to make informed decisions about matters to be voted on at a company's annual or special meeting. The SEC requires publicly traded companies to file a proxy statement with the Commission at least 30 days before the meeting.

What is a Proxy Statement Form?

A proxy statement form is a standardized document that outlines the information required by the SEC. The form is typically divided into several sections, including:

- Item 1: Election of Directors: This section provides information about the company's board of directors, including the names, ages, and biographies of nominees.

- Item 2: Ratification of Independent Registered Public Accounting Firm: This section seeks shareholder approval for the appointment of the company's independent auditor.

- Item 3: Advisory Vote on Executive Compensation: This section provides information about the company's executive compensation policies and practices.

Key Components of a Proxy Statement Form

A proxy statement form typically includes the following key components:

- Summary: A brief overview of the matters to be voted on at the meeting.

- Nominee Information: Details about the nominees for the board of directors, including their backgrounds and qualifications.

- Executive Compensation: Information about the company's executive compensation policies and practices.

- Audit Committee Report: A report from the audit committee regarding the company's financial statements and internal controls.

- Vote Recommendations: Recommendations from the board of directors on how to vote on each matter.

Why is a Proxy Statement Form Important?

A proxy statement form is essential for several reasons:

- Transparency: The proxy statement provides shareholders with critical information about the company's governance, executive compensation, and financial performance.

- Accountability: The proxy statement holds the company's board of directors and management accountable for their actions and decisions.

- Shareholder Engagement: The proxy statement enables shareholders to participate in the decision-making process and have a say in the company's future.

How to Review and Analyze a Proxy Statement Form

Reviewing and analyzing a proxy statement form can be a daunting task, but here are some tips to help you get started:

- Read the Summary: Start by reading the summary section to get an overview of the matters to be voted on.

- Review the Nominee Information: Carefully review the information about the nominees for the board of directors.

- Analyze the Executive Compensation: Study the information about the company's executive compensation policies and practices.

- Evaluate the Vote Recommendations: Consider the recommendations from the board of directors on how to vote on each matter.

Best Practices for Filing a Proxy Statement Form

Here are some best practices for filing a proxy statement form:

- File on Time: Ensure that the proxy statement is filed with the SEC at least 30 days before the meeting.

- Provide Clear and Concise Information: Use clear and concise language to ensure that shareholders can easily understand the information.

- Include All Required Information: Ensure that the proxy statement includes all the required information, including nominee information, executive compensation, and audit committee report.

Common Mistakes to Avoid When Filing a Proxy Statement Form

Here are some common mistakes to avoid when filing a proxy statement form:

- Insufficient Disclosure: Failing to provide sufficient disclosure about the matters to be voted on.

- Inaccurate Information: Providing inaccurate or misleading information in the proxy statement.

- Late Filing: Failing to file the proxy statement on time.

Consequences of Non-Compliance

Failure to comply with the SEC's proxy statement requirements can result in serious consequences, including:

- SEC Enforcement Actions: The SEC may take enforcement action against the company for non-compliance.

- Reputation Damage: Non-compliance can damage the company's reputation and erode shareholder trust.

- Financial Penalties: The company may be subject to financial penalties for non-compliance.

Conclusion

In conclusion, a proxy statement form is a critical document that provides shareholders with essential information about a company's governance, executive compensation, and financial performance. By understanding the purpose, structure, and importance of a proxy statement form, companies can ensure compliance with SEC regulations and maintain transparency and accountability.

We encourage you to share your thoughts and experiences with proxy statement forms in the comments below. Have you ever reviewed a proxy statement form? What did you find most challenging or informative? Let's start a conversation!

What is a proxy statement form?

+A proxy statement form is a standardized document that outlines the information required by the SEC. It provides shareholders with essential information about a company's governance, executive compensation, and financial performance.

Why is a proxy statement form important?

+A proxy statement form is essential for transparency, accountability, and shareholder engagement. It provides shareholders with critical information about the company's governance, executive compensation, and financial performance.

What are the consequences of non-compliance with proxy statement requirements?

+Failure to comply with the SEC's proxy statement requirements can result in serious consequences, including SEC enforcement actions, reputation damage, and financial penalties.