The Texas Sales and Use Tax Resale Certificate Form is a vital document for businesses operating in the state of Texas. As a business owner, understanding the purpose and proper use of this form can help you navigate the complexities of sales tax compliance.

What is the Texas Sales and Use Tax Resale Certificate Form?

The Texas Sales and Use Tax Resale Certificate Form, also known as Form AP-201, is a document that allows businesses to purchase taxable items for resale without paying sales tax. This form is issued by the Texas Comptroller's office and is used to certify that a business is purchasing items for resale, rather than for personal use.

Why is the Texas Sales and Use Tax Resale Certificate Form important?

The Texas Sales and Use Tax Resale Certificate Form is essential for businesses that engage in resale activities, as it allows them to avoid paying sales tax on items that will be resold. This can help businesses save money and reduce their tax liability. Additionally, the form helps the state of Texas to ensure that businesses are complying with sales tax laws and regulations.

Who needs to use the Texas Sales and Use Tax Resale Certificate Form?

The Texas Sales and Use Tax Resale Certificate Form is required for businesses that engage in resale activities, including:

- Retailers

- Wholesalers

- Manufacturers

- Contractors

- Service providers

Any business that purchases taxable items for resale must obtain a resale certificate from the Texas Comptroller's office.

How to obtain a Texas Sales and Use Tax Resale Certificate Form?

To obtain a Texas Sales and Use Tax Resale Certificate Form, businesses must register for a sales tax permit with the Texas Comptroller's office. This can be done online or by mail. Once registered, businesses will receive a resale certificate that must be renewed annually.

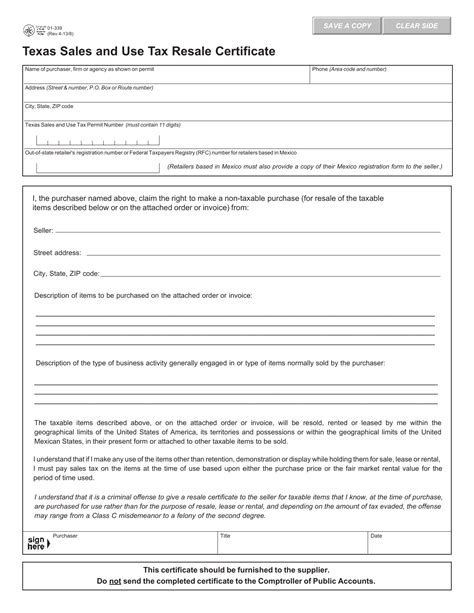

How to complete the Texas Sales and Use Tax Resale Certificate Form?

Completing the Texas Sales and Use Tax Resale Certificate Form requires the following information:

- Business name and address

- Sales tax permit number

- Description of the items being purchased for resale

- Certification that the items are being purchased for resale

Businesses must sign and date the form, and it must be renewed annually.

Common mistakes to avoid when using the Texas Sales and Use Tax Resale Certificate Form

When using the Texas Sales and Use Tax Resale Certificate Form, businesses should avoid the following common mistakes:

- Failing to obtain a resale certificate

- Failing to renew the resale certificate annually

- Using an expired resale certificate

- Providing false or inaccurate information on the form

These mistakes can result in penalties and fines, so it's essential to ensure that the form is completed accurately and renewed on time.

Benefits of using the Texas Sales and Use Tax Resale Certificate Form

Using the Texas Sales and Use Tax Resale Certificate Form provides several benefits for businesses, including:

- Avoiding sales tax on items purchased for resale

- Reducing tax liability

- Simplifying the sales tax compliance process

- Avoiding penalties and fines for non-compliance

By understanding the purpose and proper use of the Texas Sales and Use Tax Resale Certificate Form, businesses can ensure compliance with sales tax laws and regulations, and avoid costly mistakes.

Best practices for using the Texas Sales and Use Tax Resale Certificate Form

To get the most out of the Texas Sales and Use Tax Resale Certificate Form, businesses should follow these best practices:

- Ensure that the form is completed accurately and renewed on time

- Keep a copy of the form on file for audit purposes

- Provide the form to suppliers and vendors as needed

- Review and update the form annually to ensure compliance

By following these best practices, businesses can ensure that they are using the Texas Sales and Use Tax Resale Certificate Form correctly and avoiding common mistakes.

Conclusion

In conclusion, the Texas Sales and Use Tax Resale Certificate Form is a vital document for businesses operating in the state of Texas. By understanding the purpose and proper use of this form, businesses can ensure compliance with sales tax laws and regulations, avoid costly mistakes, and reduce their tax liability. Remember to complete the form accurately, renew it annually, and follow best practices to get the most out of this important document.

What is the Texas Sales and Use Tax Resale Certificate Form used for?

+The Texas Sales and Use Tax Resale Certificate Form is used to certify that a business is purchasing items for resale, rather than for personal use.

Who needs to use the Texas Sales and Use Tax Resale Certificate Form?

+Businesses that engage in resale activities, including retailers, wholesalers, manufacturers, contractors, and service providers, need to use the Texas Sales and Use Tax Resale Certificate Form.

How do I obtain a Texas Sales and Use Tax Resale Certificate Form?

+To obtain a Texas Sales and Use Tax Resale Certificate Form, businesses must register for a sales tax permit with the Texas Comptroller's office.