As tax season approaches, many individuals and businesses are scrambling to gather the necessary forms and documents to submit their tax returns. One of the most important forms for the Internal Revenue Service (IRS) is the Form 1040, but did you know that there are many other forms that may be required depending on your specific situation? In this article, we'll delve into the world of IRS forms and provide a comprehensive guide to help you navigate the complexities of tax season.

The Importance of IRS Forms

IRS forms are used to report income, claim deductions and credits, and provide other information to the IRS. The IRS uses this information to determine an individual's or business's tax liability and to ensure compliance with tax laws. Failure to file the correct forms or provide accurate information can result in penalties, fines, and even audits.

Common IRS Forms

There are numerous IRS forms, each with its own specific purpose. Here are some of the most common forms:

- Form 1040: The individual income tax return form, used to report income, claim deductions and credits, and calculate tax liability.

- Form W-2: The wage and tax statement form, used by employers to report an employee's income and taxes withheld.

- Form 1099: The miscellaneous income form, used to report income from self-employment, freelance work, and other sources.

- Form 1040EZ: A simplified version of the Form 1040, used by individuals with simple tax situations.

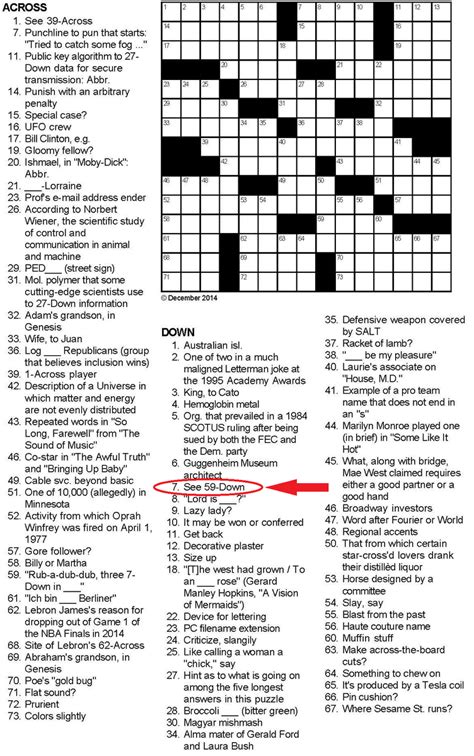

IRS Form Pros Crossword Clue Solution

If you're a fan of crossword puzzles, you may have come across a clue that reads "IRS form pros" or something similar. The answer to this clue is "CPAs" or "ACCOUNTANTS." This is because certified public accountants (CPAs) and accountants are professionals who specialize in tax preparation and planning, and are often well-versed in the various IRS forms and regulations.

How to Choose the Right IRS Form

With so many IRS forms available, it can be overwhelming to determine which ones you need to file. Here are some tips to help you choose the right forms:

- Determine your filing status: Your filing status (single, married, head of household, etc.) will determine which forms you need to file.

- Gather all necessary documents: Make sure you have all the necessary documents, including W-2s, 1099s, and receipts for deductions and credits.

- Use IRS resources: The IRS website (irs.gov) has a wealth of information and resources to help you determine which forms you need to file.

- Consult a tax professional: If you're unsure about which forms to file, consider consulting a tax professional or accountant.

Benefits of Using IRS Forms

Using the correct IRS forms can have numerous benefits, including:

- Accurate tax calculation: By using the correct forms, you can ensure that your tax liability is accurately calculated.

- Reduced audit risk: Filing the correct forms can reduce the risk of an audit, as the IRS will have all the necessary information to verify your tax return.

- Maximized deductions and credits: By claiming all eligible deductions and credits, you can minimize your tax liability and maximize your refund.

Common Mistakes to Avoid

When filing IRS forms, there are several common mistakes to avoid, including:

- Incorrect filing status: Filing with the wrong filing status can result in incorrect tax calculations and potential penalties.

- Missing or incomplete information: Failing to provide all necessary information can delay processing of your tax return and result in penalties.

- Math errors: Math errors can result in incorrect tax calculations and potential penalties.

IRS Form Filing Tips

Here are some tips to help you file your IRS forms correctly:

- File electronically: Filing electronically can reduce errors and speed up processing of your tax return.

- Use tax software: Tax software can help you navigate the complexities of tax preparation and ensure that you're using the correct forms.

- Keep accurate records: Keeping accurate records of your income, deductions, and credits can help you file your tax return accurately and efficiently.

Conclusion

IRS forms can be complex and overwhelming, but by understanding the different types of forms and how to use them, you can ensure that you're filing your tax return accurately and efficiently. Remember to choose the right forms, avoid common mistakes, and take advantage of IRS resources and tax software to make the tax filing process as smooth as possible. If you're still unsure, consider consulting a tax professional or accountant to help you navigate the world of IRS forms.

What is the most common IRS form?

+The most common IRS form is the Form 1040, which is the individual income tax return form.

What is the difference between Form 1040 and Form 1040EZ?

+Form 1040 is the standard individual income tax return form, while Form 1040EZ is a simplified version of the form, used by individuals with simple tax situations.

Can I file IRS forms electronically?

+Yes, you can file IRS forms electronically through the IRS website (irs.gov) or through tax software.