The world of digital banking has made it easier than ever to manage our finances, and one of the most popular options for those looking for a hassle-free banking experience is Chime. One of the key features that make Chime so attractive is its direct deposit functionality, which allows users to receive their paychecks, tax refunds, and other eligible funds directly into their Chime accounts. In this article, we'll take a closer look at the Chime direct deposit form and how to easily access and set it up.

What is Chime Direct Deposit?

Chime direct deposit is a feature that allows users to receive funds directly into their Chime Spending Accounts. This feature is made possible through Chime's partnership with the Early Direct Deposit program, which enables users to receive their paychecks, tax refunds, and other eligible funds up to two days earlier than traditional banks. With Chime direct deposit, users can enjoy a faster and more convenient way to access their funds, without having to worry about lengthy processing times or hidden fees.

Benefits of Using Chime Direct Deposit

There are several benefits to using Chime direct deposit, including:

- Faster access to funds: With Chime direct deposit, users can receive their paychecks, tax refunds, and other eligible funds up to two days earlier than traditional banks.

- Convenience: Chime direct deposit eliminates the need for paper checks, deposit slips, and trips to the bank.

- No hidden fees: Chime does not charge any fees for direct deposit, making it a cost-effective option for users.

- Easy setup: Setting up Chime direct deposit is a straightforward process that can be completed in just a few minutes.

How to Access and Set Up Chime Direct Deposit

Accessing and setting up Chime direct deposit is a simple process that can be completed in just a few steps:

- Log in to your Chime account: Start by logging in to your Chime account through the Chime mobile app or website.

- Navigate to the "Move Money" tab: Once logged in, navigate to the "Move Money" tab and select "Direct Deposit" from the drop-down menu.

- Enter your employer's information: Enter your employer's name, address, and other required information to set up direct deposit.

- Provide your account information: Provide your Chime account information, including your account number and routing number.

- Confirm your setup: Review and confirm your direct deposit setup to ensure that everything is accurate.

Chime Direct Deposit Form: What You Need to Know

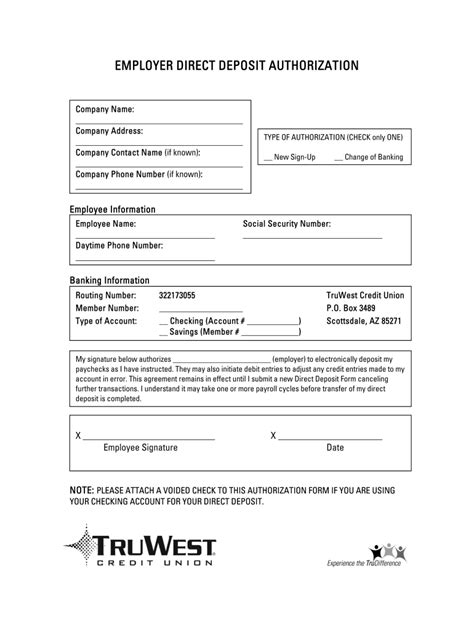

The Chime direct deposit form is a simple and straightforward document that requires users to provide their employer's information, account information, and other relevant details. Here are some key things to keep in mind when completing the Chime direct deposit form:

- Employer information: Make sure to enter your employer's name, address, and other required information accurately.

- Account information: Provide your Chime account information, including your account number and routing number.

- Direct deposit amount: Specify the amount you want to deposit directly into your Chime account.

- Frequency: Choose the frequency of your direct deposits, whether it's weekly, bi-weekly, or monthly.

Tips for Using Chime Direct Deposit

Here are some tips for using Chime direct deposit:

- Set up direct deposit ASAP: The sooner you set up direct deposit, the sooner you can start receiving your funds.

- Monitor your account: Keep an eye on your account to ensure that your direct deposits are being processed correctly.

- Take advantage of Chime's other features: Chime offers a range of features, including fee-free overdrafts, credit builder loans, and more.

Common Issues with Chime Direct Deposit

While Chime direct deposit is a reliable and convenient feature, there may be instances where issues arise. Here are some common issues with Chime direct deposit and how to resolve them:

- Delayed deposits: If your direct deposit is delayed, try contacting Chime's customer support team to resolve the issue.

- Incorrect account information: Double-check your account information to ensure that it's accurate and up-to-date.

- Employer issues: If your employer is having trouble setting up direct deposit, try contacting their HR department for assistance.

Conclusion

Chime direct deposit is a convenient and hassle-free way to receive your paychecks, tax refunds, and other eligible funds. By following the steps outlined in this article, you can easily access and set up Chime direct deposit and start enjoying the benefits of faster and more convenient banking. Whether you're looking to streamline your finances or simply want to take advantage of Chime's range of features, direct deposit is an essential feature to consider.

What is the Chime direct deposit form?

+The Chime direct deposit form is a document that requires users to provide their employer's information, account information, and other relevant details to set up direct deposit.

How do I set up Chime direct deposit?

+To set up Chime direct deposit, log in to your Chime account, navigate to the "Move Money" tab, select "Direct Deposit" from the drop-down menu, enter your employer's information and account information, and confirm your setup.

What are the benefits of using Chime direct deposit?

+The benefits of using Chime direct deposit include faster access to funds, convenience, no hidden fees, and easy setup.