Retirement planning can be a daunting task, especially when it comes to navigating the complexities of the Thrift Savings Plan (TSP). The TSP is a retirement savings plan for federal employees and members of the uniformed services, and it offers a range of benefits and investment options. However, creating a comprehensive retirement plan that meets your individual needs and goals can be overwhelming. This is where the TSP 3 Fillable Form comes in - a valuable resource that makes it easy to plan for a secure and comfortable retirement.

The TSP 3 Fillable Form is a useful tool that helps you assess your retirement readiness and create a personalized plan for achieving your long-term financial goals. By filling out this form, you'll be able to estimate your retirement income, determine how much you need to save, and make informed decisions about your TSP investments. In this article, we'll take a closer look at the TSP 3 Fillable Form and provide guidance on how to use it to achieve your retirement objectives.

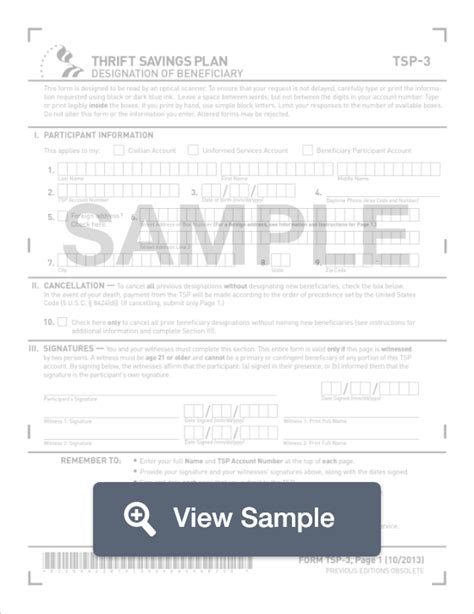

Understanding the TSP 3 Fillable Form

The TSP 3 Fillable Form is a straightforward and user-friendly document that requires you to input various pieces of information related to your retirement planning. The form is divided into three main sections: (1) personal and account information, (2) retirement income and expenses, and (3) investment options and contributions. By completing these sections, you'll be able to calculate your retirement readiness and identify areas for improvement.

Section 1: Personal and Account Information

The first section of the TSP 3 Fillable Form requires you to provide basic information about yourself and your TSP account. This includes:

- Your name and social security number

- Your TSP account balance and contribution rate

- Your desired retirement age and expected retirement date

- Your marital status and number of dependents

This information will help you estimate your retirement income and determine how much you need to save to meet your long-term goals.

Section 2: Retirement Income and Expenses

The second section of the TSP 3 Fillable Form requires you to estimate your retirement income and expenses. This includes:

- Your expected retirement income from sources such as Social Security, pensions, and TSP withdrawals

- Your estimated retirement expenses, including housing, food, healthcare, and entertainment costs

- Your desired retirement lifestyle and travel plans

By estimating your retirement income and expenses, you'll be able to determine how much you need to save to maintain your desired standard of living in retirement.

Section 3: Investment Options and Contributions

The third section of the TSP 3 Fillable Form requires you to review your investment options and contributions. This includes:

- Your current TSP investment allocation and contribution rate

- Your desired investment mix and contribution rate

- Your understanding of the various TSP investment funds and their associated risks and fees

By reviewing your investment options and contributions, you'll be able to make informed decisions about how to allocate your TSP assets and maximize your retirement savings.

Using the TSP 3 Fillable Form to Achieve Your Retirement Objectives

By completing the TSP 3 Fillable Form, you'll be able to:

- Estimate your retirement readiness and identify areas for improvement

- Determine how much you need to save to meet your long-term goals

- Make informed decisions about your TSP investments and contributions

- Create a personalized retirement plan that meets your individual needs and goals

The TSP 3 Fillable Form is a valuable resource that can help you achieve your retirement objectives. By taking the time to complete this form, you'll be able to create a comprehensive retirement plan that will help you achieve a secure and comfortable retirement.

Additional Tips and Resources

In addition to using the TSP 3 Fillable Form, there are several other tips and resources that can help you achieve your retirement objectives. These include:

- Starting to save early and consistently

- Taking advantage of employer matching contributions

- Diversifying your investment portfolio

- Reviewing and updating your retirement plan regularly

- Seeking the advice of a financial advisor or planner

By following these tips and using the TSP 3 Fillable Form, you'll be well on your way to achieving a secure and comfortable retirement.

We encourage you to share your thoughts and experiences with the TSP 3 Fillable Form in the comments section below. Have you used this form to create a personalized retirement plan? What tips and resources have you found helpful in achieving your retirement objectives? Your feedback and insights can help others achieve their long-term goals.

What is the TSP 3 Fillable Form?

+The TSP 3 Fillable Form is a document that helps you assess your retirement readiness and create a personalized plan for achieving your long-term financial goals.

How do I use the TSP 3 Fillable Form?

+To use the TSP 3 Fillable Form, simply complete the three main sections: personal and account information, retirement income and expenses, and investment options and contributions.

What are the benefits of using the TSP 3 Fillable Form?

+The TSP 3 Fillable Form can help you estimate your retirement readiness, determine how much you need to save, and make informed decisions about your TSP investments and contributions.