As a partnership, it's essential to maintain accurate financial records to ensure compliance with tax laws and regulations. One crucial document that partnerships must file with the Internal Revenue Service (IRS) is the Form 1065 Schedule L, also known as the Partnership Balance Sheet. In this article, we'll delve into the world of Form 1065 Schedule L, exploring its importance, key components, and providing a step-by-step guide on how to complete it accurately.

Why is the Form 1065 Schedule L Important?

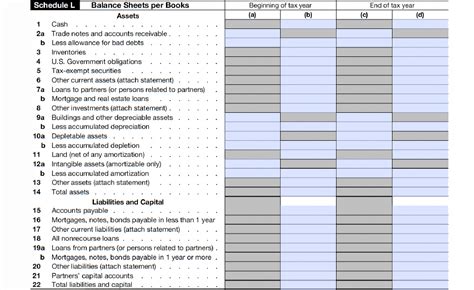

The Form 1065 Schedule L is a critical component of the partnership's tax return, as it provides a snapshot of the partnership's financial position at the end of the tax year. The balance sheet helps the IRS and other stakeholders understand the partnership's assets, liabilities, and equity, which is essential for determining the partnership's tax liability and ensuring compliance with tax laws.

Key Components of the Form 1065 Schedule L

The Form 1065 Schedule L consists of three main sections: Assets, Liabilities, and Equity. Here's a breakdown of each section:

Assets

- Cash and cash equivalents

- Accounts receivable

- Inventories

- Prepaid expenses

- Investments

- Property, plant, and equipment

- Intangible assets

- Other assets

Liabilities

- Accounts payable

- Accrued expenses

- Notes payable

- Loans from partners

- Other liabilities

Equity

- Partners' capital accounts

- Retained earnings

- Other equity

Step-by-Step Guide to Completing the Form 1065 Schedule L

Completing the Form 1065 Schedule L requires accurate and detailed information about the partnership's financial position. Here's a step-by-step guide to help you complete the form:

- Gather necessary documents: Collect the partnership's financial statements, including the balance sheet, income statement, and cash flow statement.

- Complete the Assets section:

- List all assets in the correct categories.

- Ensure that the total value of assets is accurate.

- Complete the Liabilities section:

- List all liabilities in the correct categories.

- Ensure that the total value of liabilities is accurate.

- Complete the Equity section:

- List all equity accounts, including partners' capital accounts and retained earnings.

- Ensure that the total value of equity is accurate.

- Calculate the total value of assets, liabilities, and equity:

- Add up the total value of assets, liabilities, and equity to ensure that the balance sheet balances.

- Review and verify the information:

- Review the completed form for accuracy and completeness.

- Verify that the information is consistent with the partnership's financial statements.

Tips and Best Practices for Completing the Form 1065 Schedule L

To ensure accuracy and compliance, follow these tips and best practices when completing the Form 1065 Schedule L:

- Use the correct accounting method: Ensure that the partnership uses the same accounting method for the Form 1065 Schedule L as for the financial statements.

- Keep accurate records: Maintain accurate and detailed financial records to support the information reported on the Form 1065 Schedule L.

- Seek professional help: Consult with a tax professional or accountant if you're unsure about completing the Form 1065 Schedule L.

Common Mistakes to Avoid When Completing the Form 1065 Schedule L

When completing the Form 1065 Schedule L, avoid these common mistakes:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete to avoid errors or omissions.

- Failure to balance the balance sheet: Verify that the total value of assets, liabilities, and equity balances to ensure accuracy.

Conclusion

The Form 1065 Schedule L is a critical component of the partnership's tax return, providing a snapshot of the partnership's financial position. By following the step-by-step guide and tips outlined in this article, you'll be able to complete the Form 1065 Schedule L accurately and ensure compliance with tax laws. Remember to maintain accurate financial records, seek professional help if needed, and avoid common mistakes to ensure a smooth filing process.

Now it's your turn! Share your experiences or questions about completing the Form 1065 Schedule L in the comments below. Don't forget to share this article with your fellow partners or accountants to ensure everyone is on the same page.

What is the purpose of the Form 1065 Schedule L?

+The Form 1065 Schedule L provides a snapshot of the partnership's financial position at the end of the tax year, including assets, liabilities, and equity.

Who needs to file the Form 1065 Schedule L?

+All partnerships required to file Form 1065 must also file the Schedule L.

What is the deadline for filing the Form 1065 Schedule L?

+The deadline for filing the Form 1065 Schedule L is the same as the deadline for filing Form 1065, which is typically March 15th for calendar-year partnerships.