The concept of beneficiary designations is a crucial aspect of financial planning, estate planning, and retirement planning. It allows individuals to control the distribution of their assets after their passing, ensuring that their loved ones are taken care of according to their wishes. However, the process of updating beneficiary designations can be daunting, especially when dealing with multiple accounts and institutions. In this article, we will provide a comprehensive guide on how to change beneficiary designations nationwide with ease, using a simple form guide.

Understanding Beneficiary Designations

Before we dive into the process of changing beneficiary designations, it's essential to understand what they are and why they're important. A beneficiary designation is a provision in a financial account, such as a life insurance policy, retirement account, or annuity, that names the individual or individuals who will receive the assets in the account upon the account owner's passing.

Types of Beneficiary Designations

There are two primary types of beneficiary designations:

- Primary Beneficiary: The individual or individuals who will receive the assets in the account upon the account owner's passing.

- Contingent Beneficiary: The individual or individuals who will receive the assets in the account if the primary beneficiary predeceases the account owner.

The Importance of Updating Beneficiary Designations

Beneficiary designations are an essential aspect of financial planning, as they ensure that assets are distributed according to the account owner's wishes. However, beneficiary designations can become outdated due to changes in circumstances, such as:

- Marriage or divorce

- Birth or adoption of children

- Death of a beneficiary

- Changes in estate planning goals

Failure to update beneficiary designations can result in unintended consequences, such as:

- Assets being distributed to the wrong individuals

- Probate and estate taxes being triggered

- Beneficiaries being subjected to unnecessary taxes and fees

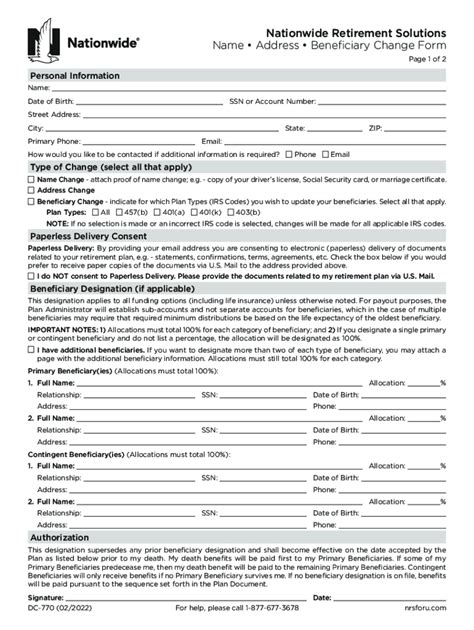

A Simple Form Guide to Changing Beneficiary Designations

Changing beneficiary designations can be a straightforward process using a simple form guide. Here's a step-by-step guide to help you update your beneficiary designations nationwide:

- Gather Required Information:

- Account information, including account numbers and institution names

- Beneficiary information, including names, addresses, and Social Security numbers

- Your identification information, including your name, address, and Social Security number

- Obtain the Required Forms:

- Contact the institution holding the account and request the beneficiary designation form

- Download the form from the institution's website or complete it online

- Complete the Form:

- Fill out the form accurately and completely, including all required information

- Sign and date the form

- Submit the Form:

- Return the completed form to the institution holding the account

- Verify that the institution has received and processed the form

Common Forms Used for Changing Beneficiary Designations

- Change of Beneficiary Form: Used to update the beneficiary designation on a specific account

- Beneficiary Designation Form: Used to establish or update the beneficiary designation on a specific account

- Transfer on Death (TOD) Form: Used to establish or update the beneficiary designation on a specific account, allowing the account to pass to the beneficiary outside of probate

Additional Tips for Changing Beneficiary Designations

Here are some additional tips to keep in mind when changing beneficiary designations:

- Review and Update Beneficiary Designations Regularly: Regularly review and update beneficiary designations to ensure that they remain current and accurate

- Use a Beneficiary Designation Service: Consider using a beneficiary designation service to streamline the process of updating beneficiary designations

- Consult with a Financial Advisor: Consult with a financial advisor to ensure that your beneficiary designations align with your overall financial and estate planning goals

Conclusion

Changing beneficiary designations nationwide can be a straightforward process using a simple form guide. By understanding the importance of beneficiary designations, gathering required information, obtaining the required forms, completing the form, and submitting it, you can ensure that your assets are distributed according to your wishes. Remember to review and update beneficiary designations regularly and consult with a financial advisor to ensure that your beneficiary designations align with your overall financial and estate planning goals.

What is a beneficiary designation?

+A beneficiary designation is a provision in a financial account that names the individual or individuals who will receive the assets in the account upon the account owner's passing.

Why is it important to update beneficiary designations?

+Updating beneficiary designations ensures that assets are distributed according to the account owner's wishes, avoiding unintended consequences such as probate and estate taxes.

What forms are commonly used for changing beneficiary designations?

+Common forms used for changing beneficiary designations include the Change of Beneficiary Form, Beneficiary Designation Form, and Transfer on Death (TOD) Form.