Utah State Tax Extension Form: A Simple Guide to Filing for a UT Tax Extension

Tax season can be a stressful and overwhelming time for individuals and businesses in Utah. With the state's tax deadline approaching, many taxpayers find themselves scrambling to gather necessary documents, calculate their tax liability, and submit their returns on time. However, what if you need more time to file your Utah state taxes? That's where the Utah state tax extension form comes in.

Why You Might Need a Utah State Tax Extension

There are several reasons why you might need to file for a Utah state tax extension. Perhaps you're waiting for additional documentation, such as a K-1 form, to arrive. Maybe you're dealing with a family emergency or illness that's left you short on time. Whatever the reason, filing for a tax extension can give you the extra time you need to complete your return accurately and avoid costly penalties.

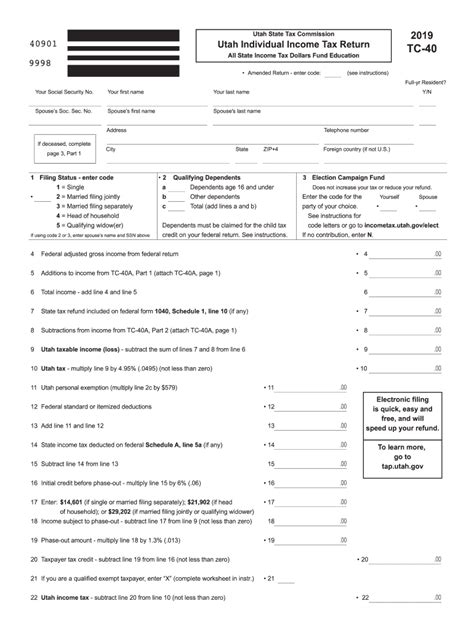

What is the Utah State Tax Extension Form?

The Utah state tax extension form is a simple document that allows taxpayers to request an automatic six-month extension to file their state income tax return. The form is typically filed with the Utah State Tax Commission and must be submitted by the original tax deadline.

Who Can File for a Utah State Tax Extension?

Any individual or business required to file a Utah state income tax return can request a tax extension. This includes:

- Individuals with a Utah state tax liability

- Businesses with a Utah state tax liability, including corporations, partnerships, and S corporations

- Trusts and estates with a Utah state tax liability

How to File for a Utah State Tax Extension

Filing for a Utah state tax extension is a relatively straightforward process. Here's what you need to do:

- Determine if you need to file: Check if you have a Utah state tax liability and if you need more time to file your return.

- Gather required information: You'll need your name, address, and Social Security number or Employer Identification Number (EIN).

- Choose a filing method: You can file for a tax extension online, by mail, or through a tax professional.

- Submit your extension request: File Form TC-305, Utah Individual Income Tax Extension, or Form TC-559, Utah Corporation Franchise and Income Tax Extension, with the Utah State Tax Commission.

Utah State Tax Extension Deadline

The deadline for filing a Utah state tax extension is typically the same as the original tax deadline, which is usually April 15th for individual taxpayers and March 15th for businesses. However, it's essential to check with the Utah State Tax Commission for specific deadlines and requirements.

Penalties for Late Filing or Payment

If you fail to file your Utah state tax return or pay your tax liability by the deadline, you may be subject to penalties and interest. These can include:

- A late-filing penalty of up to 50% of the unpaid tax

- A late-payment penalty of up to 25% of the unpaid tax

- Interest on the unpaid tax, which accrues monthly

Utah State Tax Extension Frequently Asked Questions

Here are some frequently asked questions about the Utah state tax extension:

- Q: Can I file for an extension if I don't owe any taxes? A: Yes, you can still file for an extension even if you don't owe any taxes.

- Q: How long is the extension period? A: The extension period is typically six months from the original tax deadline.

- Q: Can I file for an extension online? A: Yes, you can file for an extension online through the Utah State Tax Commission's website.

Conclusion

Filing for a Utah state tax extension can provide you with the extra time you need to complete your return accurately and avoid costly penalties. By following the steps outlined in this guide, you can easily file for a tax extension and ensure you're in compliance with Utah state tax laws. Remember to check with the Utah State Tax Commission for specific deadlines and requirements.

What is the deadline for filing a Utah state tax extension?

+The deadline for filing a Utah state tax extension is typically the same as the original tax deadline, which is usually April 15th for individual taxpayers and March 15th for businesses.

Can I file for an extension if I don't owe any taxes?

+Yes, you can still file for an extension even if you don't owe any taxes.

How long is the extension period?

+The extension period is typically six months from the original tax deadline.