The annual re-enrollment process - a crucial step for millions of Americans to secure their health insurance coverage for the upcoming year. While it may seem like a daunting task, Akebia Cares is here to make re-enrollment a breeze. In this article, we'll break down the re-enrollment process into three simple steps, ensuring you stay covered and stress-free.

Each year, the re-enrollment period offers individuals the opportunity to review, renew, or change their health insurance plans. This critical period allows you to reassess your coverage needs, explore new options, and make informed decisions about your healthcare. However, the process can be overwhelming, especially for those who are new to health insurance or unsure about the best plan for their needs.

Akebia Cares is committed to making the re-enrollment process as seamless as possible. By providing a straightforward and user-friendly experience, we empower individuals to take control of their health insurance and make informed decisions about their coverage.

Step 1: Review Your Current Coverage

Before starting the re-enrollment process, take some time to review your current health insurance coverage. Consider the following factors:

- Your current premium costs and any changes that may have occurred

- The deductible, copayments, and coinsurance associated with your plan

- The network of healthcare providers and facilities included in your plan

- Any changes in your income or family size that may affect your eligibility for subsidies or Medicaid

- Any new health needs or concerns that may require additional coverage

Step 2: Explore New Plan Options

Assessing Your Needs and Budget

Once you've reviewed your current coverage, it's time to explore new plan options. Consider the following factors when evaluating plans:

- Premium costs and any changes that may have occurred

- Deductible, copayments, and coinsurance associated with the plan

- Network of healthcare providers and facilities included in the plan

- Maximum out-of-pocket costs and any additional fees

- Any additional benefits or features, such as dental or vision coverage

Akebia Cares offers a range of plan options to suit different needs and budgets. Our plans are designed to provide comprehensive coverage, flexibility, and affordability.

Step 3: Enroll or Re-Enroll in Your Chosen Plan

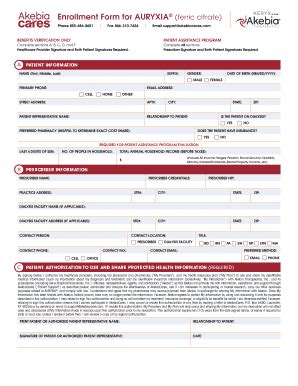

Once you've selected a plan that meets your needs and budget, it's time to enroll or re-enroll. Akebia Cares makes this process easy and convenient. Simply:

- Log in to your account on our website or mobile app

- Select your chosen plan and review the details

- Complete the enrollment or re-enrollment application

- Pay your first premium payment to secure your coverage

And that's it! With Akebia Cares, re-enrollment is a straightforward and stress-free process.

Additional Tips and Reminders

- Make sure to review and update your application carefully to avoid any errors or delays

- If you're eligible for subsidies or Medicaid, be sure to update your income and family size information to ensure accurate eligibility determination

- Don't hesitate to reach out to our customer support team if you have any questions or concerns during the re-enrollment process

Take Control of Your Health Insurance

Re-enrollment is an opportunity to take control of your health insurance and make informed decisions about your coverage. By following these three simple steps, you can ensure a seamless and stress-free experience. Remember to review your current coverage, explore new plan options, and enroll or re-enroll in your chosen plan.

Don't miss this opportunity to secure your health insurance coverage for the upcoming year. Start the re-enrollment process today with Akebia Cares!

Share Your Thoughts

Have you already started the re-enrollment process? Share your experience and tips with us in the comments below. If you have any questions or concerns, feel free to ask, and our team will be happy to assist you.

What is the re-enrollment period?

+The re-enrollment period is the annual period during which individuals can review, renew, or change their health insurance plans.

How do I know which plan is best for me?

+Consider your current coverage, income, family size, and health needs when evaluating plans. You can also consult with a licensed insurance agent or broker for personalized guidance.

Can I enroll or re-enroll in a plan outside of the re-enrollment period?

+No, the re-enrollment period is the only time during which individuals can enroll or re-enroll in a plan, unless they experience a qualifying life event, such as a change in income or family size.