Tax season can be a daunting time for many, and navigating the complexities of tax forms can be overwhelming. However, with the right guidance, filing your Missouri state taxes can be a relatively straightforward process. In this article, we will provide you with five valuable tips for filing the Missouri Short Form 1040A, making it easier for you to accurately and efficiently complete your tax return.

Understanding the Missouri Short Form 1040A

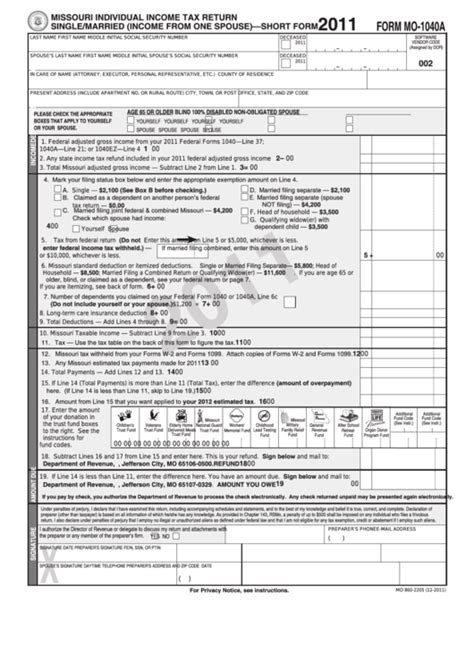

The Missouri Short Form 1040A is a simplified tax form designed for residents with straightforward tax situations. It is used to report income, claim deductions and credits, and calculate the amount of state income tax owed. To qualify for the Short Form 1040A, you must meet specific requirements, such as having only certain types of income and not itemizing deductions.

Tip 1: Gather Required Documents and Information

Before starting the filing process, ensure you have all necessary documents and information readily available. This includes:

- Your federal tax return (Form 1040)

- W-2 forms from employers

- 1099 forms for self-employment income, interest, and dividends

- Records of deductions and credits claimed

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

Having all required documents and information will help you accurately complete the form and avoid errors.

Accurately Completing the Form

Tip 2: Follow the Form's Instructions Carefully

The Missouri Short Form 1040A comes with instructions that provide guidance on completing each section. It is essential to read and follow these instructions carefully to ensure accuracy. Pay particular attention to the sections related to income, deductions, and credits, as these can significantly impact your tax liability.

Tip 3: Report Income Correctly

When reporting income on the Missouri Short Form 1040A, be sure to include all sources of income, such as:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

Failure to report income accurately can result in errors, penalties, and even audits.

Taking Advantage of Deductions and Credits

Tip 4: Claim Eligible Deductions and Credits

Missouri offers various deductions and credits that can reduce your tax liability. Some of these include:

- Standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

Research and claim any eligible deductions and credits to minimize your tax burden.

Filing and Payment Options

Tip 5: Choose the Best Filing and Payment Option

Missouri offers several filing and payment options for the Short Form 1040A, including:

- E-filing through the Missouri Department of Revenue website or tax software

- Mailing a paper return

- Paying online, by phone, or by mail

Choose the option that best suits your needs, and ensure timely filing and payment to avoid penalties and interest.

By following these five tips, you can ensure accurate and efficient completion of your Missouri Short Form 1040A. Remember to gather required documents, follow the form's instructions, report income correctly, claim eligible deductions and credits, and choose the best filing and payment option.

We hope this article has provided you with valuable insights and guidance on filing the Missouri Short Form 1040A. If you have any further questions or concerns, please don't hesitate to reach out.

What is the deadline for filing the Missouri Short Form 1040A?

+The deadline for filing the Missouri Short Form 1040A is typically April 15th, but may vary depending on the tax year and any applicable extensions.

Can I file the Missouri Short Form 1040A electronically?

+Yes, you can file the Missouri Short Form 1040A electronically through the Missouri Department of Revenue website or tax software.

What if I need help completing the Missouri Short Form 1040A?

+If you need help completing the Missouri Short Form 1040A, you can contact the Missouri Department of Revenue or seek assistance from a tax professional.