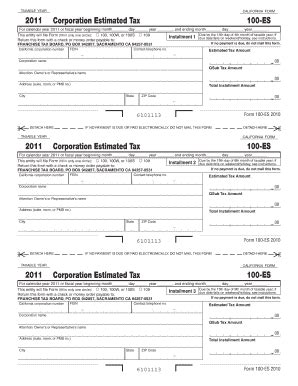

Completing CA Form 100 ES successfully is a crucial step for California employers who need to report their employment tax obligations to the Employment Development Department (EDD). The CA Form 100 ES, also known as the Quarterly Contribution Return and Report of Wages, is used to report wages, contributions, and other employment tax-related information. In this article, we will explore five ways to complete CA Form 100 ES successfully, ensuring you avoid common mistakes and penalties.

Understanding CA Form 100 ES Requirements

Before diving into the five ways to complete CA Form 100 ES successfully, it's essential to understand the requirements. The form is typically due on the last day of the month following the end of each quarter. Employers must report wages paid to employees during the quarter, as well as contributions and taxes withheld. The form also requires employers to report their account number, business name, and address.

1. Gather Required Information and Documents

To complete CA Form 100 ES successfully, you need to gather all required information and documents. This includes:

- Employer account number

- Business name and address

- Quarterly wages paid to employees

- Contributions and taxes withheld

- Tax rates and amounts due

- Supporting documentation, such as payroll records and tax returns

Make sure to review the form instructions and requirements to ensure you have all necessary information and documents.

2. Calculate Tax Rates and Amounts Due

Calculating tax rates and amounts due is a critical step in completing CA Form 100 ES. You need to determine the correct tax rates for your business, which may include state disability insurance (SDI) and employment training tax (ETT). You must also calculate the amounts due for each tax type.

To calculate tax rates and amounts due, you can use the EDD's online tax calculator or consult with a tax professional.

3. Complete the Form Accurately and Timely

Completing CA Form 100 ES accurately and timely is crucial to avoid penalties and interest. Make sure to:

- Use the correct form version and instructions

- Enter all required information and data accurately

- Report all wages, contributions, and taxes withheld correctly

- Sign and date the form

Submit the form on time to avoid late payment penalties and interest.

4. Review and Verify the Form

Reviewing and verifying CA Form 100 ES is essential to ensure accuracy and completeness. Review the form for:

- Mathematical errors

- Incorrect tax rates and amounts due

- Missing or incomplete information

- Incorrect account number or business information

Verify the form by comparing it to supporting documentation, such as payroll records and tax returns.

5. Seek Professional Help When Needed

Completing CA Form 100 ES can be complex and time-consuming. If you're unsure or need help, consider seeking professional assistance from a tax professional or accountant. They can:

- Review and verify the form for accuracy and completeness

- Calculate tax rates and amounts due correctly

- Ensure timely submission and avoid penalties

Don't hesitate to seek help when needed to ensure successful completion of CA Form 100 ES.

By following these five ways to complete CA Form 100 ES successfully, you can avoid common mistakes and penalties, ensuring you meet your employment tax obligations in California. Remember to gather required information and documents, calculate tax rates and amounts due accurately, complete the form accurately and timely, review and verify the form, and seek professional help when needed.

We encourage you to share your experiences and tips on completing CA Form 100 ES in the comments below. If you have any questions or need further clarification, feel free to ask.

What is CA Form 100 ES?

+CA Form 100 ES is the Quarterly Contribution Return and Report of Wages, used to report wages, contributions, and other employment tax-related information to the Employment Development Department (EDD) in California.

When is CA Form 100 ES due?

+CA Form 100 ES is typically due on the last day of the month following the end of each quarter.

What happens if I fail to complete CA Form 100 ES accurately and timely?

+Failing to complete CA Form 100 ES accurately and timely may result in penalties and interest, which can be costly and time-consuming to resolve.