Filing FinCEN Form 105 online can be a daunting task, but with the right guidance, it can be done easily and efficiently. The Financial Crimes Enforcement Network (FinCEN) requires individuals to report certain financial transactions, including the transportation of more than $10,000 in cash or monetary instruments across the U.S. border. In this article, we will explore five ways to file FinCEN Form 105 online easily.

Understanding FinCEN Form 105

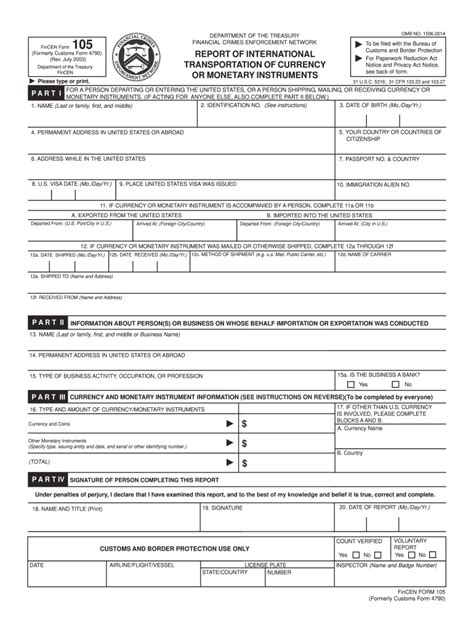

Before we dive into the ways to file FinCEN Form 105 online, it's essential to understand what the form is and why it's required. FinCEN Form 105, also known as the Report of International Transportation of Currency or Monetary Instruments, is used to report the transportation of more than $10,000 in cash or monetary instruments across the U.S. border. This includes not only cash but also other monetary instruments, such as traveler's checks, money orders, and cashier's checks.

Who Needs to File FinCEN Form 105?

Not everyone needs to file FinCEN Form 105. The requirement to file the form applies to individuals who physically transport, mail, or ship more than $10,000 in cash or monetary instruments across the U.S. border. This includes:

- Individuals traveling with more than $10,000 in cash or monetary instruments

- Businesses that transport or ship large amounts of cash or monetary instruments across the border

- Courier services that transport cash or monetary instruments on behalf of their clients

5 Ways to File FinCEN Form 105 Online

Now that we understand who needs to file FinCEN Form 105, let's explore five ways to file the form online easily.

1. FinCEN's BSA E-Filing System

The most straightforward way to file FinCEN Form 105 online is through FinCEN's BSA E-Filing System. The system allows users to create an account, fill out the form online, and submit it electronically. The system also provides a secure and convenient way to store and manage your filing history.

To access the BSA E-Filing System, follow these steps:

- Go to the FinCEN website ()

- Click on the "BSA E-Filing System" link

- Create an account or log in if you already have one

- Fill out FinCEN Form 105 online and submit it electronically

2. Use a Third-Party Filing Service

Another way to file FinCEN Form 105 online is by using a third-party filing service. These services specialize in helping individuals and businesses file FinCEN forms, including FinCEN Form 105. They often provide a user-friendly interface, secure data storage, and timely filing.

To find a third-party filing service, follow these steps:

- Search online for "FinCEN Form 105 filing service"

- Compare different services and their fees

- Choose a service that meets your needs and budget

3. File through a Bank or Financial Institution

If you have a bank or financial institution that offers international services, you may be able to file FinCEN Form 105 through them. Many banks and financial institutions have a secure online platform that allows customers to file FinCEN forms, including FinCEN Form 105.

To file through a bank or financial institution, follow these steps:

- Contact your bank or financial institution to see if they offer FinCEN form filing services

- Log in to your online account and navigate to the FinCEN form filing section

- Fill out FinCEN Form 105 online and submit it electronically

4. Use a Digital Signature Service

If you need to file FinCEN Form 105 online but don't have access to a computer or prefer to use a mobile device, you can use a digital signature service. These services allow you to sign and submit FinCEN forms electronically using your mobile device.

To use a digital signature service, follow these steps:

- Search online for "digital signature service for FinCEN forms"

- Choose a service that meets your needs and budget

- Sign and submit FinCEN Form 105 electronically using your mobile device

5. Consult with a Tax Professional or Attorney

If you're unsure about how to file FinCEN Form 105 online or need help with the filing process, you may want to consult with a tax professional or attorney. They can provide guidance on the filing requirements, help you fill out the form, and ensure that you're in compliance with FinCEN regulations.

To find a tax professional or attorney, follow these steps:

- Search online for "tax professional or attorney specializing in FinCEN forms"

- Compare different professionals and their fees

- Choose a professional who meets your needs and budget

Benefits of Filing FinCEN Form 105 Online

Filing FinCEN Form 105 online offers several benefits, including:

- Convenience: Filing online is quick and easy, and you can do it from anywhere with an internet connection.

- Accuracy: Online filing reduces the risk of errors and ensures that your form is complete and accurate.

- Security: Online filing is secure, and your data is protected by encryption and other security measures.

- Timely Filing: Online filing ensures that your form is filed on time, reducing the risk of penalties and fines.

Conclusion

Filing FinCEN Form 105 online can be a straightforward process if you have the right guidance. By following the five ways outlined in this article, you can easily file FinCEN Form 105 online and ensure that you're in compliance with FinCEN regulations. Remember to choose a method that meets your needs and budget, and don't hesitate to seek help if you need it.

What is FinCEN Form 105?

+FinCEN Form 105, also known as the Report of International Transportation of Currency or Monetary Instruments, is used to report the transportation of more than $10,000 in cash or monetary instruments across the U.S. border.

Who needs to file FinCEN Form 105?

+Individuals who physically transport, mail, or ship more than $10,000 in cash or monetary instruments across the U.S. border need to file FinCEN Form 105.

How do I file FinCEN Form 105 online?

+You can file FinCEN Form 105 online through FinCEN's BSA E-Filing System, a third-party filing service, a bank or financial institution, a digital signature service, or by consulting with a tax professional or attorney.