As the popularity of electronic filing continues to grow, the Internal Revenue Service (IRS) has introduced various fillable forms to facilitate the tax filing process. Among these forms, the Ej 130 fillable form has gained significant attention due to its simplicity and convenience. In this article, we will delve into the details of the Ej 130 fillable form, including how to download it, instructions for completion, and its benefits.

What is the Ej 130 Fillable Form?

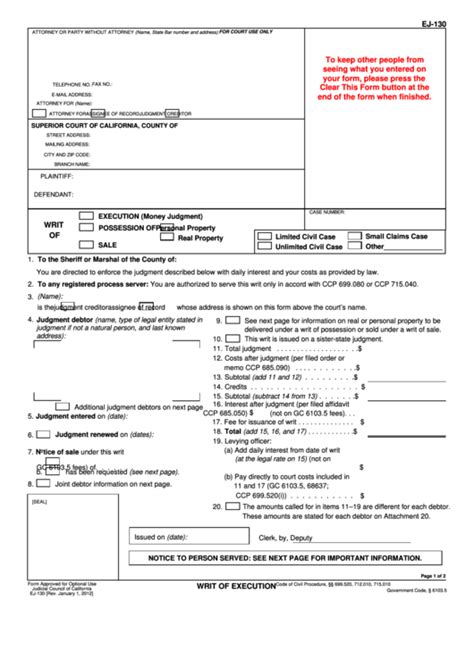

The Ej 130 fillable form is a digital version of the IRS Form 130, which is used for requesting a transcript of an account or a return. This form allows taxpayers to submit their requests electronically, eliminating the need for paper forms and manual processing.

Benefits of the Ej 130 Fillable Form

The Ej 130 fillable form offers several benefits to taxpayers, including:

- Convenience: Taxpayers can complete and submit the form from the comfort of their own homes, at any time.

- Speed: Electronic submission reduces processing time, allowing taxpayers to receive their transcripts faster.

- Accuracy: The digital format minimizes errors, ensuring that requests are processed correctly.

- Environmentally friendly: By reducing paper usage, the Ej 130 fillable form contributes to a more sustainable future.

How to Download the Ej 130 Fillable Form

Downloading the Ej 130 fillable form is a straightforward process. Here are the steps:

- Visit the IRS website at .

- Click on the "Forms and Publications" tab.

- Select "Fillable Forms" from the drop-down menu.

- Search for Form 130 using the search bar.

- Click on the "Form 130" link to access the fillable form.

Instructions for Completing the Ej 130 Fillable Form

Completing the Ej 130 fillable form requires attention to detail and accuracy. Here are the step-by-step instructions:

- Open the fillable form using Adobe Acrobat Reader or a compatible software.

- Enter your name, address, and Social Security number (or Individual Taxpayer Identification Number) in the required fields.

- Select the type of transcript you are requesting (account or return).

- Enter the tax year or period for which you are requesting the transcript.

- Provide any additional information required, such as your daytime phone number.

- Review the form for accuracy and completeness.

- Submit the form electronically through the IRS website.

Tips for Completing the Ej 130 Fillable Form

- Ensure you have the latest version of Adobe Acrobat Reader installed on your device.

- Use a compatible software to avoid any technical issues.

- Double-check your entries for accuracy and completeness.

- Save a copy of the completed form for your records.

Frequently Asked Questions

What is the purpose of the Ej 130 fillable form?

+The Ej 130 fillable form is used to request a transcript of an account or a return from the IRS.

How long does it take to receive a transcript after submitting the Ej 130 fillable form?

+The processing time for transcripts varies, but most requests are processed within 10-15 business days.

Can I submit the Ej 130 fillable form by mail or fax?

+No, the Ej 130 fillable form can only be submitted electronically through the IRS website.

In conclusion, the Ej 130 fillable form is a convenient and efficient way to request transcripts from the IRS. By following the instructions and tips outlined in this article, taxpayers can ensure a smooth and error-free process. If you have any further questions or concerns, feel free to comment below or share this article with others who may benefit from this information.