As a resident of Indiana, it's essential to understand your state tax obligations to avoid any penalties or fines. One crucial aspect of Indiana state tax is the IT-40PNR form, which is used to report and pay state income tax. In this comprehensive guide, we'll walk you through the IT-40PNR form, its requirements, and how to complete it accurately.

What is the IT-40PNR Form?

The IT-40PNR form is a state income tax form used by the Indiana Department of Revenue to report and pay state income tax. This form is used by individuals, trusts, and estates to report their income, deductions, and credits. The form is typically filed annually, and the deadline for filing is April 15th of each year.

Who Needs to File the IT-40PNR Form?

You need to file the IT-40PNR form if you:

- Are a resident of Indiana and have income subject to Indiana state income tax

- Are a non-resident of Indiana and have income earned in Indiana that is subject to Indiana state income tax

- Are a trust or estate with income earned in Indiana that is subject to Indiana state income tax

What Information is Required on the IT-40PNR Form?

To complete the IT-40PNR form accurately, you'll need to provide the following information:

- Your name, address, and social security number

- Your spouse's name, address, and social security number (if applicable)

- Your dependents' names, addresses, and social security numbers (if applicable)

- Your income from all sources, including wages, salaries, tips, and self-employment income

- Your deductions, including standard deductions, itemized deductions, and business expenses

- Your credits, including earned income tax credits, child tax credits, and education credits

How to Complete the IT-40PNR Form

To complete the IT-40PNR form, follow these steps:

- Gather all necessary documents, including your W-2 forms, 1099 forms, and receipts for deductions and credits.

- Determine your filing status and number of dependents.

- Calculate your income from all sources.

- Calculate your deductions, including standard deductions, itemized deductions, and business expenses.

- Calculate your credits, including earned income tax credits, child tax credits, and education credits.

- Complete the IT-40PNR form, following the instructions provided.

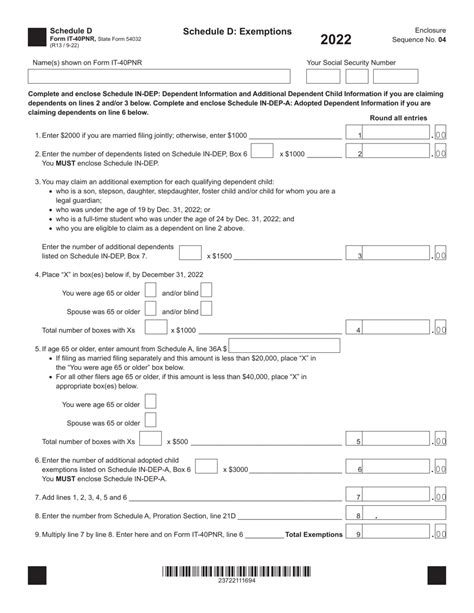

IT-40PNR Form Schedules and Supplements

The IT-40PNR form has several schedules and supplements that may be required, depending on your specific situation. These include:

- Schedule 1: Additions to Income

- Schedule 2: Deductions

- Schedule 3: Credits

- Schedule 4: Other Taxes

- Schedule 5: Payments and Refund

- Supplemental Schedule: Farm Income and Expenses

Common Mistakes to Avoid

To avoid penalties and fines, make sure to avoid the following common mistakes:

- Failure to file the IT-40PNR form on time

- Failure to report all income

- Failure to claim all eligible deductions and credits

- Failure to sign the form

- Failure to include all required schedules and supplements

IT-40PNR Form Filing Options

You can file the IT-40PNR form electronically or by mail. To file electronically, you can use the Indiana Department of Revenue's online portal or a third-party tax preparation software. To file by mail, you can send the completed form to the Indiana Department of Revenue.

IT-40PNR Form Deadline

The deadline for filing the IT-40PNR form is April 15th of each year. If you need an extension, you can file Form IT-9 to request an automatic six-month extension.

IT-40PNR Form Refund and Payment Options

If you're due a refund, you can choose to have it direct deposited into your bank account or mailed to you. If you owe taxes, you can pay online, by phone, or by mail.

IT-40PNR Form Amendments

If you need to make changes to your IT-40PNR form after it's been filed, you can file an amended return using Form IT-40X.

IT-40PNR Form FAQs

Here are some frequently asked questions about the IT-40PNR form:

- What is the IT-40PNR form used for? The IT-40PNR form is used to report and pay Indiana state income tax.

- Who needs to file the IT-40PNR form? Residents, non-residents, and trusts/estates with income earned in Indiana need to file the IT-40PNR form.

- What is the deadline for filing the IT-40PNR form? The deadline for filing the IT-40PNR form is April 15th of each year.

What is the IT-40PNR form used for?

+The IT-40PNR form is used to report and pay Indiana state income tax.

Who needs to file the IT-40PNR form?

+Residents, non-residents, and trusts/estates with income earned in Indiana need to file the IT-40PNR form.

What is the deadline for filing the IT-40PNR form?

+The deadline for filing the IT-40PNR form is April 15th of each year.

We hope this comprehensive guide to the IT-40PNR form has been helpful. If you have any further questions or need assistance with completing the form, don't hesitate to reach out to a tax professional or the Indiana Department of Revenue. Remember to file your IT-40PNR form on time to avoid penalties and fines.