Completing the TPT-EZ form can seem daunting, but it doesn't have to be. As a crucial document for businesses, it's essential to get it right to avoid any delays or penalties. In this article, we'll break down the process into 5 easy ways to complete the TPT-EZ form, making it more manageable and less stressful.

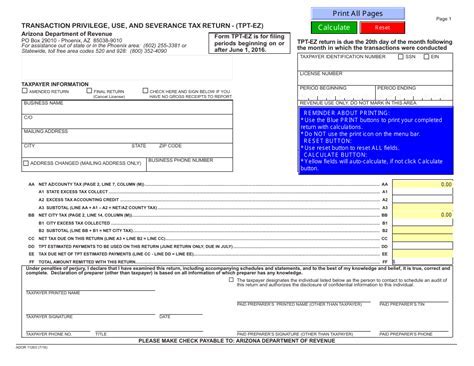

First and foremost, it's essential to understand what the TPT-EZ form is and its purpose. The TPT-EZ form is a simplified version of the Transaction Privilege Tax Return, which is used to report and pay taxes on business activities in Arizona. The form is designed for businesses with simple tax obligations, making it easier to file and pay taxes.

Understand Your Tax Obligations

Before starting the TPT-EZ form, it's crucial to understand your tax obligations. This includes knowing your business's tax rate, which products or services are subject to tax, and any deductions or exemptions you may be eligible for.

To determine your tax obligations, you can:

- Check the Arizona Department of Revenue website for information on tax rates and exemptions

- Consult with a tax professional or accountant

- Review your business's financial records to ensure you're reporting all taxable activities

Gather Necessary Documents

To complete the TPT-EZ form, you'll need to gather several documents, including:

- Your business's license or registration documents

- Financial records, such as invoices and receipts

- Records of any tax deductions or exemptions

Having all necessary documents ready will make the process of completing the TPT-EZ form much smoother.

Fill Out the Form Accurately

Now that you have all necessary documents, it's time to fill out the TPT-EZ form. Make sure to:

- Read the instructions carefully before starting

- Fill out all required fields accurately and completely

- Double-check your math calculations to ensure accuracy

Some common mistakes to avoid when filling out the TPT-EZ form include:

- Inaccurate or incomplete information

- Math errors or discrepancies

- Failure to report all taxable activities

Tips for Filling Out the Form

Here are some additional tips to keep in mind when filling out the TPT-EZ form:

- Use a calculator to ensure accurate math calculations

- Keep a record of your calculations and supporting documents

- If you're unsure about any part of the form, consult with a tax professional or accountant

Submit the Form On Time

Once you've completed the TPT-EZ form, it's essential to submit it on time to avoid any penalties or delays.

The Arizona Department of Revenue accepts TPT-EZ forms online, by mail, or in person. Make sure to check the deadline for submission and plan accordingly.

Pay Any Tax Due

Finally, if you owe taxes, it's essential to pay them on time to avoid any penalties or interest.

You can pay taxes online, by mail, or in person. Make sure to keep a record of your payment, including the date and amount paid.

By following these 5 easy ways to complete the TPT-EZ form, you'll be able to accurately and efficiently report and pay your business taxes. Remember to take your time, and don't hesitate to seek help if you need it.

What is the TPT-EZ form?

+The TPT-EZ form is a simplified version of the Transaction Privilege Tax Return, used to report and pay taxes on business activities in Arizona.

Who is required to file the TPT-EZ form?

+Businesses with simple tax obligations are required to file the TPT-EZ form.

What is the deadline for submitting the TPT-EZ form?

+The deadline for submitting the TPT-EZ form varies, but it's typically due on the 20th day of the month following the reporting period.