In today's fast-paced digital age, online payment processing has become an essential aspect of modern commerce. With the rise of e-commerce and digital transactions, businesses need reliable and efficient payment processing systems to stay ahead of the competition. One such system is the Mapfre EFT form, designed to streamline payment processing for businesses of all sizes. In this article, we will delve into the world of Mapfre EFT forms, exploring their benefits, working mechanisms, and steps for implementation.

What is a Mapfre EFT Form?

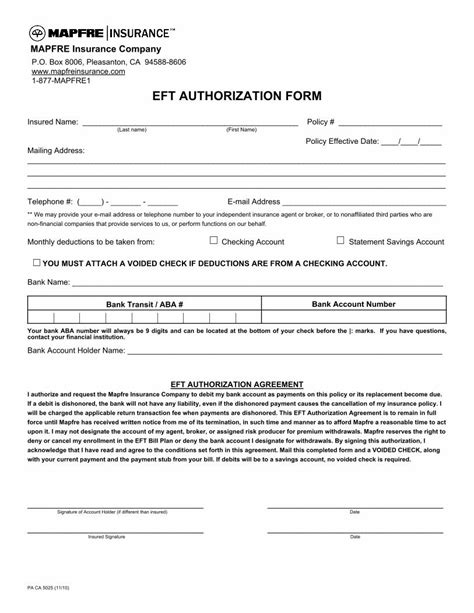

A Mapfre EFT (Electronic Funds Transfer) form is a type of payment processing system that enables businesses to electronically transfer funds from their customers' bank accounts to their own. This system is designed to simplify and accelerate payment processing, reducing the need for paper checks and manual transactions. With a Mapfre EFT form, businesses can effortlessly manage their payments, reducing errors and increasing efficiency.

Benefits of Using a Mapfre EFT Form

The Mapfre EFT form offers a multitude of benefits for businesses, including:

- Improved efficiency: By automating payment processing, businesses can save time and reduce the risk of human error.

- Enhanced security: Electronic funds transfers are highly secure, reducing the risk of fraud and unauthorized transactions.

- Increased speed: Payments are processed quickly, often in real-time, enabling businesses to access their funds faster.

- Reduced costs: By eliminating the need for paper checks and manual transactions, businesses can save on processing fees and administrative costs.

How Does a Mapfre EFT Form Work?

The Mapfre EFT form works by establishing a direct connection between the business's bank account and the customer's bank account. When a customer initiates a payment, the funds are electronically transferred from their account to the business's account. This process is facilitated by the Mapfre EFT form, which serves as a secure and reliable intermediary between the two parties.

Here's a step-by-step overview of the process:

- Customer initiates payment: The customer provides their bank account information and authorizes the payment.

- Business verifies payment: The business verifies the customer's account information and confirms the payment amount.

- Mapfre EFT form facilitates transfer: The Mapfre EFT form establishes a secure connection between the two bank accounts and initiates the funds transfer.

- Funds are transferred: The funds are electronically transferred from the customer's account to the business's account.

Implementing a Mapfre EFT Form

Implementing a Mapfre EFT form is a straightforward process that can be completed in a few simple steps:

- Contact Mapfre: Businesses can contact Mapfre directly to inquire about their EFT form services.

- Complete application: Businesses will need to complete an application form, providing necessary information about their business and bank account.

- Establish bank connection: Mapfre will establish a secure connection between the business's bank account and the customer's bank account.

- Test and verify: The business will need to test and verify the EFT form to ensure it is working correctly.

Common Applications of Mapfre EFT Forms

Mapfre EFT forms have a wide range of applications across various industries, including:

- E-commerce: Online businesses can use Mapfre EFT forms to process payments from customers.

- Healthcare: Healthcare providers can use Mapfre EFT forms to process payments from patients.

- Insurance: Insurance companies can use Mapfre EFT forms to process payments from policyholders.

Tips for Using a Mapfre EFT Form

Here are some tips for businesses using a Mapfre EFT form:

- Ensure accurate account information: Verify that the customer's account information is accurate to avoid errors or failed transactions.

- Use secure connections: Ensure that all connections between the business's bank account and the customer's bank account are secure and encrypted.

- Monitor transactions: Regularly monitor transactions to detect any potential issues or errors.

Conclusion

In conclusion, the Mapfre EFT form is a powerful tool for businesses looking to streamline their payment processing. With its improved efficiency, enhanced security, and increased speed, it's no wonder why many businesses are turning to this innovative solution. By understanding how the Mapfre EFT form works and implementing it correctly, businesses can take their payment processing to the next level.

We hope this article has provided you with a comprehensive understanding of the Mapfre EFT form and its applications. If you have any questions or comments, please don't hesitate to reach out. Share this article with your colleagues and friends to help spread the word about the benefits of using a Mapfre EFT form.

What is an EFT form?

+An EFT (Electronic Funds Transfer) form is a type of payment processing system that enables businesses to electronically transfer funds from their customers' bank accounts to their own.

How does a Mapfre EFT form work?

+The Mapfre EFT form works by establishing a direct connection between the business's bank account and the customer's bank account. When a customer initiates a payment, the funds are electronically transferred from their account to the business's account.

What are the benefits of using a Mapfre EFT form?

+The benefits of using a Mapfre EFT form include improved efficiency, enhanced security, increased speed, and reduced costs.