Intuit Payroll direct deposit is a convenient and efficient way to pay your employees. It saves time, reduces paperwork, and provides a secure and reliable method for transferring funds. In this article, we will guide you through the 5 steps to set up Intuit Payroll direct deposit.

Direct deposit is a popular payment method that allows employers to electronically transfer funds into their employees' bank accounts. It eliminates the need for paper checks, reduces the risk of lost or stolen checks, and provides a faster and more secure payment process.

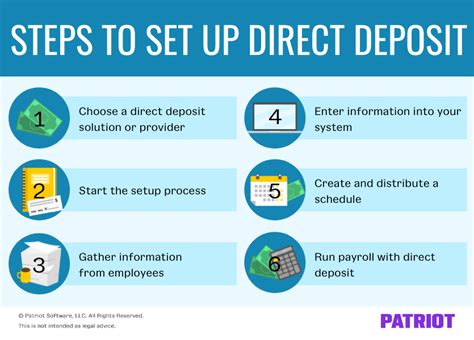

Setting up Intuit Payroll direct deposit is a straightforward process that can be completed in a few steps. Here's what you need to do:

Step 1: Verify Employee Information

Before setting up direct deposit, it's essential to verify your employees' information, including their names, addresses, and bank account details. Ensure that you have the correct information to avoid any errors or discrepancies.

To verify employee information in Intuit Payroll, follow these steps:

- Log in to your Intuit Payroll account

- Go to the "Employees" tab

- Select the employee you want to verify

- Review their information, including their name, address, and bank account details

- Make any necessary corrections or updates

Importance of Accurate Employee Information

Accurate employee information is crucial for setting up direct deposit. Any errors or discrepancies can lead to delayed or incorrect payments, which can negatively impact your employees' finances and your company's reputation.

Step 2: Obtain Employee Consent

Before setting up direct deposit, you need to obtain your employees' consent. This involves providing them with information about the direct deposit process and obtaining their written authorization to deduct funds from their bank accounts.

To obtain employee consent in Intuit Payroll, follow these steps:

- Log in to your Intuit Payroll account

- Go to the "Employees" tab

- Select the employee you want to obtain consent from

- Click on the "Direct Deposit" tab

- Follow the prompts to generate a direct deposit authorization form

- Provide the form to your employee and obtain their signature

Employee Consent and Authorization

Employee consent and authorization are essential for setting up direct deposit. By obtaining their written consent, you ensure that you have their permission to deduct funds from their bank accounts.

Step 3: Set Up Direct Deposit in Intuit Payroll

Once you have verified your employees' information and obtained their consent, you can set up direct deposit in Intuit Payroll. To do this, follow these steps:

- Log in to your Intuit Payroll account

- Go to the "Payroll Settings" tab

- Click on the "Direct Deposit" tab

- Follow the prompts to set up direct deposit for your employees

- Enter the required information, including your employees' bank account details

Direct Deposit Settings in Intuit Payroll

Intuit Payroll provides a user-friendly interface for setting up direct deposit. By following the prompts and entering the required information, you can quickly and easily set up direct deposit for your employees.

Step 4: Test Direct Deposit

Once you have set up direct deposit in Intuit Payroll, it's essential to test the system to ensure that it's working correctly. To test direct deposit, follow these steps:

- Log in to your Intuit Payroll account

- Go to the "Payroll Settings" tab

- Click on the "Direct Deposit" tab

- Follow the prompts to generate a test direct deposit payment

- Verify that the payment is processed correctly and that the funds are deposited into your employee's bank account

Testing Direct Deposit

Testing direct deposit ensures that the system is working correctly and that your employees' payments are processed accurately. By testing the system, you can identify any errors or discrepancies and make necessary corrections.

Step 5: Monitor and Maintain Direct Deposit

Once you have set up and tested direct deposit in Intuit Payroll, it's essential to monitor and maintain the system to ensure that it continues to work correctly. To monitor and maintain direct deposit, follow these steps:

- Log in to your Intuit Payroll account regularly to verify that direct deposit payments are being processed correctly

- Monitor your employees' bank account statements to ensure that the funds are being deposited correctly

- Make any necessary corrections or updates to your employees' information or direct deposit settings

Maintaining Direct Deposit

Maintaining direct deposit involves regularly monitoring the system to ensure that it continues to work correctly. By monitoring and maintaining direct deposit, you can ensure that your employees' payments are processed accurately and that your company's payroll processing runs smoothly.

What is Intuit Payroll direct deposit?

+Intuit Payroll direct deposit is a feature that allows employers to electronically transfer funds into their employees' bank accounts.

How do I set up direct deposit in Intuit Payroll?

+To set up direct deposit in Intuit Payroll, follow the 5 steps outlined in this article: verify employee information, obtain employee consent, set up direct deposit, test direct deposit, and monitor and maintain direct deposit.

What are the benefits of using Intuit Payroll direct deposit?

+The benefits of using Intuit Payroll direct deposit include increased efficiency, reduced paperwork, and improved accuracy. It also provides a secure and reliable method for transferring funds into your employees' bank accounts.

We hope this article has provided you with a comprehensive guide to setting up Intuit Payroll direct deposit. By following the 5 steps outlined in this article, you can quickly and easily set up direct deposit for your employees and improve your company's payroll processing. If you have any questions or need further assistance, please don't hesitate to contact us.