As a homeowner, navigating the complexities of loan adjustments can be a daunting task. The UCF Loan Adjustment Form is a crucial document that helps borrowers and lenders communicate effectively, ensuring a smoother loan modification process. In this article, we will delve into the world of loan adjustments, exploring the UCF Loan Adjustment Form in detail. We will provide a step-by-step guide on how to complete the form, highlighting key sections, and offering expert tips to ensure a successful loan modification.

Understanding the UCF Loan Adjustment Form

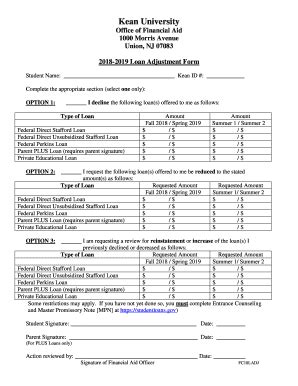

The UCF Loan Adjustment Form is a standardized document used by lenders and borrowers to facilitate loan modifications. The form is designed to provide a clear and concise framework for discussing loan terms, ensuring that both parties are on the same page. By using the UCF Loan Adjustment Form, borrowers can request changes to their loan, such as a temporary reduction in payments or a permanent modification of the loan terms.

Why is the UCF Loan Adjustment Form Important?

The UCF Loan Adjustment Form plays a critical role in the loan modification process. It provides a clear and structured approach to requesting changes to a loan, ensuring that both parties understand the terms and conditions of the modification. By using the form, borrowers can:

- Clearly communicate their financial situation and needs

- Request specific changes to their loan terms

- Receive a formal response from the lender regarding the modification request

- Negotiate a mutually beneficial agreement

Step-by-Step Guide to Completing the UCF Loan Adjustment Form

Completing the UCF Loan Adjustment Form requires careful attention to detail. Here's a step-by-step guide to help you navigate the form:

- Borrower Information: Begin by providing your personal and contact information, including your name, address, phone number, and email.

- Loan Information: Enter the loan details, including the loan number, property address, and current loan balance.

- Reason for Request: Clearly explain the reason for requesting a loan modification, including any financial hardship or changes in your circumstances.

- Proposed Modification: Outline the proposed modification, including the desired changes to the loan terms, such as a reduced payment or extended repayment period.

- Financial Information: Provide detailed financial information, including your income, expenses, and assets.

- Hardship Affidavit: If applicable, complete the hardship affidavit, which provides a sworn statement regarding your financial hardship.

- Supporting Documentation: Attach supporting documentation, such as pay stubs, bank statements, and tax returns, to substantiate your financial information.

Tips for Completing the UCF Loan Adjustment Form

When completing the UCF Loan Adjustment Form, keep the following tips in mind:

- Be accurate and thorough when providing financial information

- Clearly explain your reason for requesting a loan modification

- Ensure all supporting documentation is attached and up-to-date

- Review the form carefully before submission

What Happens After Submitting the UCF Loan Adjustment Form?

After submitting the UCF Loan Adjustment Form, the lender will review your request and may request additional information or documentation. The lender will then evaluate your eligibility for a loan modification and provide a formal response, which may include:

- Approval of the requested modification

- Denial of the request

- Counteroffer with alternative terms

If your request is approved, the lender will provide a modified loan agreement outlining the new terms and conditions. It's essential to carefully review the agreement before signing, ensuring that it meets your needs and expectations.

Common Challenges and Solutions

When navigating the loan modification process, borrowers may encounter challenges, such as:

- Incomplete or inaccurate information: Ensure that all information is accurate and complete to avoid delays or denials.

- Lack of supporting documentation: Attach all required documentation to substantiate your financial information.

- Communication breakdowns: Regularly communicate with the lender to ensure that your request is being processed efficiently.

By understanding the UCF Loan Adjustment Form and following the step-by-step guide, borrowers can navigate the loan modification process with confidence. Remember to carefully review the form, provide accurate information, and attach supporting documentation to ensure a successful loan modification.

Conclusion: Taking Control of Your Loan Modification

The UCF Loan Adjustment Form is a powerful tool for borrowers seeking to modify their loan terms. By understanding the form and following the step-by-step guide, you can take control of your loan modification process. Remember to stay informed, communicate effectively, and seek professional advice when needed.

If you have any questions or concerns about the UCF Loan Adjustment Form or the loan modification process, please share them in the comments below. We're here to help you navigate the complex world of loan adjustments.

What is the UCF Loan Adjustment Form?

+The UCF Loan Adjustment Form is a standardized document used by lenders and borrowers to facilitate loan modifications.

Why is the UCF Loan Adjustment Form important?

+The UCF Loan Adjustment Form provides a clear and structured approach to requesting changes to a loan, ensuring that both parties understand the terms and conditions of the modification.

What happens after submitting the UCF Loan Adjustment Form?

+The lender will review your request and may request additional information or documentation. The lender will then evaluate your eligibility for a loan modification and provide a formal response.